Has Bitcoin Hit Bottom Yet? Here’s What On-Chain Data Says

Bitcoin continued to crash down yesterday, with the coin hitting as low as $21k before rebounding to current values. Has the crypto made the bottom yet? Bitcoin NUPL Indicator Assumes Negative Values For First Time Since 2020 As pointed out by an analyst in a CryptoQuant post, the NUPL metric has declined below zero, which could be a sign that the crypto may be approaching a bottom. The Bitcoin “net unrealized profit and loss” (NUPL) is an indicator that’s defined as the difference between the market cap and the realized cap, divided by the market cap. In simpler terms,....

Related News

The biggest question so far in the bear phase has been when and where the Bitcoin price will bounce back. According to the latest on-chain data, there might be a fresh answer as to where the price bottom will be in the current bear market. Here’s Why $40,000 Could Be Pivotal To The Bear Market […]

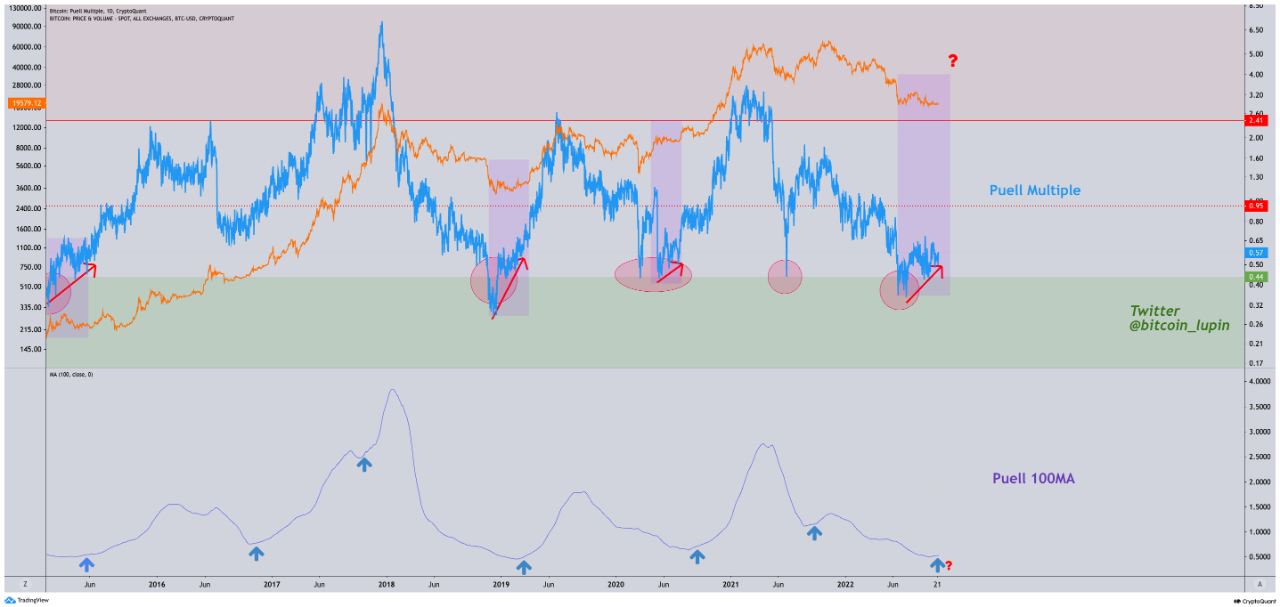

On-chain data shows the Bitcoin Puell Multiple has been going up recently after having formed a possible bottom. Here’s what history says could happen next for the crypto’s price. Bitcoin Puell Multiple 100MA Has Bounced Off A Potential Cycle Bottom As pointed out by an analyst in a CryptoQuant post, BTC miners seem to be […]

Ethereum has been a major victim of the ongoing crypto market onslaught, recording a 27.63% loss in the last month alone. The largest altcoin now trades around $2,800, representing a significant fall from the local cycle peak around $4,800. As prices continue to tumble with each new drop triggering waves of liquidation, analyst Ali Martinez has postulated on a market bottom target. Related Reading: Ethereum Golden Pocket In Play – Can ETH Turn The Tide Above $2,800? ETH MVRV Pricing Bands Reveal Potential 28% Decline Ahead In an X post on November 22, Martinez shares critical on-chain data....

After a disappointing performance during the week, the price of Bitcoin has continued its sluggish action over the weekend. According to data from CoinGecko, the premier cryptocurrency has been hovering around the $102,000 level over the past 24 hours. While this current choppy price action seems like an improvement from the severe downturn witnessed in recent days, it doesn’t particularly bring calm to the world’s largest cryptocurrency. Interestingly, the latest on-chain data suggests that the Bitcoin price might still be at risk of further correction in the coming days. Why BTC Price....

On-chain data shows that Ethereum transaction fees have dropped to their lowest level since January, a sign that a bottom could be close. Ethereum Transfer Fees Has Plunged As Network Has Gone Cold According to data from the on-chain analytics firm Santiment, Ethereum transaction fees have taken a notable hit recently. The “transaction fees” here […]