What is OpenOcean? Crypto’s Only Full Market Liquidity Aggregator

The 2021 bull market continues to rage on, fueled by an inflow of institutional money, the likes of which has never been seen before in crypto. And it looks set to continue. Most experts agree that we can expect to see further growth over the remainder of this year, with the numbers to back it […]

Related News

OpenOcean, the leading DeFi and CeFi full aggregation protocol, recently conducted a poll on its Twitter handle asking its community which network they would want to see aggregated next. The community overwhelmingly voted for Polygon Network. While 48.7% of the total votes cast went in favor of Polygon, Solana came second with a little above […]

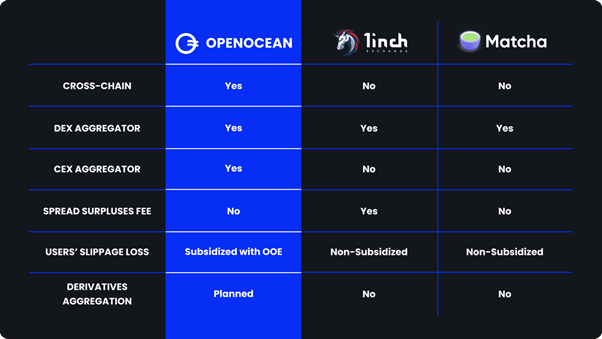

User experience has been a longstanding problem in cryptocurrency. Early adopters have accepted many issues that just don’t exist in traditional financial markets, including friction with onboarding, slow block confirmation times, and exchange outages. However, perhaps one of the most significant UX issues for cryptocurrency traders and investors is liquidity. The cryptocurrency markets are heavily […]

A series of protocol upgrades and new liquidity integrations prove that 1INCH is aiming to increase its DeFi and DEX aggregator market share. As the decentralized finance (DeFi) ecosystem evolves and expands to encompass the whole of the cryptocurrency sector, the race to become the top decentralized exchange (DEX) aggregator is heating up as new entrants to the field seem to emerge on a weekly basis. One of the top DEX aggregators that has recently seen its price reach a new record high is 1Inch (1INCH), a protocol which offers “access to the most liquidity, lowest slippage and best....

The partnership enables Zerion’s retail users to provide liquidity without the fear of volatility. Gelato Network, a protocol that automates smart contract executions on Ethereum (ETH), has integrated with DeFi aggregator Zerion to help users better manage liquidity when interacting with decentralized exchanges like Uniswap. The partnership enables Zerion’s over 200,000 monthly active users to have their Uniswap v3 positions managed automatically, Gelato Network announced Tuesday. “With this integration, Zerion has become the go-to DeFi aggregator to natively offer fungible Uniswap v3 LP....

Decentralized exchange aggregator 1inch has been integrated into the crypto wallet app BitPay, enabling users to access its rates for their crypto swaps. 1inch Network, a major decentralized exchange (DEX) aggregator and automated market maker, is broadening its reach by partnering with veteran crypto wallet provider BitPay. The two companies announced that 1inch’s DEX aggregation functionality is available for all users of the BitPay wallet — an app that allows individuals to manage, convert and spend 12 different cryptocurrencies through integrations with ATMs, Apple Pay, Google Pay and....