DAOs in court? Curve Finance ponders enforcing license over rival Saddle

Which takes precedence: the open-source ethos of DeFi, or the natural right to protect the fruits of your intellectual labor? Square peg, meet round hole: a decentralized autonomous organization is pondering taking a rival fork to court. Earlier today, a member of the Curve Finance community made a post in Curve’s governance forum titled “Enforce Curve’s IP Rights.” “Curve has proven incredibly popular, with over $10B deposited, hundreds of millions in daily volume, and around $1M/week in earnings to veCRV holders. This places it among the top of all exchanges in crypto today, even....

Related News

An assertion of property rights on the part of a DAO could be healthy for decentralized finance — another sign that DeFi is maturing. Curve Finance, a decentralized exchange for stablecoin trading, is one of the world’s largest decentralized autonomous organizations (DAO), with $6.5 billion in deposits, but last week, one of its token holders made an unusual proposal:The Ethereum-based DAO should “engage competent counsel” — both in the United States and other relevant jurisdictions — to prevent other DAOs from the “wholesale copying” of its software code. Why is this unusual? In the....

Are you ready to Saddle up? A decentralized finance platform architectured to facilitate efficient trade between pegged crypto assets is now one of the most prominent names on the Ethereum blockchain. Saddle Finance, an automated market maker (AMM), is developing solutions to eliminate roadblocks related to the spread between stablecoins and tokenized crypto assets. In […]

Silicon Valley's Saddle is solving the stablecoin spread that currently dogs DeFi.

A lucky trader turned 0.34 BTC into 4.6 BTC in just one swap. A recently launched decentralized finance platform, Saddle Finance, has netted one particular trader a more than 10x return on an arbitrage trade between different permutations of synthetic Bitcoin (BTC).According to transaction data from Etherscan, a user swapped 0.34 sBTC, Synthetix’s Bitcoin-based token, in exchange for 4.36 Wrapped Bitcoin, a custodial wrapper offered by BitGo. The trade offered an almost 13x return on investment, netting $150,000 to the trader.Two other similar transactions were registered on the platform,....

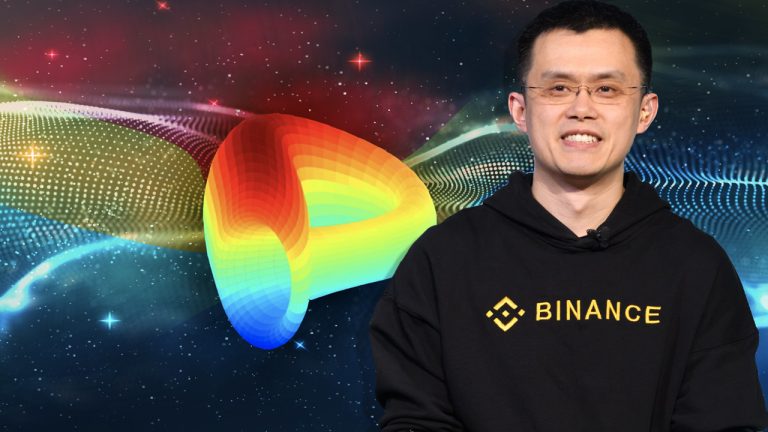

Following the recent Curve Finance attack, Binance CEO Changpeng Zhao announced that the exchange had recovered $450 million from hackers. The decentralized finance (defi) platform Curve saw roughly $570 million siphoned from the application on August 9. Binance Boss Says Exchange Froze 83% of the Curve Finance Hack Funds, Domain Provider Says Exploit Was DNS Cache Poisoning Four days ago, the crypto community was made aware that the Curve Finance front end was exploited. Curve fixed the situation but $570 million was removed from the defi protocol. The attackers, however, decided to send....