Drops Allows to Maximize Returns on NFTs and DeFi Assets by Leveraging Them a...

NFT and decentralized finance (DeFi) asset owners who are interested in putting their assets to work and intend to maximize passive returns without having to sell their holdings may be able to leverage them as collateral. They may use the funds acquired to benefit from arbitrage opportunities, purchase another asset with significant upside potential, and […]

Related News

Non-Fungible Tokens (NFTs) have taken over the web3 space. Their popularity is second to none, as web3 enthusiasts have created an industry that has taken the world by storm. Use-cases have shifted from purely digital art marketplaces to certificates and even yield earnings. Digital art still dominates NFT uses. That will change. The Decentralized Finance (DeFi) space has figured out that NFTs have many product use-cases within the industry. NFTs get used as assets on several DeFi platforms. Before now, fungible tokens, stablecoins, and other digital assets reigned supreme. The entrée of....

Decentralized finance (DeFi), tokenization and non-fungible tokens (NFTs) are gaining momentum as sub-sectors that could transform the traditional financial system. All are leveraging a broader approach to unlock earning opportunities to everyone, offering a permissionless financial ecosystem. Owning real-world assets or private equity, however, doesn’t allow you to access DeFi yield-generating products. Additionally, much of […]

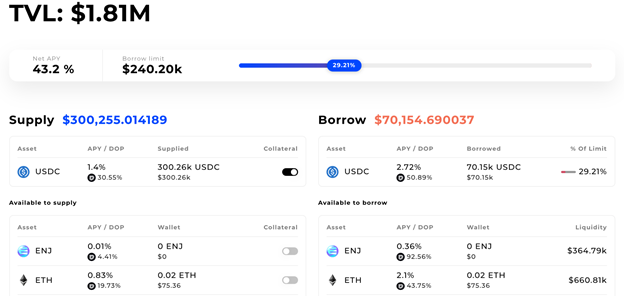

The mainnet launch opens up the crypto ecosystem to instant decentralized loans using non-fungible tokens (NFTs), JPEG and metaverse assets as collateral. Drops DAO, a decentralized lending platform, is celebrating the launch of its mainnet, unlocking its ecosystem for users to borrow loans and interact with everything the ecosystem has to offer. Announced Wednesday, the transition to the mainnet will provide users with collateralized loans for NFTs, DeFi assets, and metaverse collections. The launch of the mainnet allows users to lock their assets as collateral, providing the NFT and DeFi....

Drops, a platform that facilitates loans for NFTs and DeFi assets, has revealed the first phase of the three-phase rollout of its NFT Lending platform. Per the official release, the Drops NFT lending platform offers users options to use their NFTs as collateral in return for access to trustless loans from Drops’ permissionless NFT lending pools. The NFT lending platform will be first launched on the testnet, flagging off the journey towards the eventual mainnet inauguration. Interested NFT owners can drop in their applications to join the testnet and witness history in the making. The....

As decentralized finance (defi) has become more popular, digital currency proponents are making money off of more than 140 yield-bearing cryptocurrencies. While most of the defi ecosystem revolves around the Ethereum network, a number of people leverage these defi applications in order to earn more bitcoin. The following list is a few defi platforms that allow individuals to stack satoshis by utilizing liquidity pools and lending apps. A great number of people hold bitcoin (BTC) for a long period of time whether in a noncustodial wallet or with a custodian like an exchange. However, these....