Ghanaian Central Bank Allays Fears That a CBDC Will Disrupt Mobile Money Oper...

The Bank of Ghana has said the expected implementation of the central bank digital currency will not disrupt or negatively impact the operations of mobile money operators. Rather, the central bank expects the digital currency to improve the efficiency of Ghana’s settlement systems as well as to “fast-track cross border trade.” CBDC to Complement Mobile Money The Ghanaian central bank has moved to allay fears that the implementation of the central bank digital currency (CBDC) known as the e-cedi might adversely impact the operations of mobile money operators....

Related News

In a recently released document, the Bank of Ghana (BOG) outlines some of its key reasons for developing the central bank digital currency (CBDC). Also, in the document, the bank’s governor insists the institution is open to suggestions that will help it to successfully launch the digital currency.

Benefits of a CBDC

The Ghanaian central bank recently released a document that outlines the key motivations behind its plan to issue a central bank digital currency (CBDC). The document also touches on the digital currency’s design as well as the benefits it will bring....

A Ghanaian blockchain and crypto association, Afroblocks, has warned the Bank of Ghana (BOG) to resist the urge to develop a central bank digital currency (CBDC) that is based on the “old traditional siloed financial thinking.” Afroblocks Not Consulted Afroblocks (formerly Blockchain Society Ghana) instead wants the central bank to emulate “financial projects that are borderless and decentralized like modern-day cryptocurrencies.” According to Omar Majdoub, one of the association’s co-founders, doing this will increase the likelihood of the CBDC’s....

The Ghanaian central bank is seeking to make its digital currency, the e-cedi, available to offline users, an official with the bank has said. Overcoming the Challenge of Limited Power According to Kwame Oppong, who heads fintech and innovation at the Bank of Ghana (BOG), the e-cedi is also expected to facilitate transactions without the need for power or connectivity. “Financial inclusion is limited by the availability of connectivity and power. What we hope to be able to do – and we’re one of the people pioneering this – is that the e-cedi would also be....

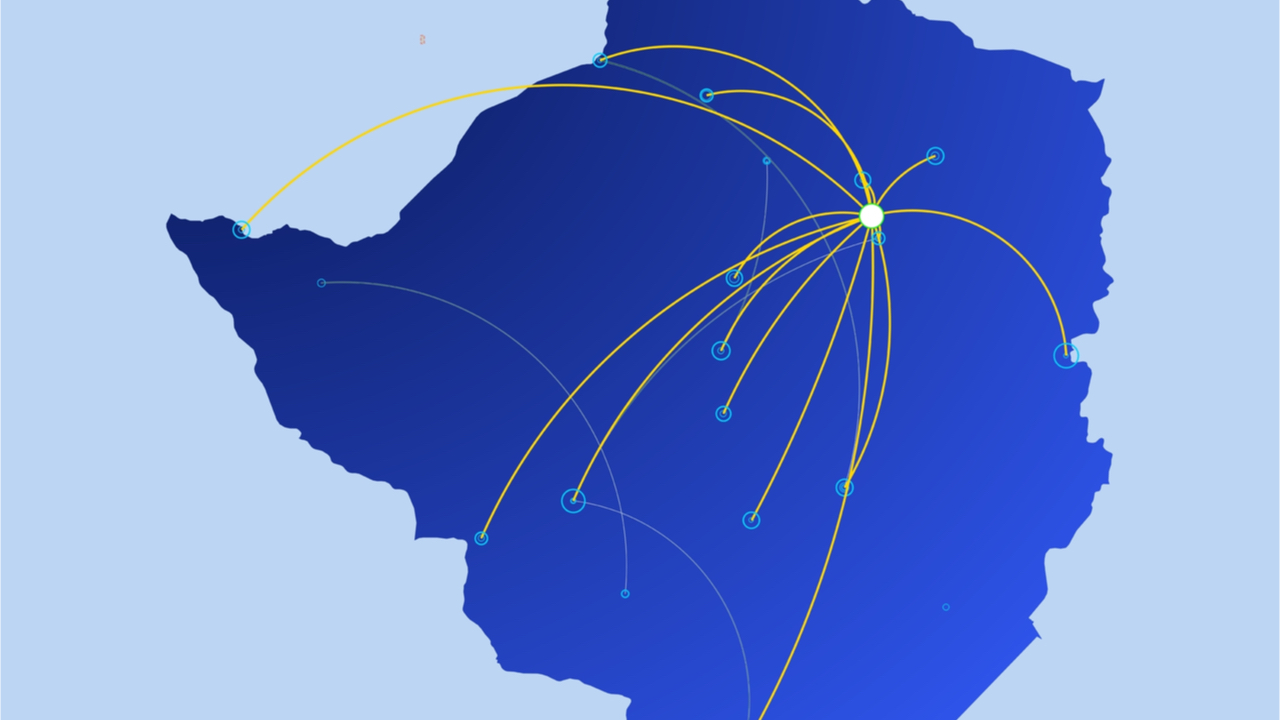

Zimbabwe’s central bank, which has expressed its opposition to cryptocurrencies in the past, announced yesterday it is presently exploring the feasibility of rolling out its own central bank digital currency (CBDC). The bank also said its regulatory sandbox continues to garner interest.

CBDC Roadmap

The Zimbabwean central bank, the Reserve Bank of Zimbabwe (RBZ), has reiterated that it prefers a central bank digital currency (CBDC) to cryptocurrencies, in its latest monetary policy statement. It adds it is now “actively exploring the feasibility of adopting a....

Bank Indonesia, the country’s central bank, is reportedly considering issuing a central bank digital currency (CBDC) to fight the use of cryptocurrency. “A CBDC would be one of the tools to fight crypto. We assume that people would find CBDC more credible than crypto,” said an assistant governor of the central bank. Central Bank Sees CBDC as Tool to ‘Fight Crypto’ Juda Agung, an assistant governor of Bank Indonesia, the country’s central bank, talked about cryptocurrency and central bank digital currency (CBDC) during his parliamentary “fit....