SushiSwap CTO resigns citing internal structural chaos

"I am now going to take a one-month vacation with my wife and kids and go build my next project. Long live Sushi," said Joseph Delong. Late Wednesday, Joseph Delong, chief technology officer of SushiSwap, the 13th largest decentralized exchange, or DEX, by trading volume, tendered his immediate resignation from the role. Explaining his decision, Delong gave the following statement:"I wish Sushi the best and am saddened that Sushi is so imperiled within and without. The chaos that is occurring now is unlikely to result in a resolution that will leave the DAO as much more of a shadow than it....

Related News

"In the end, ultimately, I failed to deliver because of my compounding failures and will incorporate this knowledge into my next project," said Delong. On Friday, Joseph Delong, former chief technology officer of decentralized exchange, or DEX, SushiSwap, published a brief reflection of experiences during his tenure.Delong unilaterally resigned two days prior, citing internal structural chaos among developers behind the popular DEX. In explaining his decision, Delong outlined failures to scale operations, lack of organization skills, problematic contributors, and poor communication as the....

The company's director of finance will serve as acting CFO.

The cost to purchase one SushiSwap governance token surged by more than 15 percent in the last 24 hours. Dubbed as SUSHI, the cryptocurrency established a weekly high near $2.74 on Monday following a dramatic move upside. So it appears, traders flocked into the SushiSwap market as SUSHI was trading near a level that previously […]

SushiSwap’s governance cryptocurrency SUSHI fared better than Bitcoin ahead of the New York opening bell Tuesday. The decentralized finance token surged more than 15 percent during the European session, hitting an intraday high of 1.9471. Traders flocked into the SushiSwap market even as the protocol discovered a serious bug, a vulnerability that eventually led to […]

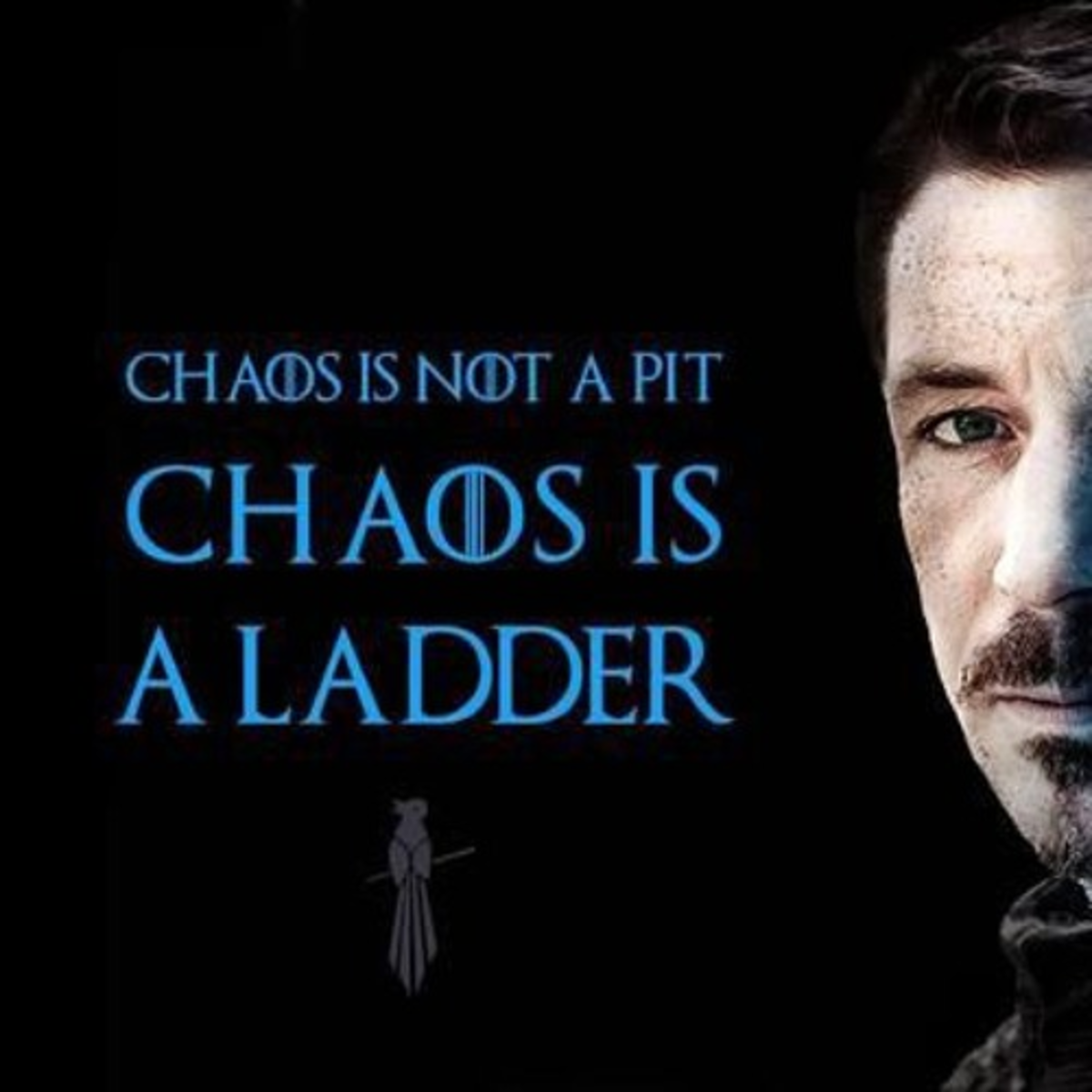

Four thoughtful individuals recognized that this year’s chaos wasn’t a pit, but a ladder. And they helped others realize it too. The post These Bitcoin Leaders Saw Ladders In 2020’s Chaos appeared first on Bitcoin Magazine.