The Ethereum 2.0 factor: Changing the way DeFi projects operate

Ethereum 2.0 is finally taking form after the beacon chain launch, so how has it affected the DeFi and Dapp ecosystems so far? The end of 2020 has been huge for the crypto community. Not only was there a spectacular price surge across digital assets, possibly signaling the beginning of another bull market, but there was also the launch of Ethereum 2.0 beacon chain, which has been in development for some time.The long-awaited update to the Ethereum blockchain transforms the network from a proof-of-work to a proof-of-stake consensus model and is intended to improve speed, security, lower....

Related News

Decentralized finance participants eye a “multichain” future as Ethereum’s DeFi-powering peers continue to attract users and projects. Ethereum is not the only blockchain platform seeing a significant increase in value as the decentralized finance space continues to move in tandem with the booming cryptocurrency ecosystem. The new year has continued to be good to the DeFi space, evident in the sheer amount of value that has been injected into various platforms.The value staked in DeFi protocols briefly surpassed $27 billion on Jan. 20, according to DappRadar, driven in part by the increase....

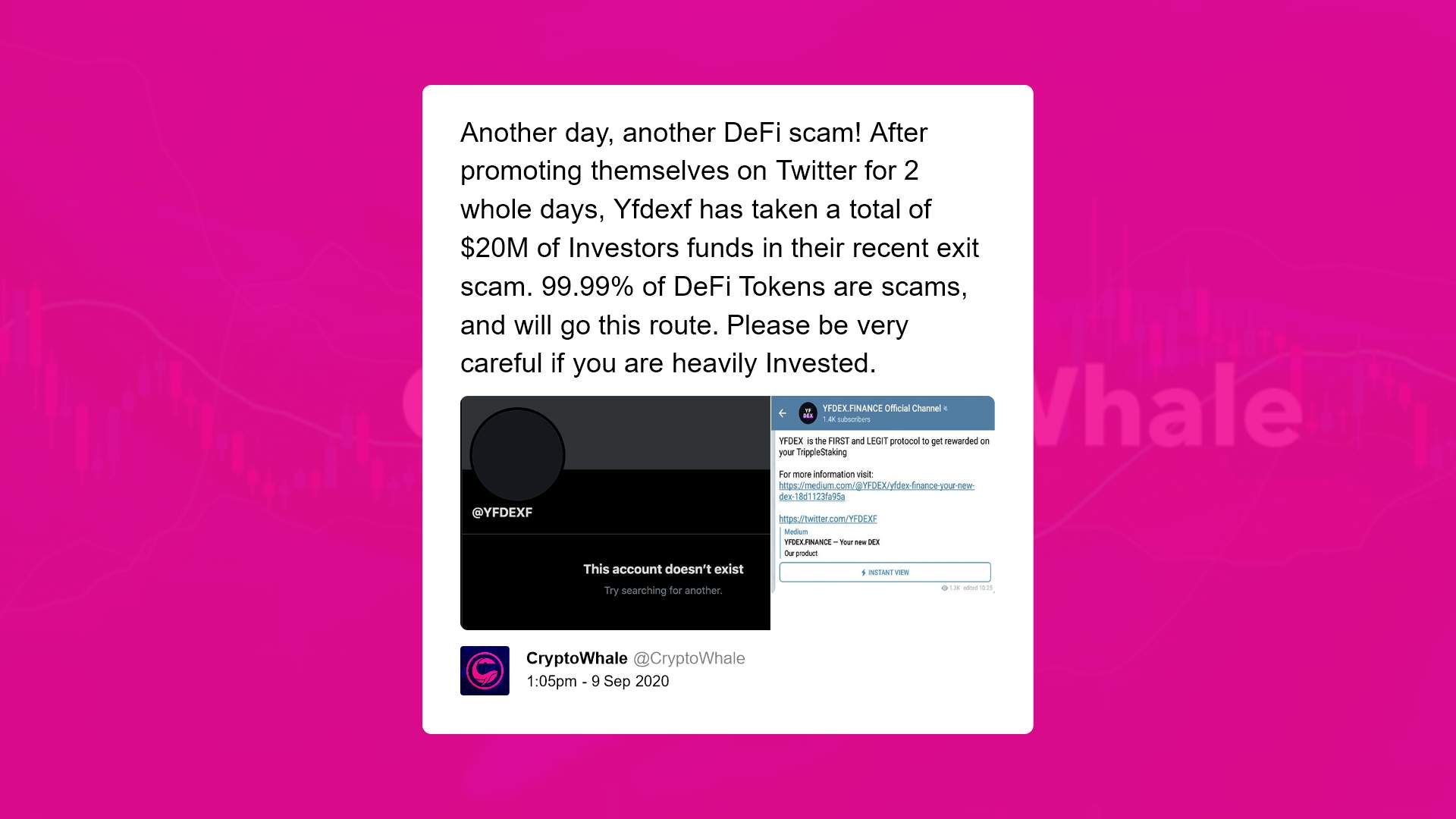

Many have drawn similarities between DeFi and the ICO craze of 2017, and it’s easy to see why as well. To begin with, both operate(d) primarily on the Ethereum network. However, it’s the flood of fly by night projects that links the two in the minds of many. With that, in recent times, critics have […]

A new working group aims to create standards that will ensure secure Ethereum smart contracts are used by businesses and DeFi projects. Decentralized finance continues to make its impact on the crypto market, and with over $13 billion of total value of assets locked, DeFi projects are clearly resonating with eager crypto investors. Yet while the DeFi space has been progressing over the last year, a number of illegitimate projects have come to fruition, reminding some of the 2017 ICO boom and its subsequent bust.For example, Harvest Finance, a major decentralized protocol, was recently....

Over the past months, we have seen tremendous growth in DeFi, and millions if not billions of dollars are being invested in it daily. DeFi can affect the way traditional banks operate and might even change the structure of the whole financial system in the future. One of the projects that have recently caught people’s […]

A report by Steno Research states that the decentralized finance (DeFi) summer on Ethereum and the crypto market could return as early as 2025. Four years after the fondly remembered DeFi summer of 2020, the total value locked (TVL) in protocols can hit an all-time high by early next year. However, the return of DeFi […]