Bitcoin’s Biggest Intra-Market Risk Right Now – What You Need To Know

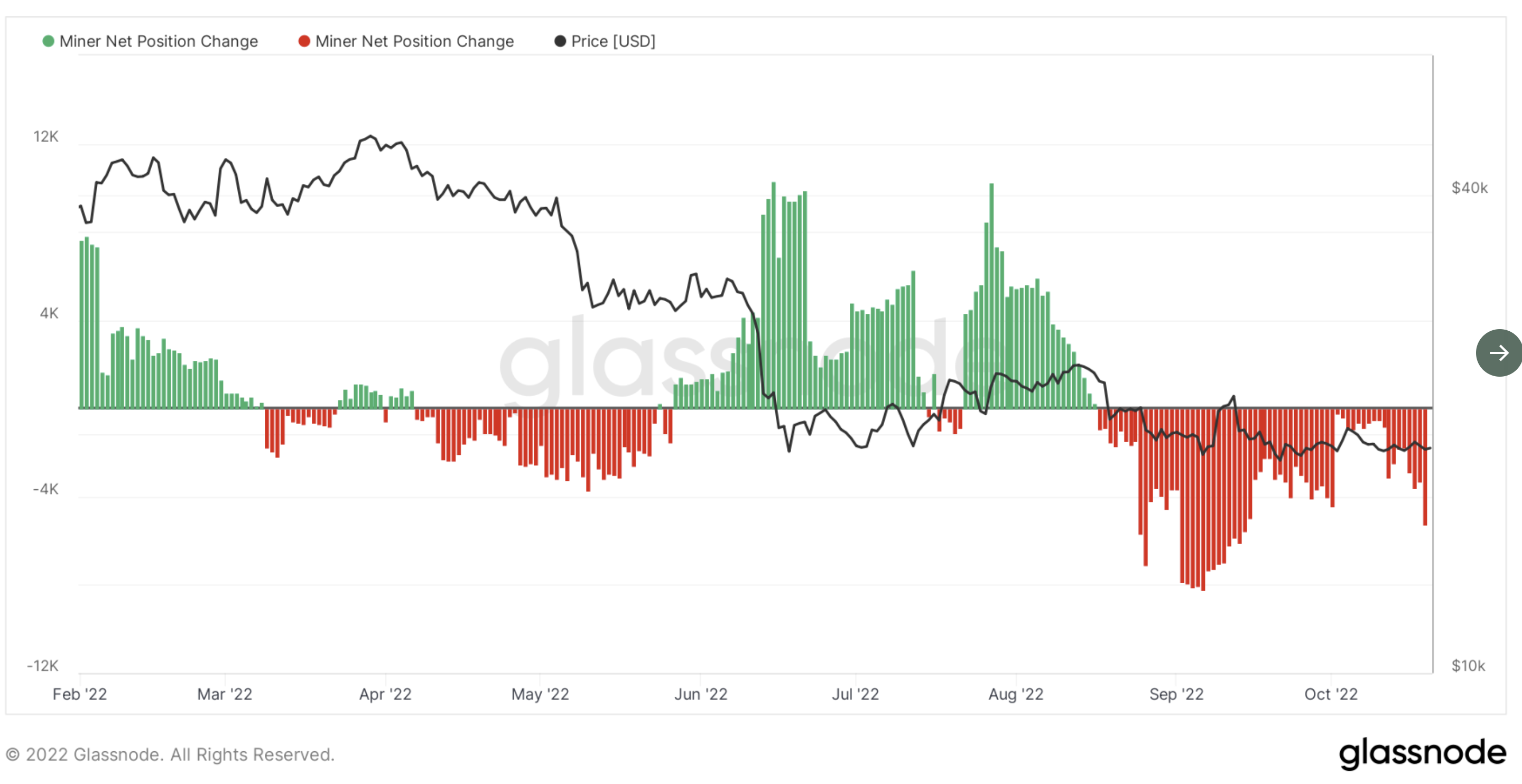

The monetary policy of the Federal Reserve (FED) continues to be the all-determining factor for both the financial markets worldwide and Bitcoin. With this in mind, all eyes are currently on November 02, when the next Federal Open Market Committee (FOMC) meeting is scheduled. However, while this is an external market risk, there is also an internal market risk currently developing that should not be underestimated from a historical perspective: a Bitcoin miner capitulation. The lower Bitcoin falls and the longer the price stays at the current level, the more pressure is put on Bitcoin....

Related News

The Bitcoin price is currently so stable that some experts are already jokingly comparing it to a stablecoin. However, from a historical perspective, this low volatility level carries a lot of risk. As Glassnode reports, BTC is trading in an incredibly small range of $869, separating the weekly low and high by just 4.6%. Glassnode looks at these bearish risks but also bullish opportunities in its new weekly report. Periods of extremely low volatility have been very rare in Bitcoin’s history. Ultimately, there has either been an extremely strong move up or down. The Bear Case For The....

The largest publicly traded Bitcoin miner in the U.S. by hash rate and mining fleet, Core Scientific (CORZ), issued a bankruptcy warning in a filing with the SEC on Oct. 26. Shortly thereafter, the stock took a nosedive. The stock plummeted from $1.02 to $0.22. While the CORZ stock was trading at $10.43 at the beginning of the year, it is now down 97% year-to-date. Notably, the Bitcoin price was unimpressed by the news. As NewsBTC reported, a Bitcoin miner capitulation is currently the biggest intra-market risk. Therefore, it is questionable whether the risk of a capitulation event is now....

So for the past day or so we have been experimenting with a wider than normal range in the bitcoin price, with the goal of bringing our intra range strategy into play. Last night we got some pretty solid upside momentum, and saw this intra range play validated with a profit hit on our long trade during the Asian session. Action has now consolidated somewhat, and for today's session we are looking at bringing our breakout strategy back into play. As such, we are tightening up our range, and looking at some predefined key levels to give us our entry and exit points. Here's what we are....

As we mentioned in our last few bitcoin price watch analysis piece's, action over the past couple of days has been relatively muted. We have seen something of a stabilization following the volatility that we saw at the beginning of the week, and this has presented us with relatively few trading opportunities - at least as far as our scalp strategy is concerned. With this said, there is still an element of intra-range strategy that we can incorporate if things remain as are. So, as we head into Thursday evening, what are the levels we are keeping an eye on in the bitcoin price now, and how....

The price of bitcoin has registered another flat week with a slight decline, as it opened the week at $378.64 and closed just four dollars down at $374.26 on 7th December. The biggest intra-day swing was a one-day rally on 5th December that saw the price rise from a low of $365.68 to a high of $378.65, adding $18 over 24 hours. Trading volume, however, dropped sharply compared with last week, with just over two million coins traded across all exchanges tracked by Bitcoinity. This represented a 42% fall in traded volume compared to the previous week, which saw 3.6 million coins change....