Contango And Over Collateralization

Over the last few weeks, the concept of contango has been making the rounds on Bitcoin Twitter. But what is it and why is it important?Over the last couple of weeks, the concept of “contango” — the situation where a futures price of a commodity is higher than the spot price, made popular among Bitcoiners by Preston Pysh and Plan B — has been discussed (and meme’d) throughout the Bitcoin community, particularly on Twitter. But what actually is contango? Why is it important? And how does it affect the price of bitcoin? The goal of this piece is to provide you with the answers to these....

Related News

The fact that bitcoin is trading in contango presents a remarkable investment opportunity and suggests hyperbitcoinization. But what is it?

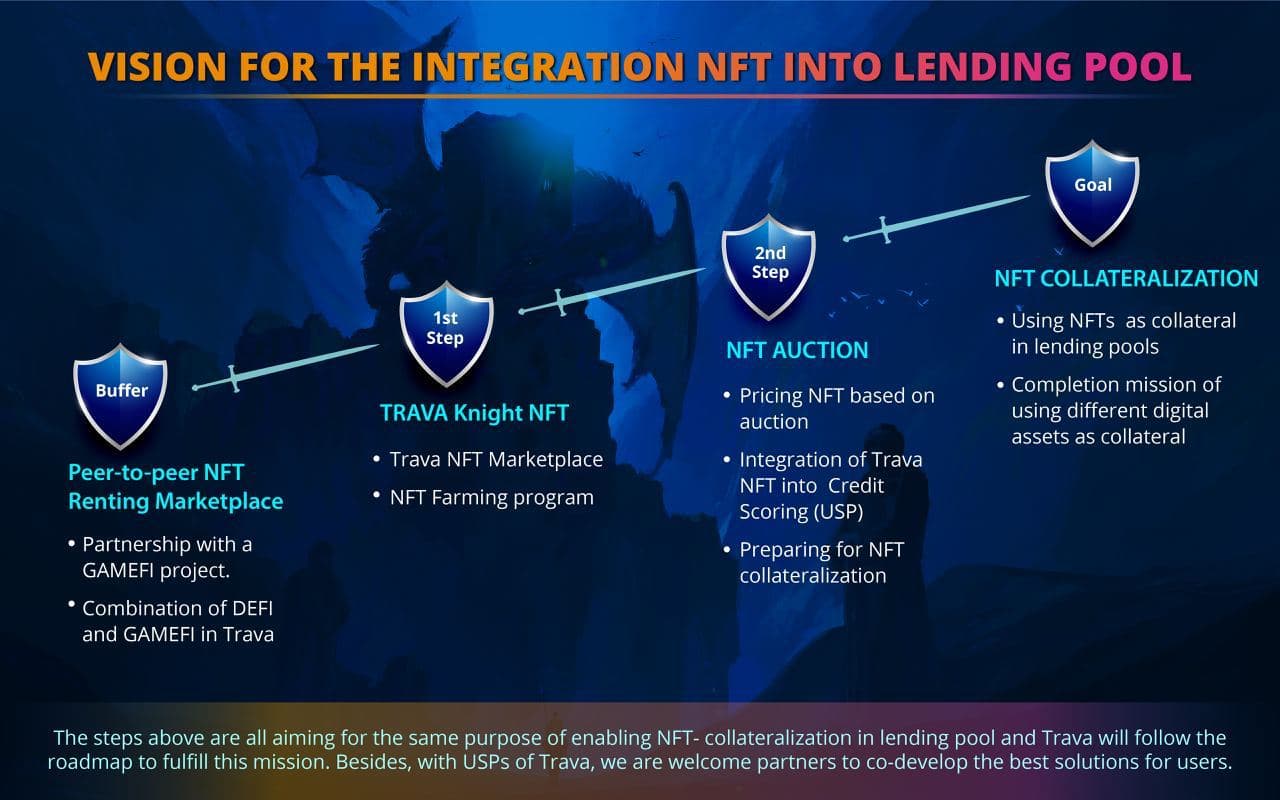

Something exciting & sensational is coming for NFT collectors and enthusiasts alike to look forward to. Trava.Finance is launching #KnightNFT for enabling NFT-collateralization. By opening the NFT marketplace for everyone and facilitating collateralization, we can see more activity in the future & benefits. This will enable Trava.Finance to progress towards achieving their goals and introducing more NFT utilities in their lending pool. Read on to find out more about the thrilling launch and what Trava.Finance is up to, in detail. Introducing Trava Knight NFT Trava.Finance is the....

Hashstack aims to disrupt and improve the appeal of decentralized borrowing and lending. Users can access under-collateralized loans through its Open Protocol at a 1:3 collateral-to-loan ratio. It is a welcome change for the broader DeFi industry, as current collateralization rates remain too high. Adjusting Loan Collateralization In DeFi In traditional finance, one can obtain a loan if they have a fraction of the borrowed amount to put up as collateral. One would expect the same to apply to decentralized finance, yet that is not the case. Instead, users often put up 150% – or more....

Bitcoin bulls may get some respite from a derivatives market indicator that hints at a price bottom. As the price of Bitcoin (BTC) is attempting to establish support at $37,000 on Tuesday, the recent $30,000 lows may have been the bottom, suggests one derivatives market indicator that has a history of accurately predicting BTC/USD cyclical lows following its bear cycles. The last time it predicted a bottom was on Nov. 1, following which the cost to purchase one Bitcoin surged from $13,771 to as high as $64,899 on Coinbase.Anatomy of a bullish indicatorDubbed as “rolling basis,” the....

After a bank run on the Iron Finance protocol cost him dearly, Mark Cuban is calling for regulation to define “what a stablecoin is and what collateralization is acceptable.” Billionaire investor and DeFi proponent Mark Cuban has called for stablecoin regulation after losing money on what he dubbed as a “rug pull” on the Iron Finance protocol. According to Iron Finance, the partially collateralized stablecoin project was the subject of a “historical bank run” that resulted in the price of the IRON stablecoin moving off peg. As a consequence, the price of Iron’s native token TITAN crashed....