Bitcoin price is fragile, but on-chain data points to fresh accumulation

On-chain data shows long-term holders are back in accumulation mode after the recent shake-out cleared network congestion and shook out over-leveraged traders. The May 19 crypto market sell-off saw $1.2 trillion in value erased from the total market capitalization as the froth and excess leverage of over-hyped markets was quickly eliminated. But similar to a forest fire, whose destructive power is essential to the rejuvenation of a forest's ecosystem, dramatic market shake-outs are a vital part of the full life cycle of a developing market, as excesses that have accumulated are burned away....

Related News

On-chain data shows the Bitcoin investors with no history of selling are back to intense accumulation, a sign that could be bullish for BTC’s price. Bitcoin Accumulation Addresses Have Been Showing High Demand Recently In a new post on X, the on-chain analytics firm CryptoQuant has talked about how the demand is looking from the […]

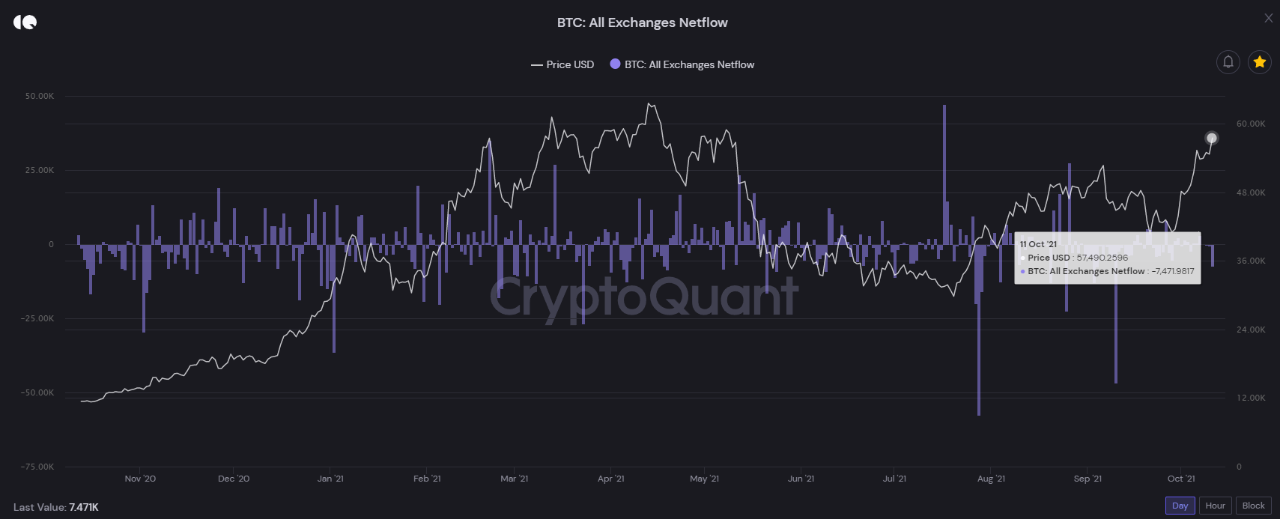

Bitcoin on-chain data suggests accumulation is going on as investors feel FOMO about the current rally above $57k. Bitcoin Accumulation Goes On As Investors Feel FOMO As explained by a CryptoQuant post, on-chain data is showing signs of accumulation as BTC netflows show negative spikes, and the stablecoins inflows indicate big moves. The Bitcoin netflow […]

On-chain data shows the Bitcoin “accumulation addresses” have observed all-time high inflows following the latest asset price slump. Bitcoin Accumulation Addresses Have Aggressively Bought The Dip As an analyst in a CryptoQuant Quicktake post pointed out, the total Bitcoin inflows going towards the accumulation addresses have set a new all-time high recently. The “accumulation addresses” […]

Ethereum is once again under heavy selling pressure after losing the critical $2,000 level — a psychological and technical zone that bulls have struggled to defend in recent weeks. With price action turning increasingly bearish, investor sentiment is weakening, and analysts are warning that a deeper correction may be on the horizon. As Ethereum slides lower, concerns are growing across the broader crypto market, which often relies on ETH’s strength to lead recovery phases. Related Reading: Bitcoin OTC Desks Are Draining – Supply Squeeze On The Horizon? The current situation is both....

After bitcoin prices dipped to a low of $30,066 per unit last week, lots of people have been focused on the panic sellers. Meanwhile, when bitcoin prices plunged, the number of bitcoin addresses in accumulation tapped an all-time high at 545,115 addresses. Number of Bitcoin Accumulation Addresses Hit New Highs Bitcoin (BTC) prices slid from a $64,895 per unit high to a low of $30,066 per bitcoin in 30 days losing more than 53% in value. When the price plunge took place data from Glassnode’s bitcoin “accumulation addresses” spiked. The number of bitcoin addresses in....