Bitcoin trader eyes US dollar for BTC price breakout cue, Ethereum clings to $2K

No sign of a breakout as $33,000 becomes resistance overnight and altcoins trade mostly flat as a result of BTC price weakness. Bitcoin (BTC) stayed below the $33,000 mark on July 9 with a fresh price dip also putting an end to altcoin strength. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingViewBTC price flips $33,000 supportData from Cointelegraph Markets Pro and TradingView followed BTC/USD as it ranged below a previous support level into Friday.Earlier in the week, $33,000 saw multiple tests but remained in place as support, this only coming undone on Thursday.$33,000 then....

Related News

The Dogecoin price has just completed a key technical breakout against Bitcoin (BTC), potentially signaling the start of a significant rally. According to the analyst who identified the Falling Wedge breakout, Dogecoin may also outperform Bitcoin in this market cycle. Dogecoin Price Eyes Pump After Falling Wedge Breakout On April 27, Trader Tardigrade, an X […]

Ether is forming classic bullish patterns against the greenback and its top crypto rival on shorter-timeframe charts. Ethereum's native token, Ether (ETH), looks ready to grow stronger compared to the U.S. dollar and Bitcoin (BTC) in the days leading up to its proof-of-stake transition in September.ETH price chart bullish setupThe bullish outlook emerges from classic technical indicators on ETH/USD and ETH/BTC charts. For instance, ETH/USD has been forming a "falling wedge" pattern with a profit target sitting around 30% above the current prices. Meanwhile, the ETH/BTC chart is painting a....

The Dogecoin price looks set to witness a breakout above the psychological $1 level, having broken a resistance trendline. Crypto analyst Trader Tardigrade provided a timeline for when this massive surge could happen as DOGE rallies to a new all-time high (ATH). Dogecoin Price Eyes Rally Above $1 Following Breach Of Resistance Trendline In an […]

A gloomy outlook for the US dollar is leaving Bitcoin with a potential to continue its bull run towards $20,000.

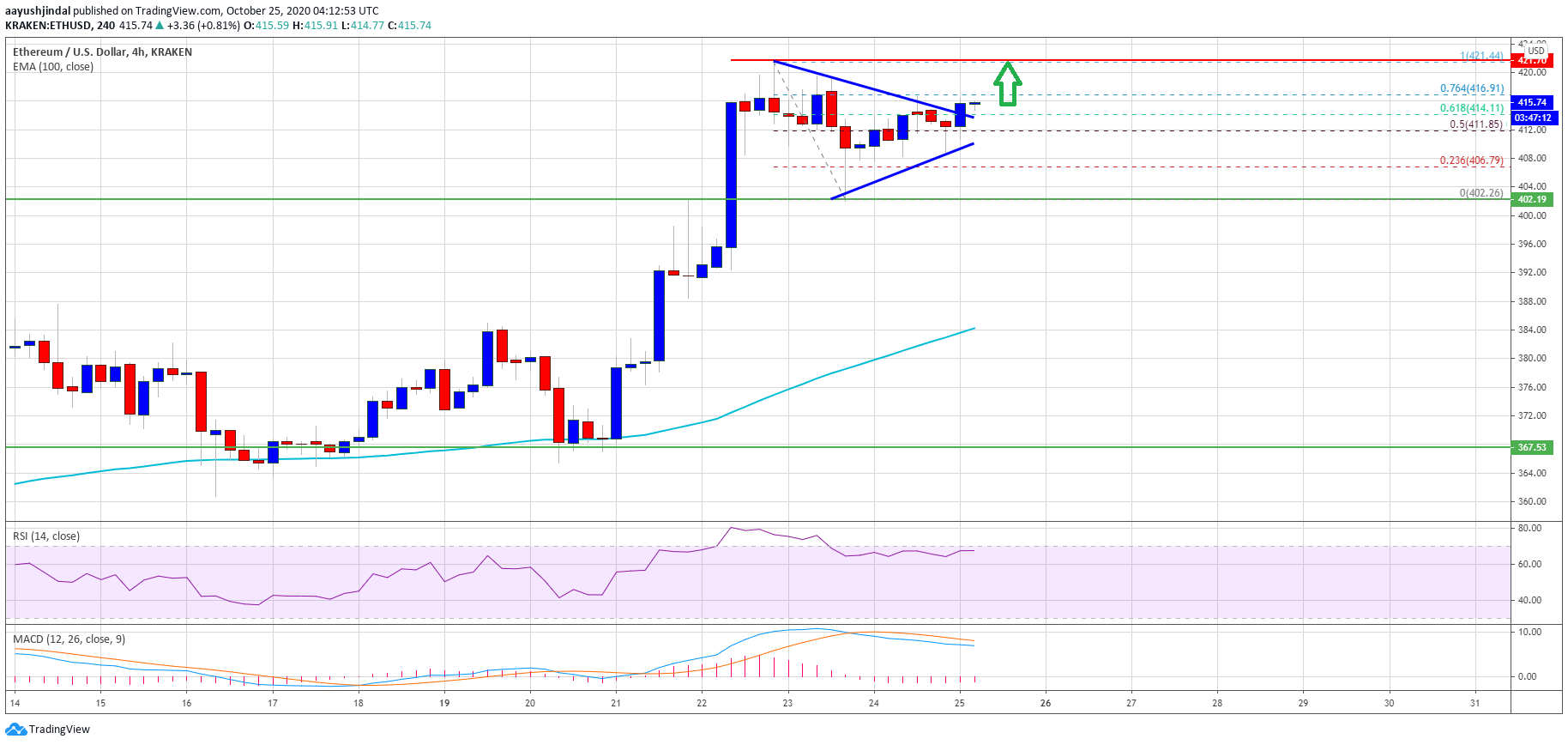

Ethereum traded to a new monthly high at $422 before correcting lower against the US Dollar. ETH price is trading well above the 100 SMA (H4) and it is likely to resume its upside above $422. ETH price is trading in a strong uptrend above the $400 support against the US Dollar. The price is […]