Crypto Long & Short: Could Scalable Payments for Bitcoin Undermine Its Value?

A stream of crypto payments services coming to market give new life to the debate around whether bitcoin can be both a store of value and a payments token.

Related News

Payments giant Visa has revealed it is seeking to hire a software engineer to help it create a "secure, scalable blockchain network". The news was revealed in a job advertisement by Visa Research – a research arm created by the company to expand its technology research capabilities. Visa Research's remit is to engage with the company's technology and product teams, and business and other partners, to investigate and develop technologies that are "critical to the payments industry in the future", the firm says. As part of its efforts to build three research sections....

The latest OCC statement, which opens the door for banks to use blockchains to validate payments, hints at more than just better services.

The crypto market is experiencing a correction with Bitcoin and Ethereum giving back their gains from previous weeks. The general sentiment in the sector was optimistic but could take a blow if main cryptocurrencies lose their current levels. Related Reading: USDC Exchange Reserve Spikes – Can This Help Push Bitcoin Back Up? At the time of writing, Ethereum (ETH) trades at $1,690 with a 10% loss in the last 24 hours and 7 days, respectively. The cryptocurrency has preserved a critical support zone at $1,700 that was turned from major resistance into support. In a market update, BitMEX....

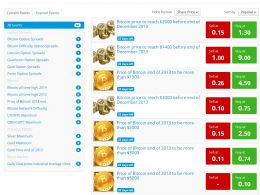

A whole lot of Bitcoin holders have made bank on the cryptocurrency's recent meteoric rise. But is it possible to make money from a falling Bitcoin price? Well, it is now! But let's start at the beginning, by defining terms. In trading, a bet that price will fall is called a "short." This is the opposite of a "long," which is buying something in the expectation of a future price rise. Probably a lot of people reading this are long cryptocurrency, or at least thinking of going long. The old joke for people who've bet the farm on a long position is that they're "long like John" (Holmes, the....

Discover the intricacies of short and long positions in crypto trading. These principles can be applied by both new and experienced traders. How can margin trading amplify the targets of long and short positions?Margin trading can magnify the potential results of long and short positions thanks to leverage — i.e., borrowed funds.Going long or short might be lucrative, especially when the cryptocurrency is volatile. Still, professional traders prefer margin trading, as they can amplify potential profits by several times. However, the risks also increase by the same degree, which is why....