Traders think Bitcoin bottomed, but on-chain metrics point to one more capitu...

BTC price gravitates around the low $30,000 zone, luring traders to believe the bottom is in, but data from Glassnode warns of another final sell-off. The bull market euphoria that carried prices to new highs throughout 2021 has given way to bear market doldrums for any Bitcoin (BTC) buyer who made a purchase since Jan. 1, 2021. Data from Glassnode shows these buyers "are now underwater" and the market is gearing up for a final capitulation event. Bitcoin net unrealized profit/loss. Source: GlassnodeAs seen in the graphic above, the NUPL, a metric tha is a measure of the overall unrealized....

Related News

On-chain and technical analysis indicators suggest BTC price may have bottomed, but several traders are still wary that BTC price could fall as low as $10,000 in the short-term. The crypto market is currently going through a period of heightened volatility as global economic conditions continue to worsen amid a backdrop of rising inflation and interest rates. As the headwinds impacting global financial markets beat down all traces of bullish sentiment, many crypto investors are predicting that Bitcoin (BTC) price could drop to as low as $10,000 before a market bottom is found. BTC/USDT....

Traders are using a variety of strategies to determine whether Bitcoin price has bottomed, but on-chain activity and derivatives data hint that the situation remains precarious. Traders are using various strategies to determine whether Bitcoin price has bottomed, but on-chain activity and derivatives data hint that the situation remains precarious.Has Bitcoin price bottomed yet? According to @noshitcoins, derivatives and on-chain data signal that further downside could be in store.Traders have been trying to time the much-anticipated trend reversal ever since Bitcoin (BTC) initiated its....

Is it time for a correction after ETH rallied 34% in two weeks? On-chain metrics and derivatives data say yes. Investors tend not to complain about a price rally, except when the chart presents steep downside risks. For example, analyzing Ether's (ETH) current price chart could lead one to conclude that the ascending channel since March 15 is too aggressive.Ether price at FTX, in USD. Source: TradingViewThus, it is only natural for traders to fear that losing the $3,340 support could lead to a retest of the $3,100 level or a 12% correction down to $3,000. Of course, this largely depends on....

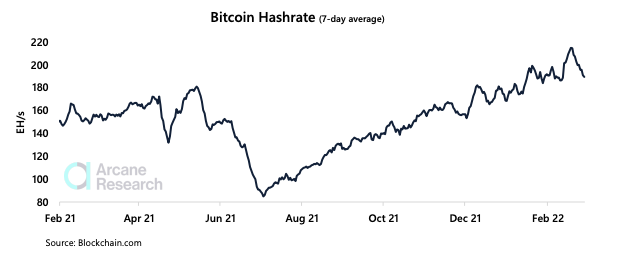

Bitcoin remains on an upward trend after breaking through $40,000 once again. However, this upward trend has not translated onto on-chain metrics. While the price of the digital asset continues to sit in the green, on-chain metrics have plummeted paining an entirely different picture in relation to price. From miner revenues to transaction fees, the […]

An analyst has explained, using different on-chain indicators, how Uniswap (UNI) could be gearing up for a price breakout. Uniswap Metrics May Point That A Rally Could Be Brewing Up In a new post on X, analyst Ali has discussed the outcome that UNI may face based on some underlying metrics. The first indicator of […]