Thinking Too Small And The Pitfalls Of The Inflation Narrative

It may be that the most-cited narrative of bitcoin is simply one of many aspects in this global technological adoption. The One Chart We Need To Study And Why Bitcoiners Need To Move Away From The 1970s-Style Inflation ThesisThe first chart plotted below is deceptively simply, and yet extremely important. I would even make the argument that it is the most important chart to fully internalize so far in 2021. This is the signal through the recent noise of messy economic data. Chart #1 below visualizes Nominal Gross Domestic Product (Quarterly GDP in actual dollars, annualized), divided by....

Related News

Jeff Booth and Aaron Segal joined "Fed Watch" to discuss the pitfalls of the common inflation narrative purported by Bitcoiners.

It might be hard to find a bullish narrative for Bitcoin currently. The inflation hedge has plummeted during the worst inflation in 40 years. It hasn’t acted as a safe haven during war, a pandemic, or anything else. In fact, given the recent price action, few would argue in the favor of cryptocurrency. But what […]

A reading of a new piece on inflation from the Wall Street Journal that NLW argues shows a shifting mainstream narrative.

Despite inflation being most commonly cited as the reason for Bitcoin’s price appreciation, there are other factors at play.

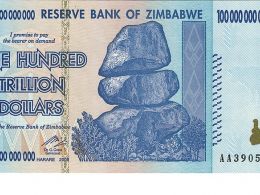

Inflation is one of those read-the-small-print kind of taxes that people don’t often think about even though it can have a major impact on their finances and, thereby, on their lives. Rising long-term inflation is more insidious than you might think because it can steadily and most assuredly decrease the value of your earnings/savings – especially, if your taxes aren’t indexed to compensate you for the cost of inflation. Inflation has always been the bane of many businesses and individuals alike. One thing is clear: something needs to be done. If cryptocurrency, perhaps Bitcoin, was....