A Big Bitcoin Move Ahead as Volatility Hits 3-Month Low: Fund Manager

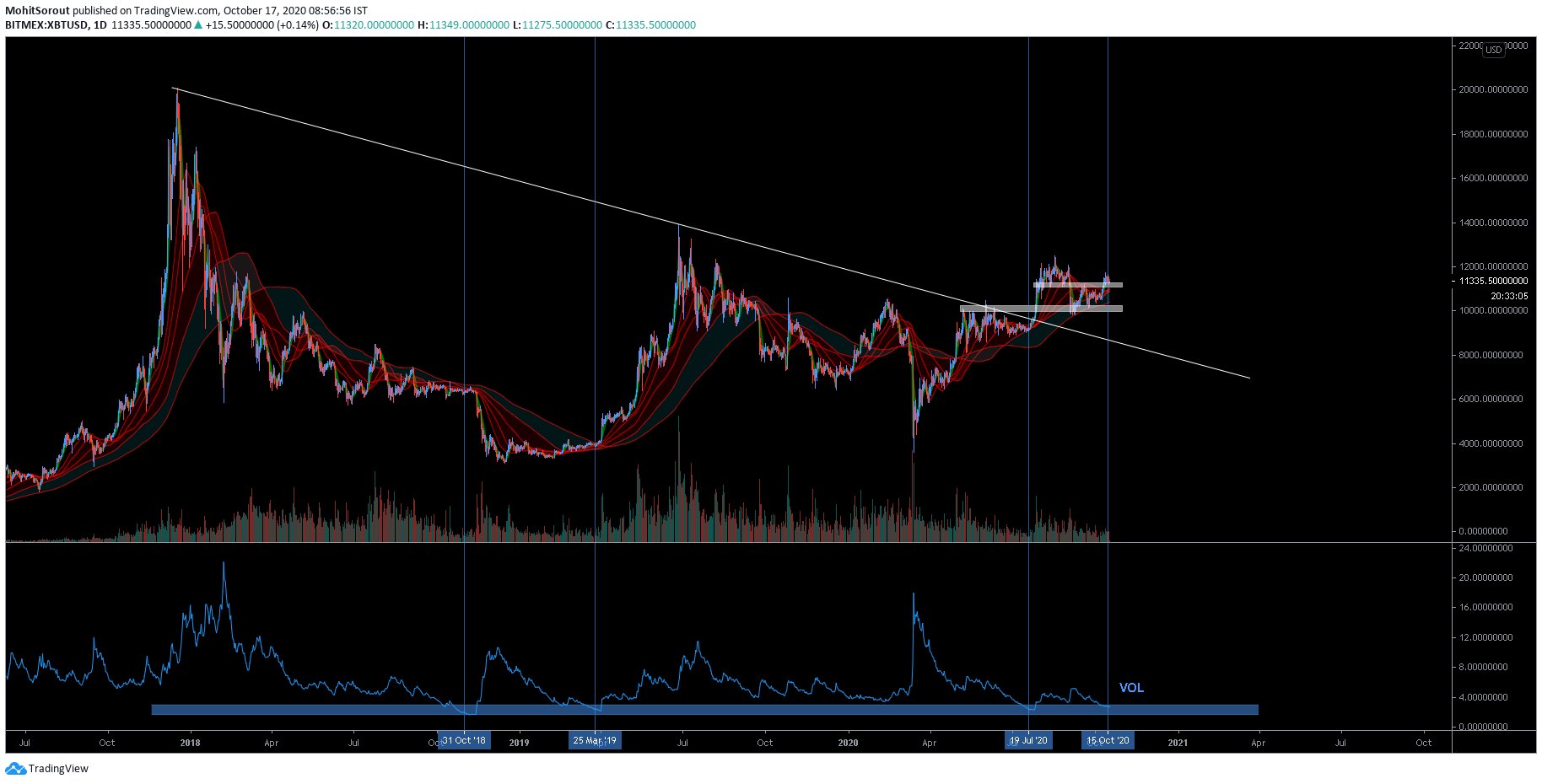

Bitcoin strategists are waiting for a bias-defining price move as the cryptocurrency’s historical volatility falls to its lowest in three months. Jan Uytenhout, the co-founder of Capriole Investments in Denmark, iterated the outlook in a tweet issued earlier this Wednesday. The fund manager cited old references to show a correlation between the Bitcoin price and […]

Related News

While Bitcoin has seen strong volatility on a day-to-day and week-to-week basis, it is flat on a macro scale. The crypto-asset has basically traded in the same $3,000 range for five months now. This has allowed macro volatility indicators to subside to critical historical points. Volatility analysis by one fund manager in the space suggests […]

180-day volatility dropped to its lowest level since Nov. 2018

Bitcoin expects to undergo major price swings in the coming sessions as its price volatility hits its lowest levels in more than a month.

The digital asset manager also reached C$1 billion in net asset value this week.

European asset manager Amundi has announced its first tokenized fund in partnership with CACEIS, running on the Ethereum blockchain. Amundi Launches Tokenized Fund On Ethereum As per an announcement on the official website, Amundi has launched the first tokenized share of one of its money market funds. Headquartered in France, Amundi is an asset manager […]