Central Bank Digital Currencies May Drive Cash ‘Shadow Economy’ to Crypto: Re...

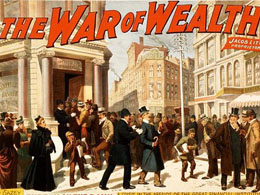

"Shadow economy" participants, those who use deal mostly in hard cash for anonymity's sake, are unlikely to be drawn to using a CBDC, according to a Reuters column.

Related News

Deputy Governor of the Bank of England Ben Broadbent has spoken out on the implications of a central bank digital currency (CBDC) for the financial system as we know it. In Broadbent’s lecture at the London School of Economics on March 2, he focused on what a central bank digital currency could look like, and potential economic implications of introducing one. Central Bank Digital Currency A CBDC could be issued by a central bank to widen access to the central bank’s balance sheet. Liabilities on the central bank’s balance sheet include banknotes and commercial bank reserves, and are the....

In a speech on Monday, Yves Mersch, Member of the Executive Board of the European Central Bank (ECB), discussed how the bank could design, issue, and manage a central bank digital currency for everyone, to be used alongside cash. One of the two types considered was a cash-like digital currency with anonymity. The proposed central bank digital currency or....

Representatives from the Bank of Canada claim the institution remains unconcerned by the advent of bitcoin and digital currencies in general. Speaking at a session of the Senate banking committee, central bankers said it is simply too early to predict whether digital currencies will gain traction from mainstream users. Bank of Canada governor Stephen Poloz added that digital currencies are still in their infancy and have not progressed to the point where he would call them money, reports Global News. "We've got a ways to go before we need to be thinking about policy implications," he said.....

While the world waits to see how the People’s Bank of China moves to regulate bitcoin and digital currencies, another central bank is quietly putting its own rules in place. The Central Bank of the United Arab Emirates (UAE) released a new regulatory framework earlier this month, aimed at providing a basis for the development of a new digital payments ecosystem as part of a broader modernization drive. The framework, published on 1st January, applies to companies that offer withdrawals and deposits to payment accounts, debit and credit services (both retail and government), remittances and....

According to a report on Zero Hedge, "My Bank," one of Russia's top 2oo lenders by assets, has suspended all cash withdrawals. The lockdown is expected to last for a week. This news follows the recent statement by the Russian Central Bank warning citizens against the speculative and legal risks of Bitcoin. The Russian Ruble is experiencing downward pressure from the current "risk-off" environment afflicting emerging market economies. It's possible this currency situation is responsible for the bank freeze. My Bank shuts down cash withdrawls to prevent a bank run? This story, together with....