Active Bitcoin miners now 'unlikely' sellers thanks to profit boost — data

The upcoming record difficulty drop means mining Bitcoin is about to get a lot more profitable while hash rate slowly returns to the network, Glassnode predicts. Bitcoin (BTC) miners are “unlikely” to pressure BTC price by selling coins in the coming weeks, new data says.As part of its latest weekly report, The Week On-chain, analytics resource Glassnode sought to allay fears of another large miner sell-off.Difficulty drop a gift to remaining minersAmid the ongoing transfer of mining equipment — and therefore Bitcoin hash rate — out of China, fears have emerged over miners selling BTC to....

Related News

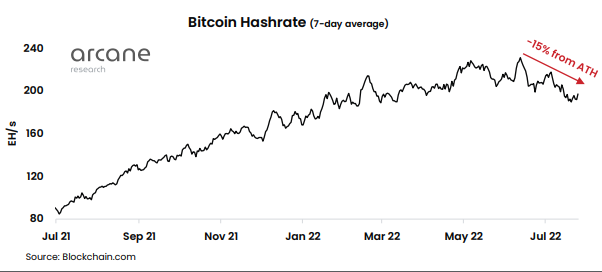

Data shows the recent large negative Bitcoin mining difficulty adjustment has provided a significant boost to the miners’ revenues. Bitcoin Miners Observe Big Boost In Revenues After Difficulty Decrease As per the latest weekly report from Arcane Research, the BTC miner revenues have seen a 15% growth over the last seven days alone. A relevant […]

The mining difficulty for Bitcoin (BTC) has reached an all-time high, reducing the already diminishing profit margins of miners. The new development could be catastrophic for crypto miners. As it also appears that the price of BTC is declining, Bitcoin miners may be going into a storm. According to data from btc.com, a company that […]

Miners are starting to get strapped for cash and need a boost since BTC has dropped in price since November and revenue has fallen even further due to increased competition. Bitcoin miners are selling off coins from their stockpiles and shares in their companies after the profitability of mining took a dive since November.With Bitcoin (BTC) currently holding around $43,500, about 33% below the all-time high (ATH) of about $69,000 reached that month, miners are selling at a less-than-opportune time. However, electricity and equipment bills must be paid.Data from on-chain analytics firm....

Bitcoin has pulled back $10,000 from highs set earlier in the year, and according to on-chain data, it is due to extreme profit taking from early investors and miners. Here’s what past bull markets suggest about the current sell off and if this is an opportunity to “buy the dip,” or if the top is in. Bitcoin Bull Market Correction Is Here, According To On-Chain Data After rising from $3,800 to over $40,000 in less […]

The Boost community has seen huge developments in the last month. Features from the highly anticipated Boost DeFi app have started going live and by mid-November even more will be available. Boost’s native token, Boost Coin, has seen amazing results so far. Analysts are predicting Boost Coin will reach $1 as the app gets closer […]