All eyes on Asia — Crypto’s new chapter post-China

From Singapore to Thailand and Indonesia: Asia’s crypto landscape continued to thrive, unabated by China’s sudden crackdown. A fundamental trait of crypto is as an asset class that transcends jurisdictions. Yet, one of the key hubs driving adoption and innovation is Asia. Since the heady days of Korea’s Kimchi premium and Bitcoin (BTC) arbitrage opportunities, the region is playing a role in defining crypto’s development pathways and anchoring its future.According to Chainanalysis’ report, in the first half of 2021, Asia was already the destination for 28% of the overall global transaction....

Related News

The South China Morning Post, which was founded in Hong Kong in 1903, has become Asia’s first news organization to support a new blockchain standard for connecting, discovering, and collecting historical and archive items. South China Morning Post Forays Into NFTs According to a press release, the newspaper will use non-fungible token (NFT) technology to […]

The Asia-Pacific region led by China is quickly catching up to the West in terms of wealth. With the accelerating pace of innovation in mobile communications and fintech, the region is expected to not only leapfrog the US & Europe by 2019, but also integrate millions of unbanked people into the global economy. The Asia Pacific region, led by China, is growing fast. In 2014, the sum total of worldwide assets reached a record high of US$164.3 trillion. As central banks have come to the rescue, asset prices have risen to record highs globally. Global growth overall grew by 11.9% (see chart....

Bitcoin mining hardware manufacturer HashFast has formally entered Chapter 11 bankruptcy following a court ruling. The US bankruptcy court granted the company's request on 7th June after it filed for bankruptcy protection two days earlier. The move closes a turbulent chapter in HashFast's history, nearly a month after laying off half of its workforce and publicly denying that it was filing for bankruptcy. According to a 10th June blog post, the company is now in the process of reorganizing under Chapter 11. Most notably, CEO Eduardo DeCastro has resigned from his position as part of a....

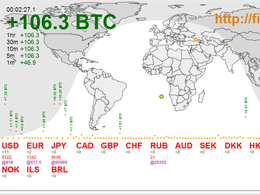

Reports of massive Bitcoin Buyback in China circulating gain credibility http://t.co/PhNidqe4lp shows large buy orders originating from asia. - COINSPRINT (@coinsprint) January 14, 2014. This is the view from fiatleak.com showing a flurry of bitcoin buys in China: Here is an update one hour later:

Asia is home to over half the world's population, not to mention a large number of its fastest-growing economies and busiest financial centers. In terms of funding and business activity, the Asian bitcoin scene is dominated by its most advanced economies: China, South Korea, Japan, Hong Kong and Singapore. The region is home to more than 50 countries and jurisdictions with diverse conditions and financial needs. In theory, this should be bitcoin's land of milk and honey. However, Asia's economic and political diversity is both an advantage and disadvantage, and there are still plenty of....