Nigerian Central Bank Hikes Key Interest Rate Just Days After Naira Plunges t...

Following the latest meeting of the monetary policy committee, the Central Bank of Nigeria says it has hiked the monetary policy rate to 15.5%. By increasing the key interest rate by 150 basis points, the central bank hopes to “narrow the negative real interest rate gap and rein in inflation.” The rate increase came just days after the naira’s parallel exchange rate against the dollar plunged to a new low. Narrowing the Negative Real Interest Rate Gap According to the Central Bank of Nigeria (CBN), members of the bank’s monetary policy committee (MPC) have....

Related News

The Central Bank of Nigeria should be discontinuing the fixed exchange rate system and let the naira freely float against the major currencies, Alhaji Aminu Gwadabe, the leader of a Nigerian association of bureau de change operators has said. The leader also slammed the recent adjustment of the central bank’s interest rate to 13%, which he said could have a negative impact on Nigeria’s underperforming economy. Central Bank Told to Intervene to Save the Naira The leader of a Nigerian association of bureau de change operators, Alhaji Aminu Gwadabe, has urged the....

The Nigerian currency, the naira, plunged to a new all-time low of N570 for every dollar on September 16, 2021. This new exchange rate means since August 17, the naira has now lost about a tenth of its value on the foreign currency black market. Naira Overvalued In spite of this plunge, which has been attributed to the biting shortage of foreign exchange, authorities insist the naira’s real exchange is unchanged at N411 for every dollar. This means forex buyers that source this commodity on the parallel market are now paying a premium of over N150. Alternatively, the new parallel....

Fighting to stop the value of the naira from dropping further, the Central Bank of Nigeria (CBN) faces yet another problem: abuse of naira banknotes. According to the CBN’s Aladeen Badajo, the central bank is concerned with the rate at which Nigerians “mutilate, deface, squeeze and even spray and sell the naira notes.” He adds that as a result of this abuse, Nigeria is now spending more money on reprinting banknotes than it should. According to a report that quotes Badajo, an assistant director at the CBN’s Currency Operations Department, offenders now face....

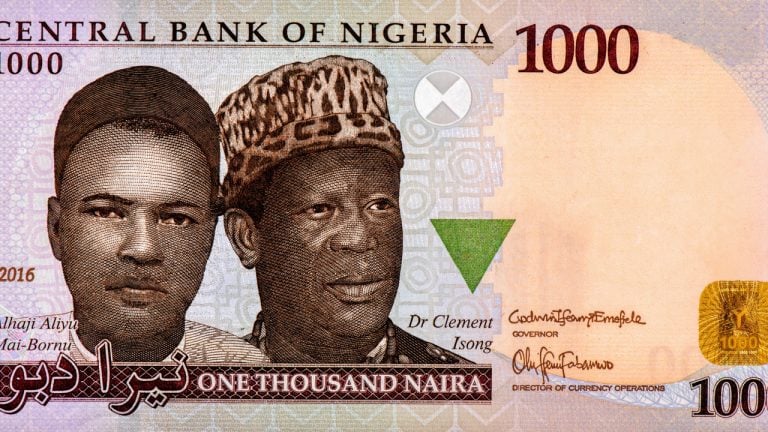

Starting December 15, Nigerians will be using newly-designed 100, 200, 500 and 1,000-naira banknotes, the governor of the Central Bank of Nigeria (CBN) has said. The announcement has since resulted in the naira’s parallel market exchange rate versus the U.S. dollar dropping to a new low of N781:$1. Redesigning Currency a Global Best Practice The Central Bank of Nigeria (CBN) governor, Godwin Emefiele, recently said his institution will begin circulating newly-designed naira banknotes on December 15. Emefiele claimed the injection of the new notes into Nigeria’s financial system is....

Apathetic Nigerian lenders are frustrating the e-naira’s adoption because they are worried this could deprive them of a key revenue source, Godwin Emefiele, the Central Bank of Nigeria (CBN) governor, has said. Emefiele said the central bank is working on a channel that would enable Nigerians without bank accounts to open e-naira wallets. E-Naira Undercuts Lenders’ Investment in Mobile Banking Infrastructure The Nigerian central bank governor, Godwin Emefiele, has reportedly slammed some lenders he accuses of thwarting the adoption of the e-naira digital currency in the....