Bitcoin Bear Market Sends On-Chain Metrics Into Sideways Trend

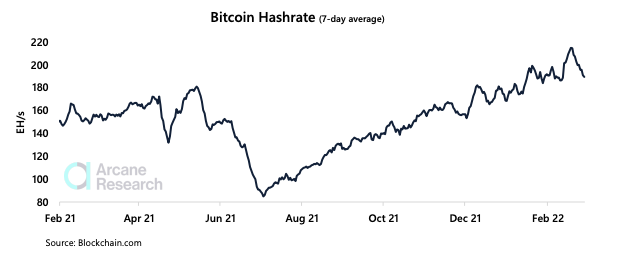

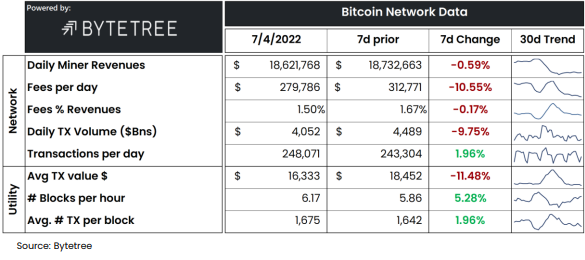

Data shows the Bitcoin bear environment has caused the market to become inactive as transaction fees continues to be extremely low. Bitcoin On-Chain Activity Remains Low As Price Action Stays Stale As per the latest weekly report from Arcane Research, the last week saw the lowest average daily transaction fees since April 2020. The “transaction […]

Related News

Bitcoin remains on an upward trend after breaking through $40,000 once again. However, this upward trend has not translated onto on-chain metrics. While the price of the digital asset continues to sit in the green, on-chain metrics have plummeted paining an entirely different picture in relation to price. From miner revenues to transaction fees, the […]

The fundamentals accompanying the previous Bitcoin bear markets are entirely different from 2022, however, putting the BTC price recovery at risk. Bitcoin (BTC) has been consolidating inside the $18,000–$20,000 price range since mid-June, pausing a strong bear market that began after the price peaked at $69,000 in November 2021.Many analysts have looked at Bitcoin’s sideways trend as a sign of a potential market bottom, drawing comparisons from the cryptocurrency’s previous bear markets that show similar price behaviors preceding sharp bullish reversals.Here are three strikingly similar....

Bitcoin’s price action is still above the $100,000 threshold and within striking distance of its all-time high at $111,700, but its on-chain activity tells a completely different story. According to the latest report from on-chain analytics firm Glassnode, even though Bitcoin’s price is pushing to new heights, underlying blockchain metrics have slipped into territories more […]

Though on-chain metrics point to the worst Bitcoin bear market on record, they also highlight hodlers' growing resilience. While the current bear market may be the worst on record, on-chain metrics signal that the Bitcoin (BTC) network is becoming increasingly resilient, said Glassnode analyst James Check during a recent interview with Cointelegraph. In particular, Check refers to the amount of Bitcoin holders who don’t sell even in extreme market conditions, which has become much higher than in previous bear markets. “Cycle after cycle, that floor of hodlers is higher, the amount of....

Bitcoin on-chain analysis is showing more short-term holders registering losses, and they are statistically more likely to sell according to Glassnode. Blockchain analytics provider Glassnode has depicted a bearish scenario for Bitcoin as on-chain metrics suggest increased selling pressure is imminent.In its weekly analytics report on Feb. 21, on-chain metrics firm Glassnode said that Bitcoin bulls “face a number of headwinds,” referring to increasingly bearish network data.The researchers pointed at the general weakness in mainstream markets alongside wider geopolitical issues as the....