QE Infinity: US Fed to Keep Rates at Zero, Billion-Dollar Bond Purchases Unti...

This week the U.S. Federal Reserve met for two days at the Federal Open Market Committee meeting and detailed that it would keep short-term borrowing rates at near zero. Meanwhile, the Fed also stated that it would continue buying bonds until the U.S. economy returns to full employment. America’s central bank met this week for the last Federal Open Market Committee (FOMC) meeting of 2020. The Fed has a touch more optimism for the end of this year and into 2021 according to the summary of economic projections. However, the central bank will make no changes to the benchmark interest....

Related News

The $3 billion blockchain bond has been effectively cancelled. China Construction Bank’s $3 billion blockchain bond has been reportedly withdrawn following an initial delay.Fusang Exchange, a Malaysian cryptocurrency exchange that was to be responsible for listing the bond, said that it has been withdrawn at the issuer’s request.According to Reuters on Nov. 23, CCB’s branch in Labuan informed Fusang Exchange on Nov. 20 that the bond issuance would not proceed.The blockchain-based bond was to be issued by Longbond Ltd, a special purpose platform designed solely to issue digital bonds and....

The exchange rates of Bitcoin vs. US. Dollar has been holding level between $440 - $460 a few days in a row. Positive macroeconomic indicators from the US and anincrease in interest rates to 0.50% led to a strengthening of the Dollar. However, Bitcoin’s price was unharmed. Today, the release of another piece of important economic data is also expected. The Dollar relative to other currencies will be further strengthened, while Bitcoin should continue its sideways trend to about $440 - $470 and begin to grow to the levels of $480 and $490. We can see an increase in the yield differential of....

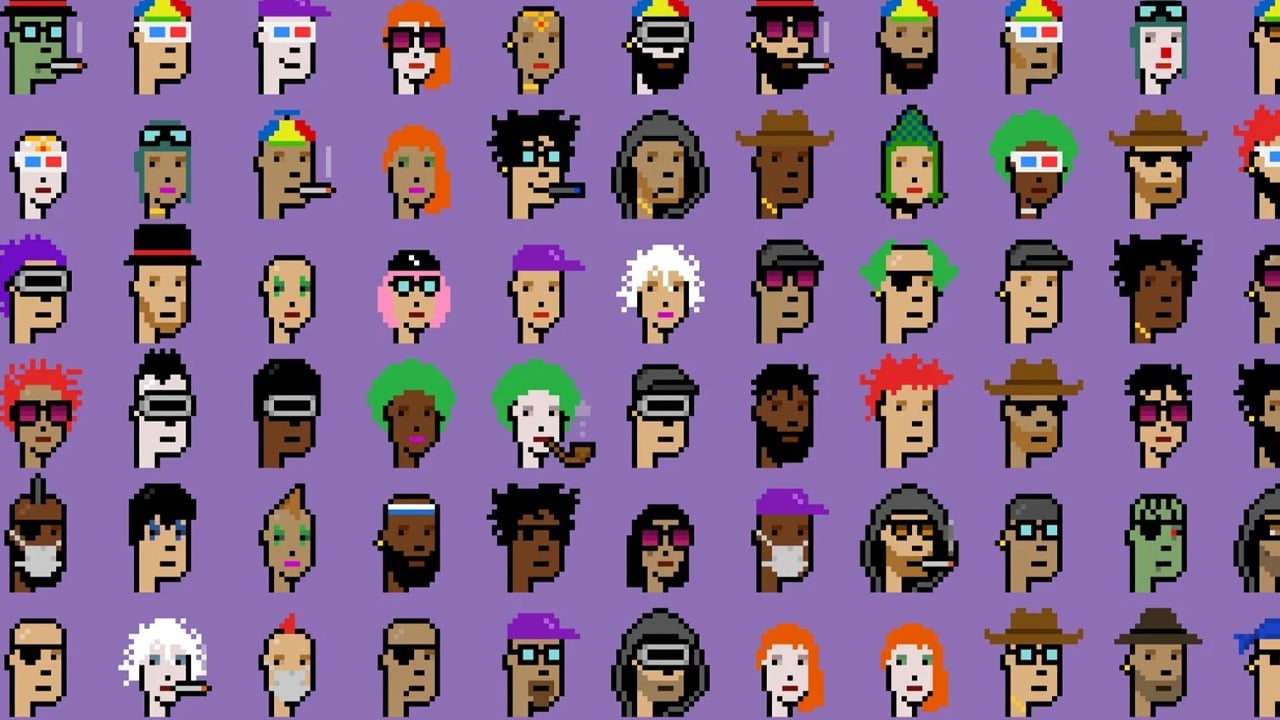

On Saturday, August 28, the non-fungible token (NFT) project Cryptopunks crossed $1 billion in all-time sales. Cryptopunks joins the heavyweight NFT hitters Axie Infinity’s $1.6 billion and Opensea’s $3.53 billion. Three NFT Projects Have Sold More Than a Billion-Dollars in Sales The non-fungible token project Cryptopunks is now a billion-dollar NFT collection as statistics show all-time sales tapped $1.095 billion, according to dappradar.com data. Cryptopunks has a bunch of records on dappradar.com’s “top sales” page, in terms of NFT sales. Cryptopunks....

Coinbase has sold $2 billion worth of corporate bonds in an offering that saw $7 billion worth of bids placed. Leading U.S.-based cryptocurrency exchange Coinbase has seen enormous demand for its junk bond offering, with the firm increasing the size of the sale by one-third from $1.5 billion to $2 billion.According to Economic Times, at least $7 billion worth of orders were placed in competition for equal quantities of seven and 10-year bonds, offering interest rates of 3.375% and 3.625% respectively.The publication cites an anonymous source as claiming the interest rates were cheaper than....

After the inflation rate in the eurozone reached a high of 7.5% in March, the European Central Bank (ECB) and the bank’s president Christine Lagarde explained on Thursday the central bank’s bond purchases will cease in Q3. Reiterating what she said at a press conference in Cyprus two weeks ago, Lagarde stressed on Thursday that inflation “will remain high over the coming months.” European Central Bank Plans to End Asset Purchase Program in Q3 The eurozone is suffering from significant inflationary pressures as rising consumer prices are ravaging European Union....