China's central bank says crypto gave impetus to the creation of its CBDC

A working paper released in English by the People's Bank of China cites cryptocurrencies as an important context for the digital yuan's development and reveals that the digital currency will use smart contracts to allow for programmability. Much attention has been paid to the global, geopolitical implications of China’s rapid and pioneering development of its digital yuan, also provisionally known as e-CNY.Yet in a new white paper published by the Working Group on E-CNY Research and Development of the People’s Bank of China (PBoC), the institution gave a more domestic-focused and....

Related News

The United States is embarking on a campaign toward the introduction of a CBDC, or central bank digital currency. As part of the White House’s first-ever comprehensive framework, the Treasury Department is now suggesting the creation of a national stablecoin or CBDC. To counter China’s advancements on the CBDC, five panelists at a hearing for the […]

Bank Indonesia, the country’s central bank, is reportedly considering issuing a central bank digital currency (CBDC) to fight the use of cryptocurrency. “A CBDC would be one of the tools to fight crypto. We assume that people would find CBDC more credible than crypto,” said an assistant governor of the central bank. Central Bank Sees CBDC as Tool to ‘Fight Crypto’ Juda Agung, an assistant governor of Bank Indonesia, the country’s central bank, talked about cryptocurrency and central bank digital currency (CBDC) during his parliamentary “fit....

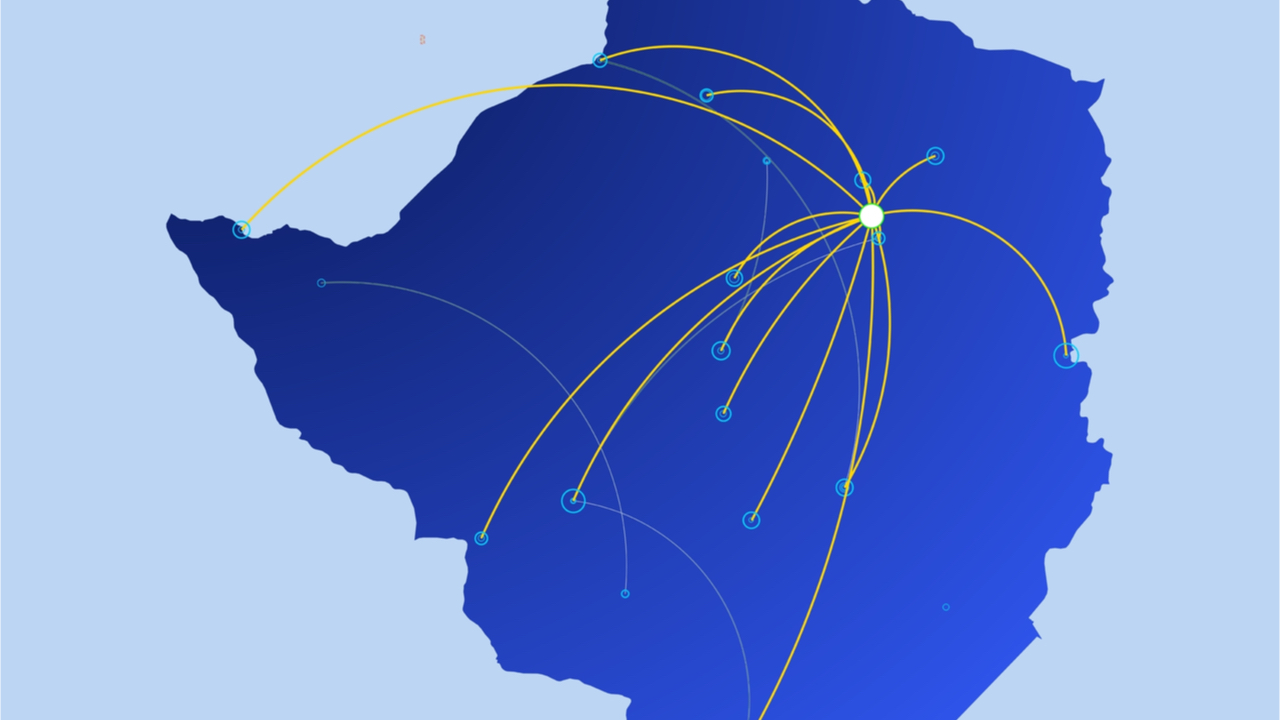

Zimbabwe’s central bank, which has expressed its opposition to cryptocurrencies in the past, announced yesterday it is presently exploring the feasibility of rolling out its own central bank digital currency (CBDC). The bank also said its regulatory sandbox continues to garner interest.

CBDC Roadmap

The Zimbabwean central bank, the Reserve Bank of Zimbabwe (RBZ), has reiterated that it prefers a central bank digital currency (CBDC) to cryptocurrencies, in its latest monetary policy statement. It adds it is now “actively exploring the feasibility of adopting a....

One of cryptocurrency’s most notable use cases is enabling instant cross-border payments. That’s why the Central Bank Digital Currency (CBDC) program has attracted hundreds of jurisdictions worldwide, and some countries like China have already linked the technology with their central bank. Similarly, Europe Central Bank (ECB) is currently in the investigation phase of CBDC and […]

Japan is getting more serious about the digital yen. Japan needs to adapt its laws to issue a central bank digital currency, according to a local financial official.Kozo Yamamoto, head of the Liberal Democratic Party’s council on financial affairs and a former official at the Ministry of Finance, believes that Japan must revise a law stipulating the Bank of Japan’s (BoJ) mandate and responsibilities regarding the development of a CBDC.According to an Oct. 12 Reuters report, Yamamoto said that potential amendments to the BoJ law would be a good opportunity to consider other changes like....