Why Crypto Market Fear Mirrors Lull In Volatility

Data shows the crypto market fear has been mirroring the volatility in the market recently, as the latest burst in the price of Bitcoin has improved investor sentiment. Crypto Fear And Greed Index Escapes Out Of “Extreme Fear” Zone The “fear and greed index” is an indicator that tells us about the general sentiment among investors in the cryptocurrency market. The metric uses a numeric scale that runs from zero to hundred for displaying this sentiment. All values above fifty signify greed in the market, while those below the threshold suggest fear amongst the....

Related News

As Coti ramps up efforts to bring a decentralized fear index to crypto, it has enlisted the help of Professor Dan Galai, one of the pioneering brains behind the Cboe Market Volatility Index (VIX), to help the organization develop a crypto-oriented version. VIX Co-Creator to Join Coti-Backed Volatility Project Since exchanges for cryptocurrencies first arose, the market and accompanying price action have proven to be among the most volatile around. Intraday swings of double-digit percentage rates are regular occurrences. While it might seem like outsized volatility given the market’s....

Crypto market sentiment has dropped into the far negative once more. This has been one in the making ever since the Terra crash had begun and investors had scrambled to leave the market. A culmination of this and speculations that the market is headed into one of the longest bear trends ever recorded has now seen sentiment fall to levels not recorded since 2020. In The Extreme Fear Region Now, the crypto market sentiment has not been positive for a while. Most of the last two months have been spent in the fear territory and April had closed out in extreme fear. Nevertheless, the scores on....

Data shows the crypto market has remained in a state of extreme fear recently despite the Bitcoin volatility being quite low. Crypto Fear And Greed Index Continues To Point At “Extreme Fear” As per the latest weekly report from Arcane Research, investors in the cryptocurrency sector have remained extremely fearful since late August. The “fear and greed index” is an indicator that tells us about the current sentiment among participants in the crypto market. The metric makes use of a numeric scale that runs from zero to hundred for representing this sentiment. All....

A lot of positive price movement kicked off recently; the crypto market is enjoying a bullish run as Dogecoin and Bitcoin jumped beyond the previous levels, which had become a feat seemingly unachievable. Ethereum also recorded some gains for the first time after its merge. However, recall that the upgrade was already priced in before it took place. So, while many investors expected the number two crypto to gain, ETH plummeted from above $1,500 to sit at $1,300 for a long time. Related Reading: Why Crypto Market Fear Mirrors Lull In Volatility Other altcoins weren’t performing better....

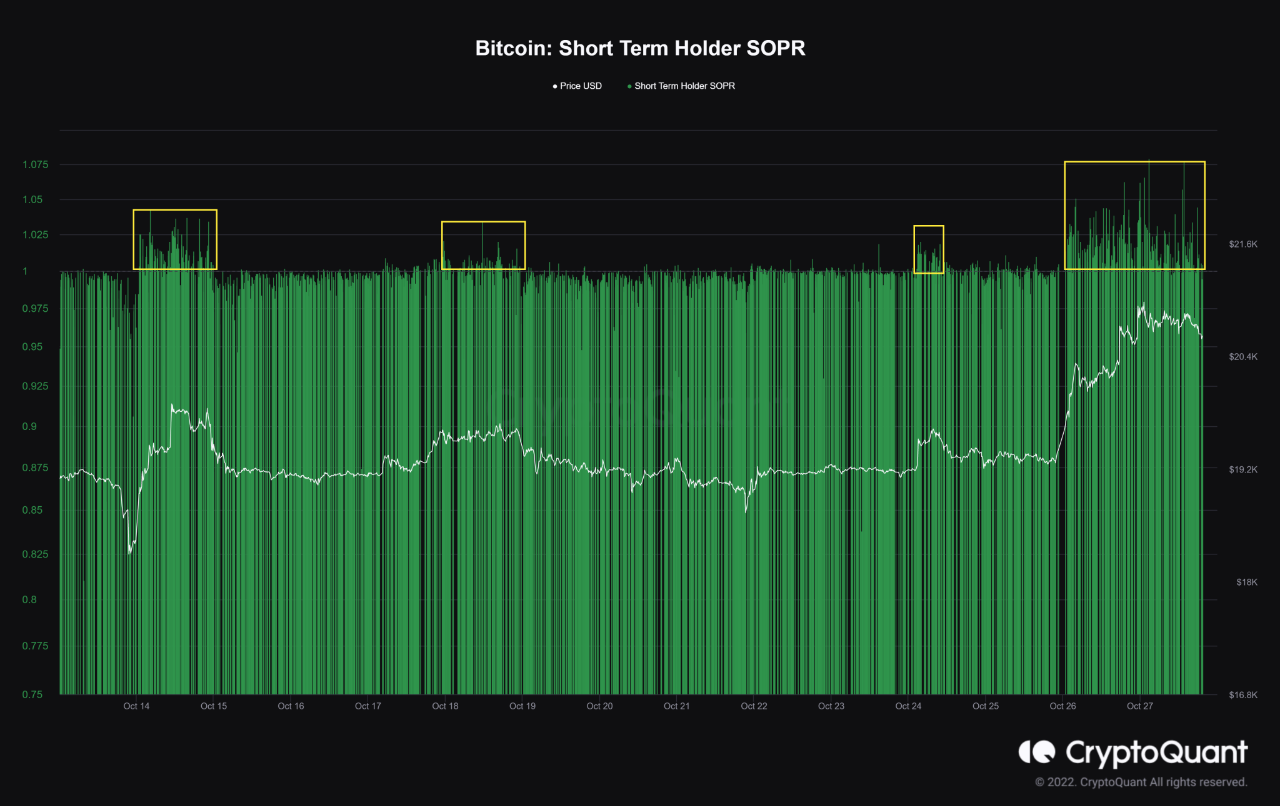

After surging to as high as $20.9k, Bitcoin has today observed a slight decline back into the low $20k levels as a result of profit taking from short-term holders. Bitcoin Short-Term Holder SOPR Has Been Elevated Over The Past Two Days As pointed out by an analyst in a CryptoQuant post, the short-term holders seem to be using the latest price rise for profit taking. The relevant indicator here is the “Spent Output Profit Ratio” (SOPR), which tells us whether the average investor is selling Bitcoin at a profit or at a loss right now. When the value of this metric is greater than....