On-Chain Data Shows Mass Accumulation Among Ethereum Investors

Ethereum has gained a few percent since the lows of last week. The coin currently trades for $380 but peaked earlier today at $385. This price action has been underscored by reports that mass Ethereum accumulation has been taking place. Leading crypto analytics firm Santiment reports that ETH is leaving exchange wallets en-masse, suggesting accumulation and long-term confidence. The firm recently wrote: “ETH’s top 10 whale exchange addresses have continued swapping their funds to non-exchange […]

Related News

On-chain data shows Ethereum whales have recently ramped up their accumulation, a sign that could be bullish for the asset’s price. Ethereum Whales Have Been Buying Big According to data from the on-chain analytics firm Glassnode, the Ethereum whales have been participating in a very significant amount of accumulation during the past week. Related Reading: […]

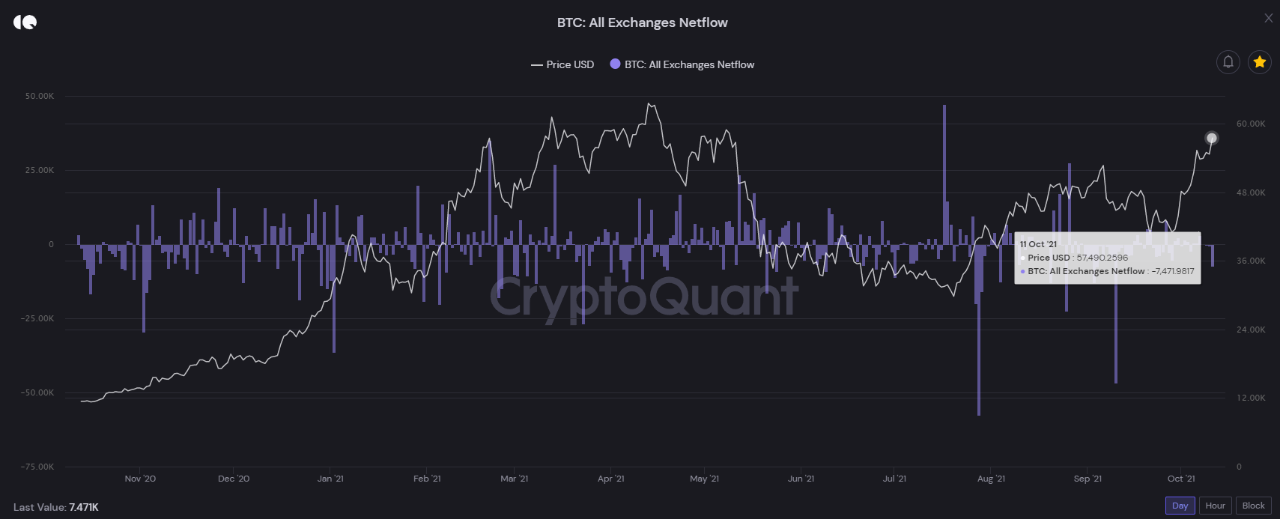

Bitcoin on-chain data suggests accumulation is going on as investors feel FOMO about the current rally above $57k. Bitcoin Accumulation Goes On As Investors Feel FOMO As explained by a CryptoQuant post, on-chain data is showing signs of accumulation as BTC netflows show negative spikes, and the stablecoins inflows indicate big moves. The Bitcoin netflow […]

On-chain data shows all Bitcoin investor cohorts have pivoted to distribution recently, an indication that a shift in market mood has occurred. Bitcoin Accumulation Trend Score Has Turned Red For All Holders In a new post on X, on-chain analytics firm Glassnode has talked about the latest trend in the Accumulation Trend Score of Bitcoin for the various investor cohorts. The Accumulation Trend Score measures, as its name suggests, the degree of accumulation or distribution that BTC holders are participating in. Related Reading: 215% PENGU Rally Incoming? Analyst Says Token ‘Inches’ From....

Investors are accumulating Ethereum in droves amidst what could become a return to bullish sentiment for the cryptocurrency. Ethereum is currently ranging around $3,170, with its price undergoing volatility in the past seven days. Amidst this price volatility, on-chain data has revealed an accumulation trend from Ether investors during the week. Additionally, transaction data has shown an uptick in whale movement of ETH to and from exchanges, with recent market happenings indicating a transformation in the price of the crypto asset. Related Reading: All Quiet On The Bitcoin ETF Front –....

On-chain data shows the Bitcoin investors with no history of selling are back to intense accumulation, a sign that could be bullish for BTC’s price. Bitcoin Accumulation Addresses Have Been Showing High Demand Recently In a new post on X, the on-chain analytics firm CryptoQuant has talked about how the demand is looking from the […]