Pantera, Coinbase Ventures and Sony back NFT-focused MakersPlace in $30M Seri...

“At MakersPlace, we view our work as an investment in the future of creativity,” said co-founder and CEO Dannie Chu. MakersPlace, a nonfungible token market dedicated to digital art, has secured $30 million in Series A financing, highlighting once again that venture funds are keen to back promising NFT plays.The funding round will be used by MakersPlace to scale business operations and acquire additional talent as it continues to attract new users and artists to its platform. The investment was co-led by Bessemer Venture Partners and Pantera Capital, with additional participation from....

Related News

The new trademark application covers video recordings, text, artwork, and audio featuring live music authenticated by NFTs. American music giant Sony Music Entertainment has signaled intentions to utilize non-fungible tokens (NFTs) after filing a trademark application covering music and artists under the Columbia Records logo. According to an Aug. 30 trademark application to the United States Patent and Trademark Office (USPTO) shared by trademark attorney Mike Kondoudis on Sept. 6, the application covers "audio and video recordings featuring live musical performances authenticated by....

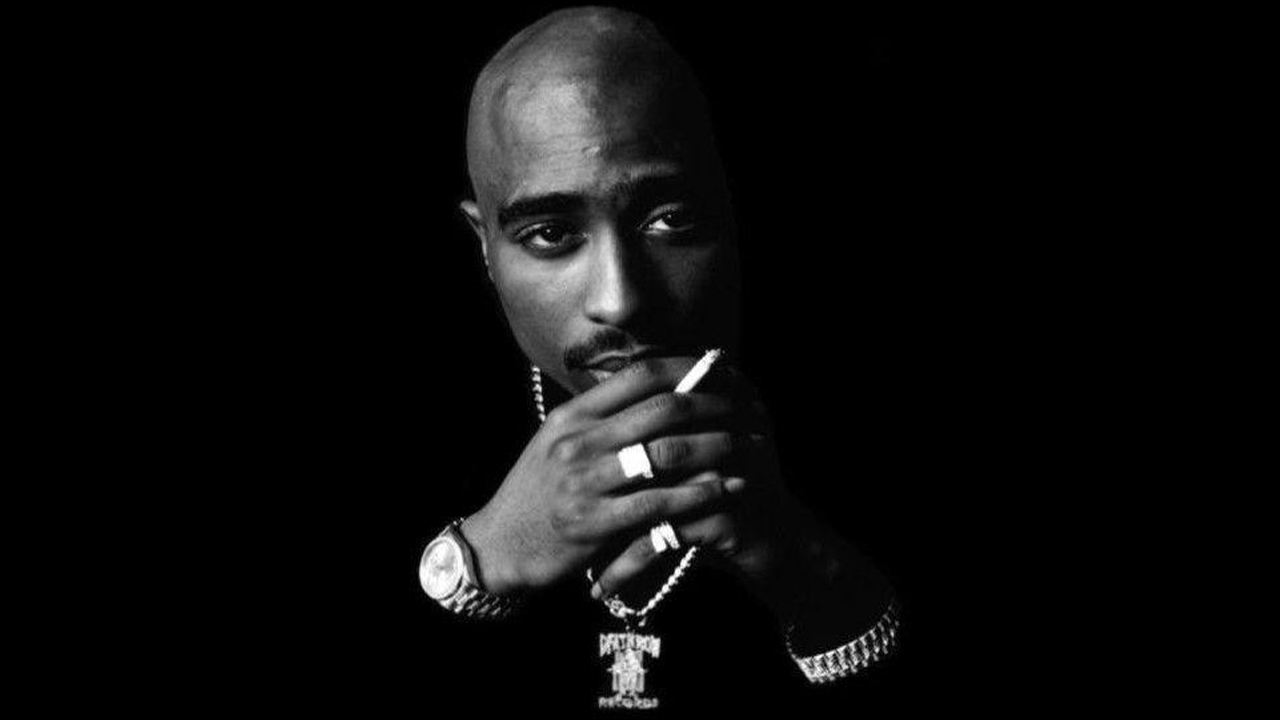

On December 15, the non-fungible token (NFT) market platform Makersplace will drop an assortment of NFTs based on Tupac Shakur’s most well-known jewelry pieces. Makersplace and the NFT artists and curators Impossible Brief and Digital Arts & Sciences worked closely with Shakur’s estate in order to drop the NFT collectibles called “The Immortal Collection.”

Tupac’s ‘The Immortal Collection’ to Drop on December 15

Fans of the rap legend Tupac Shakur (also known by his stage names 2pac and Makaveli) will soon be able to bid on....

Fortress Investment Group LLC and Pantera Capital have announced that they are teaming up to form an investment fund focused on virtual currencies. According to the Wall Street Journal, the joint venture Pantera Bitcoin Partners LLC, is controlled by Pantera and allows minority equity partners Fortress, Benchmark Capital and Ribbit Capital to manage future and existing virtual currency-related investments through the fund. New York based Fortress, who manages about $58 billion in assets, was an early bitcoin investor. A recent regulatory filing indicates the firm purchased $20 million....

Non-fungible tokens are going 3D, and Sony Electronics – the Japanese tech juggernaut – wants to be the company that takes them into a whole new experience. Sony is collaborating with Theta Labs, the operator of the blockchain-based video streaming platform Theta, to produce two types of 3D NFTs designed specifically for use with the Sony Spatial Reality […]

Sony Group Corporation has revealed it has partnered with Theta Labs in order to launch 3D non-fungible token (NFT) assets. The upcoming NFTs will be crafted for the Sony Spatial Reality Display and are designed for three-dimensional viewing. Sony 3D NFTs to Enhance Spatial Reality Display Features The Japanese multinational conglomerate corporation Sony is working with Theta Labs, the creators of the Theta blockchain. The Theta project is described as a decentralized video streaming network or video delivery network with its own native crypto asset, theta network (THETA). According to....