Bitcoin Whales Who Bought 1 Month Ago Hold Strong Despite Chance To Take Profit

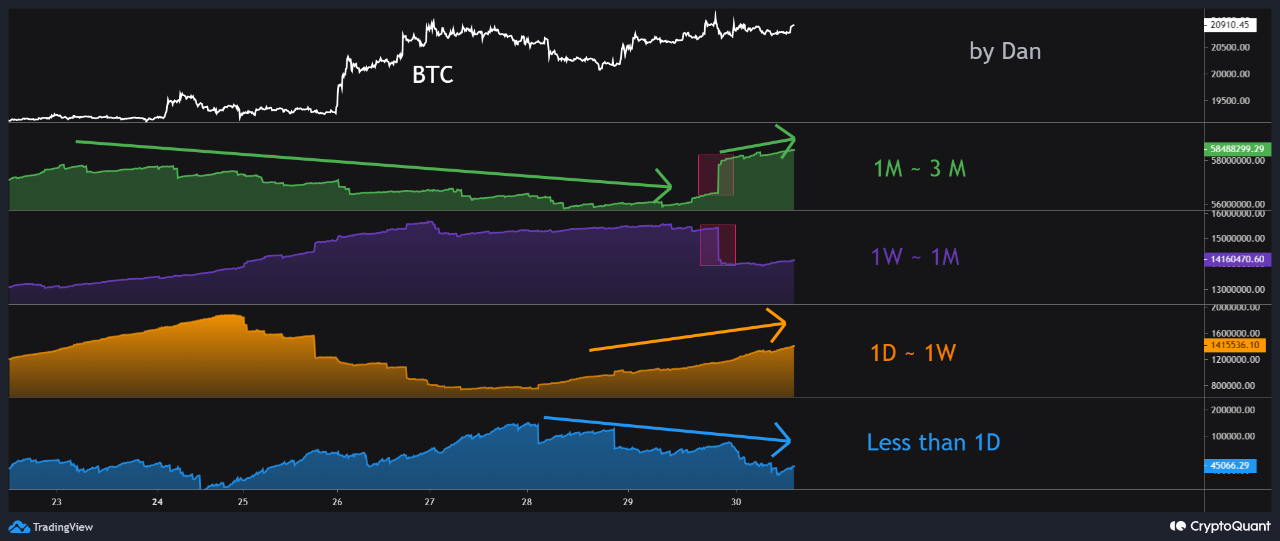

On-chain data shows the Bitcoin whales who bought around one month ago have continued to hold strong despite the price surge providing them with a chance to take some profit. Bitcoin 1 Month To 3 Month Old Supply Has Been Rising In Recent Days As pointed out by an analyst in a CryptoQuant post, the whales who bought at $19k about a month ago seem to not have realized their profits yet. The relevant indicator here are the Bitcoin supply age bands, which tell us how much coins are held by each cohort right now. These groups or age bands are divided based on the amount of time the coins....

Related News

Are the Whales selling in this bear market? A deep dive into the on-chain data of whales. Deriving their names from the size of the massive mammals swimming around the earth’s oceans, cryptocurrency whales refer to individuals or entities that hold large amounts of cryptocurrency. In the case of Bitcoin (BTC), someone can be considered a whale if they hold over 1,000 BTC, and there are less than 2,500 of them out there. As Bitcoin addresses are pseudonymous, it is ofte difficult to ascertain who owns any wallet. While many associates the term “whale” with some lucky early adopters of....

On-chain data shows the Bitcoin sharks and whales have continued to hold strong despite the asset’s price surge. Bitcoin Sharks & Whales Have Been Increasing Their Holdings Recently According to data from the on-chain analytics firm Santiment, the BTC sharks and whales have been participating in accumulation during the past month. The indicator of relevance […]

On-chain data shows the XRP investors with more than 300% in profits took part in a significant amount of selling earlier in the month. XRP Whales With Over 300% Gains Are Calm For Now In a new post on X, the on-chain analytics firm Glassnode has talked about the trend in the Realized Profit for […]

Bitcoin price surged past $11,000 and 3 key indicators suggest a strong trend reversal is underway. Within the last few hours, Bitcoin (BTC) price surpassed $11,000 in a swift turnaround from its swing low at $10,500 in early October. Analysts have attributed three major factors to BTC’s abrupt trend reversal.The potential catalysts are whale accumulation, a spike in institutional demand, and the strength of the $10,500 support.Whales are either accumulating or refusing to sellEarlier this week, Cointelegraph reported that activity within whale clusters pointed to strong buying demand from....

Whales have not stopped accumulating bitcoin. Current trend patterns suggest that bitcoin whales who hold between 100 to 1,000 BTC remain very bullish on the digital asset’s prospects. The slow month of September had seen the asset suffer dips and crashes which brought the price down to the $40K trading range. However, whales had used this as an opportunity to increase their holdings at a low price. Bitcoin wallets holding between 100 and 1,000 had continued to add to their balance and by the end of September, these wallets had accumulated a collective total of 85.7K BTC. In today’s....