Top Defi Dogs YFI, LEND, and UNI Correct Nearly 20%

Bitcoin, Ethereum, and other major crypto assets all plummeted over the last several hours, but few have dropped as hard as top DeFi tokens, YFI, LEND, and UNI. Why have these once soaring altcoins plunged so hard and is there more downside ahead? Yearn-Ing For The DeFi Trend To Continue After 20% Pullback For a […]

Related News

Decentralized finance (DeFi) tokens, including Chainlink (LINK), Yearn.finance (YFI), and Aave (LEND) strongly recovered after a prolonged slump. At its monthly low, YFI declined by nearly 64% in the past 11 days. Similarly, DeFi giants like Chainlink declined by 45% at the monthly low since mid-September. But following Bitcoin’s lead, Chainlink, YFI, and LEND are […]

Demand for LEND has surged dramatically over the last week as the token undergoes a rebranding. Aave, the non-custodial “DeFi” protocol, earlier launched its Aave Improvement Proposal (AIP1) to allow community consent over the migration from its governance token LEND to its rebranded avatar AAVE. In retrospect, the switchover attempted to take people’s opinions on the […]

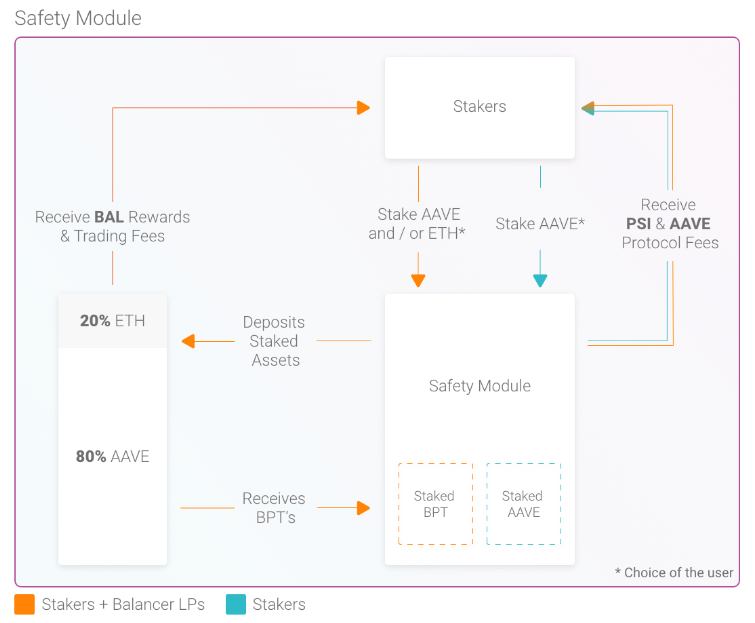

Leading decentralized finance (DeFi) coin LEND, the native token of the Aave protocol, is up 5% in the past 24 hours. Its performance comes as the prices of both Bitcoin and Ethereum have stagnated. LEND’s outperformance seems to stem from a crucial technical change to the Aave protocol and the cryptocurrency itself. This technical change […]

Silicon Valley's Saddle is solving the stablecoin spread that currently dogs DeFi.

As DeFi protocols continue to garner mainstream traction, here’s an introduction to how lending and borrowing work on these platforms. Are there any risks involved?DeFi protocols feature certain risks, such as third-party smart contract tampering and the risk of borrow APYs rising dramatically within a short time period.When compared with centralized finance, there are no practical dangers associated with DeFi lending. However, like anything else, DeFi, too, has risks associated with it. For example, there are certain smart contract risks that are present as well as the threat of APYs....