Insiders sold MicroStrategy stock after Bitcoin’s bull run

Notorious Bitcoin bull and MicroStrategy CEO Michael Saylor himself hasn’t dumped any company stock since 2012. Virginia-based enterprise software company MicroStrategy has captured the attention of crypto and financial news outlets alike with its CEO’s atypical strategy of going all-in on Bitcoin, beginning in 2020, with some reporters quipping that the company has since morphed into something closer to a Bitcoin (BTC) investment vehicle than a software firm. Recent filings with the United States Securities and Exchange Commission suggest some of the company’s top-level executives are....

Related News

The company's holdings are valued at roughly $5.9 billion, representing more than $2.1 billion in gains since its initial purchase in August 2020. Business intelligence firm MicroStrategy has added $94 million worth of Bitcoin (BTC) to its holdings after purchasing the crypto asset at an average price of $49,229.According to a Thursday filing with the U.S. Securities and Exchange Commission, MicroStrategy purchased 1,914 BTC between Dec. 9 and Dec. 29 for $94.2 million, making its total holdings 124,391 BTC. With the recent buy, the company’s holdings are valued at roughly $5.9 billion,....

Bitcoin’s options market has flipped bearish for the short term while Citi analysts downgrade MicroStrategy's stock.

Michael Saylor’s MicroStrategy plans to raise $21B for additional Bitcoin ($BTC) purchases through the At The Market (ATM) Program. Specifically, MicroStrategy will sell $21B worth of 8% Series A perpetual strike preferred stock – shares that pay an 8% dividend, have a $0.001 par value, and are convertible into MicroStrategy’s Class A common stock without […]

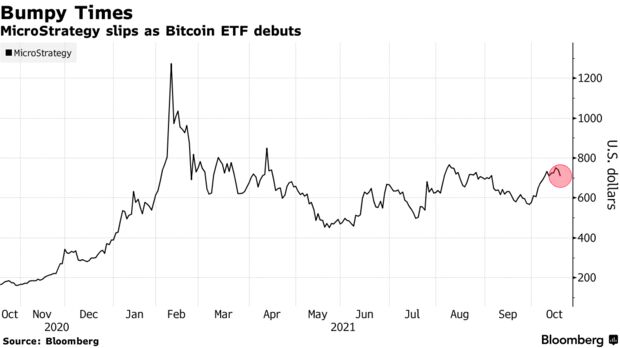

Following the launch of the first ever Bitcoin exchange-traded fund (ETF), Microstrategy’s stock took a hit. This may show that investors would prefer to get BTC exposure through the ETF rather than the tech company’s stock. Microstrategy’s Stock Drops 2% In Response To Bitcoin ETF Launch As reported by Bloomberg, the tech firm’s stock had […]

Equity options for COIN stock are coming to Nasdaq today. Less than one week after the largest crypto exchange in the U.S. was listed, Nasdaq is set to start trading options for Coinbase Global.According to an April 19 Reuters report, a representative for Coinbase stated that the COIN.O options will start trading on Nasdaq on Tuesday, April 20.The launch of equity options will offer a new way for investors to bet on the fortunes of Coinbase. Equity options represent the right, but not the obligation, to buy or sell a stock at a certain price, known as the strike price, on or before an....