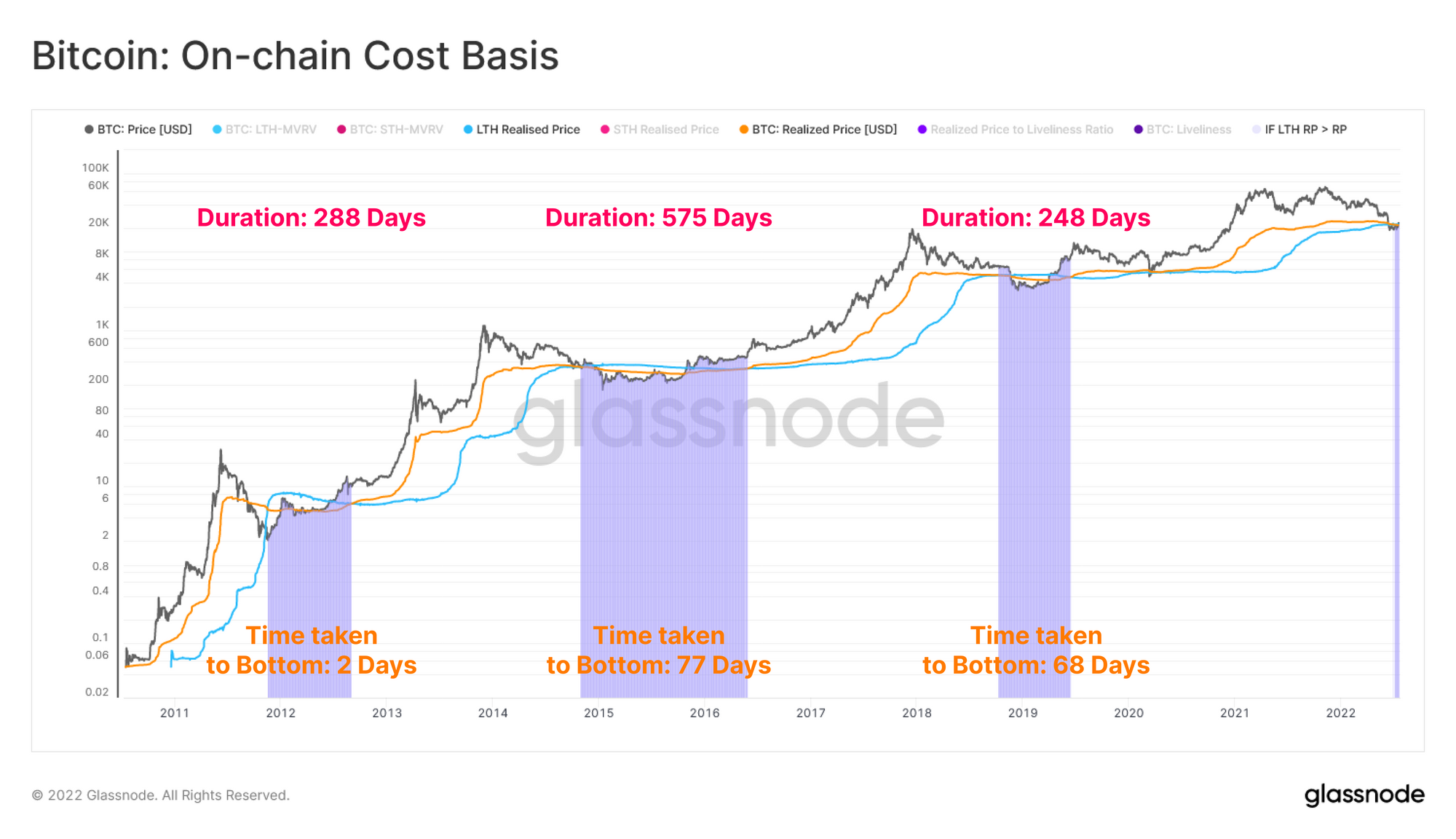

Analyzing The Current Long-Term And Short-Term Bitcoin Holder Cost Bases

The current short-term and long-term bitcoin holder cost bases offer some signals about the market.The below is from a recent edition of the Deep Dive, Bitcoin Magazine's premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.The current short-term holder cost basis has been a key price support to watch over the last couple months as it’s dropped from nearly $53,000 to $49,986. Price below the short-term cost basis is a fairly cautious market sign as recent market buyers are down 15.5% on....

Related News

The short-term and long-term bitcoin holder cost basis ratio is trending downward, signaling a shift in market conditions.

On-chain data shows that the Bitcoin short-term holder whales have a cost base above $64,000, which could be a potential resistance point for BTC. Bitcoin Is Not Far From Realized Price Of Short-Term Holder Whales After Rally As pointed out by an analyst in a CryptoQuant Quicktake post, the BTC price had slipped below the Realized Price of the short-term holder whales earlier. The “Realized Price” here refers to an indicator that keeps track of the average cost basis that the investors of a particular group currently share. Related Reading: Bitcoin NVT Golden Cross Gives Bottom....

Data from Glassnode shows the Bitcoin long-term holder cost basis is currently above the realized price of the crypto. Bitcoin Long-Term Holder Cost Basis May Have Hints For Bear Market Length As per the latest weekly report from the analytics firm Glassnode, the LTH cost basis has remained below the realized price for a period […]

Bitcoin has seen a rebound since retesting the short-term holder Realized Price, a sign that this historical on-chain support may be holding. Bitcoin Short-Term Holder Realized Price Just Acted As Support As explained by CryptoQuant author IT Tech in an X post, Bitcoin found support around the short-term holder Realized Price during the latest dip. The “Realized Price” here refers to an on-chain indicator that measures the cost basis of the average investor on the BTC network. Related Reading: Bitcoin HODLers Spend 97,000 BTC—Biggest Move This Year When the price of the....

What the ratio of short-term bitcoin holders to long-term bitcoin holders can tell us about the market.