Veteran Fund Manager Blames Bitcoin for Massive Gold ETF Outflows

Gold hit its lowest levels in more than eight months on Tuesday, a day after holdings in the precious metal-backed exchange-traded funds fell by 14 tonnes, logging the biggest outflow seen in 2021. Analysts blamed signs of an economic global recovery and rising US bond yields for the said decline. That is because gold does […]

Related News

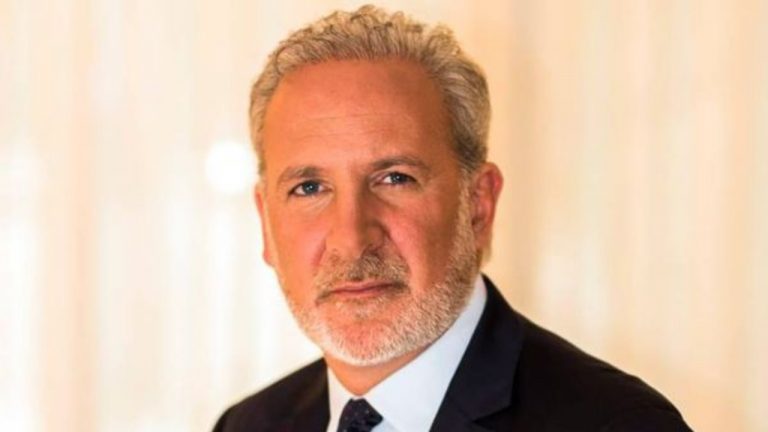

Gold bug and bitcoin opponent Peter Schiff says the U.S. government’s actions in the past 78 years are partly responsible for the massive depreciation of the U.S. dollar. Using a medical bill from 1942 to illustrate the extent of the dollar’s decline, Schiff says the $70 paid to foot hospital expenses that year was equal to two ounces of gold. Dollar Depreciation In 1942, an ounce of gold was sold for about $35 but due to inflation and the subsequent depreciation of the U.S. dollar, the same ounce now sells for above $1,750. Using this analogy, Schiff asserts that the same....

The world’s largest asset manager, BlackRock, has notably been on a Bitcoin selling spree throughout this week, triggering a wave of sell-offs in the process. These sales have occurred due to the outflows that the asset manager has witnessed from its BTC ETF. BlackRock Dumps Around $500 Million In Bitcoin Arkham data shows that BlackRock has offloaded around $500 million in Bitcoin this week, with transfers to Coinbase, a move that indicates a move to sell these coins. The asset manager has sold these coins following outflows from its iShares Bitcoin ETF, which was the norm throughout....

The digital gold narrative in 2020 has begun to boil over, with Bitcoin stealing all the financial media headlines and turning the heads of boomers and hedge funds everywhere for the first time. Recent data from, Bloomberg suggested futures interest and fund flows signaled that the precious metal’s capital had begun pour into crypto. The same data now shows that weekly gold fund outflows have reached the highest point ever, beating the flight back to […]

BlackRock executive Russ Koesterich says gold is failing as an equity hedge amid massive outflows from bullion ETFs into assets like Bitcoin. With the price of gold down more than 11% over the last six months, some investment managers are questioning its status as a hedge asset.According to Bloomberg, Russ Koesterich, portfolio manager at BlackRock’s Global Allocation Fund, gold is currently failing to prove its effectiveness as a viable hedge against inflation.Indeed, Koesterich countered the popular hedge asset narrative for gold, stating, “Gold’s ability to hedge against inflation has....

Gold's prospects seem to dim as Bitcoin's glitter According to multiple experts, one possible reason for Bitcoin’s remarkable recent price rise are massive investor outflows from another popular inflation hedge: gold. Spot gold swooned over the past week, falling 4.62% to $1,857. The asset previously had been surging in unison with Bitcoin, which is up over 40% from $28,000 lows last week.In a Tweet on Friday, Charlie Morris, founder and CIO at ByteTree Asset Management, said that the pullback in gold might be attributable to investors moving to Bitcoin:With bond yields up and inflation....