'Grim Reapers' financial crimes unit revived to investigate Terra collapse

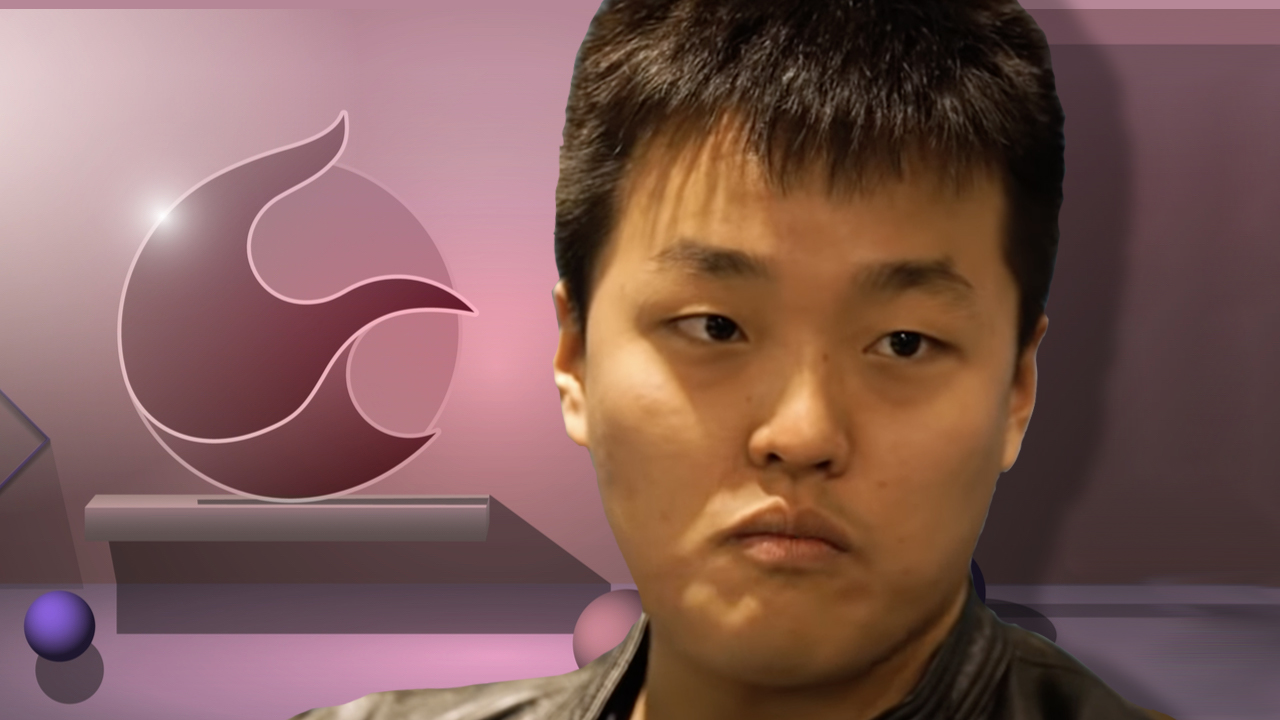

After over two years, the feared investigative and prosecutorial team has been reformed by the new President to look into the mess caused by Terraform Labs. Legal troubles are mounting for the co-founder of failed Terra crypto project Do Kwon as the South Korean government revives the dormant "Grim Reapers of Yeoui-do" to investigate Terra’s fall.The special investigative and prosecutorial team consists of members from various financial regulators, and is designed to prosecute securities fraud and unfair trading schemes. Potentially at risk are co-founders Do Kwon and Shin Hyun-seong,....

Related News

According to South Korean corporate tax laws, foreign-registered companies are treated as domestic if the decision-making process and operations are carried out from the country. Terraform Labs and co-founder Do Kwon continue to attract more legal trouble in the wake of the collapse of the Terra ecosystem. After early reports of a possible congressional hearing and an investigation from 'Grim Reapers' financial crimes unit, the crypto firm has now come under the radar of the national tax agency.According to a report published in Naver news, South Korea’s national tax agency has slapped the....

The public prosecution of the Federal District, located in the center-west region of Brazil, has launched its own cryptocurrency investigation unit. The newly formed unit will focus its activities on aiding other prosecutors in cryptocurrency investigations, and also educating consumers about the safe use of cryptocurrencies.

Cryptocurrency Crimes Unit Launched in Brazil

Cryptocurrency crimes have several traits that make them difficult to detect by traditional intelligence units. This is why some countries have already dedicated part of their budget to building resources to face....

Terra’s new LUNA 2.0 token has lost 54% in value in the last two weeks, after reaching $11.33 per unit on May 30. Meanwhile, the whistleblower Fatman has accused Terra’s co-founder Do Kwon of cashing out $2.7 billion a few months before the UST de-pegging incident. Kwon, however, has been keeping tabs on Fatman’s accusations and he claims the allegations are “categorically false.” LUNA 2.0 Token Drops 54% in Value During the Last 2 Weeks The LUNA 2.0 rebirth token has been extremely lackluster in terms of market performance during the past two weeks.....

The collapse of the algorithmic stablecoin Terra and its native token, LUNA, created a great storm in the cryptocurrency space. Many investors watched as the Terra ecosystem crumbled with TerraUSD (UST) and LUNA hitting the zeros. The storm and its effects brought reckless distortions for almost all the tokens in the crypto market. Coupled with […]

The world’s largest asset manager, Blackrock, and hedge fund giant Citadel Securities have denied claims that they had a role in the fall of terrausd (UST) and terra (LUNA). In addition, crypto exchange Gemini has denied making a bitcoin loan that resulted in the terra collapse. Blackrock, Citadel Securities, Gemini Deny Rumors Following the collapse of terra (LUNA) after algorithmic stablecoin terrausd (UST) lost its peg to the U.S. dollar this week, rumors have been circulating that Blackrock, Citadel Securities, and Gemini had some part in the fall. The three companies quickly....