Curve Finance exploit: Experts dissect what went wrong

Attackers who hijacked Curve Finance’s landing page moved quickly to convert stolen funds to various tokens through different exchanges, wallets and mixers. Decentralized finance protocols continue to be targeted by hackers, with Curve Finance becoming the latest platform to be compromised after a domain name system (DNS) hijacking incident.The automated market maker warned users not to use the front end of its website on Tuesday after the incident was flagged online by a number of members of the wider cryptocurrency community.While the exact attack mechanism is still under investigation,....

Related News

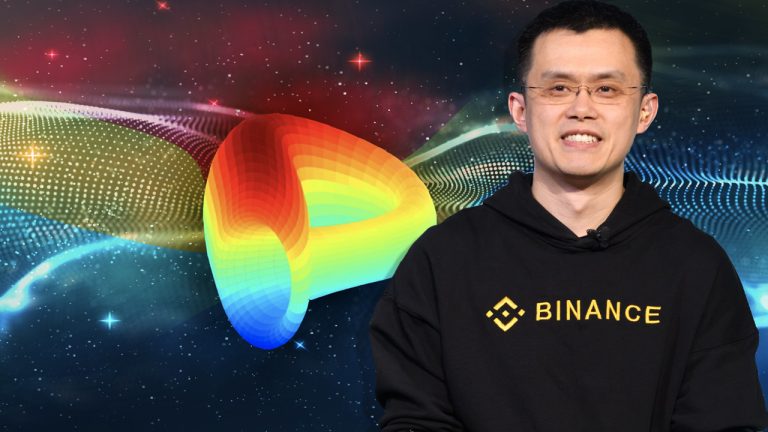

Following the recent Curve Finance attack, Binance CEO Changpeng Zhao announced that the exchange had recovered $450 million from hackers. The decentralized finance (defi) platform Curve saw roughly $570 million siphoned from the application on August 9. Binance Boss Says Exchange Froze 83% of the Curve Finance Hack Funds, Domain Provider Says Exploit Was DNS Cache Poisoning Four days ago, the crypto community was made aware that the Curve Finance front end was exploited. Curve fixed the situation but $570 million was removed from the defi protocol. The attackers, however, decided to send....

Via their official Twitter handle, the Ethereum-based decentralized finance (DeFi) protocol Curve Finance has confirmed a vulnerability in their nameserver or frontend curve.fi which was successfully reverted. Earlier, the team behind the project advised caution to its users and claimed an investigation has been launched to look into any potential vulnerabilities exploit. Related Reading: TA- My Neighbor Alice Could Be Set For A Major Bounce – Eyes $5 The team behind the project said: The issue has been found and reverted. If you have approved any contracts on Curve in the past few hours,....

A still undefined exploit of the site’s frontend appears to have resulted in the theft of over $573K USD so far. On Aug 9, automated market maker Curve Finance took to Twitter to warn users of an ongoing exploit on its site. The team behind the protocol noted that the issue, which appears to be an attack from a malicious actor, was affecting the service’s nameserver and frontend.Don't use https://t.co/vOeMYOTq0l site - nameserver is compromised. Investigation is ongoing: likely the NS itself has a problem— Curve Finance (@CurveFinance) August 9, 2022 Curve stated via Twitter that its....

Curve Finance community members are already voting to terminate CRV releases from all UST liquidity pools. Curve Finance, an innovative crypto project, announced on Thursday morning that it would end all connections with the UST stablecoin. The platform took to Twitter, announcing how it’d be terminating its deal with the recently-crashed stablecoin, UST. This move […]

Majority of the DeFi tokens in the top-100 traded in green along with rest of the market in the wake of new CPI data release and several tokens registered doubled digit gains. Welcome to Finance Redefined, your weekly dose of essential decentralized finance (DeFi) insights — a newsletter crafted to bring you significant developments over the last week.This past week, cross-bridge protocols became the center of DeFi discussions as a new report showed RenBridge was used to launder $540 million in stolen funds. Curve Finance, on the other hand, resolved its site exploit and directed users to....