Argo Blockchain, A Cryptocurrency Mining Firm Awaits Secondary Listing On Nasdaq

Agro Blockchain that concentrates on cryptocurrency mining is desiring a secondary listing on Nasdaq. The blockchain technology company was already the first to appear on the London Stoch Exchange listings. Related Reading | Bitcoin Water Trust Raises $1.4 Million, And Counting While announcing, Agro blockchain revealed its intention of getting a secondary listing on Nasdaq. According […]

Related News

After becoming the first blockchain firm to list on the London Stock Exchange, Argo Blockchain is now looking at a potential secondary listing on the Nasdaq. Argo Blockchain, a publicly traded blockchain technology company focused on cryptocurrency mining, is looking at a potential secondary listing on the Nasdaq exchange.On Tuesday, the company announced that it is now exploring the possibility of a secondary listing on the Nasdaq as part of its operational and strategic update for June 2021.Argo Blockchain said that the firm has not yet reached a decision on the timing of the secondary....

Argo Blockchain pocketed a record revenue of $26 million for the third quarter after mining nearly 600 BTC. Cryptocurrency mining firm Argo Blockchain has just released its Q3 financial report detailing record setting revenues for the period.The London headquartered company reported that it had mined 597 BTC and “BTC equivalents” during the third quarter of 2021. At current prices, Argo’s Bitcoin haul would be worth roughly $36.5 million.As of Sept. 30, the firm had amassed holdings of 1,836 BTC (roughly $113 million at current prices).Argo also reported a gross margin of 120% and a mining....

The company has been publicly traded on the London Stock Exchange since 2018. Argo Blockchain, a U.K. publicly traded company focused on crypto mining, has begun the process of applying for an initial public offering in the United States.According to a confidential draft registration statement filed Tuesday with the U.S. Securities and Exchange Commission, or SEC, Argo has proposed a dual-listing and initial public offering of American Depositary Shares, expected to occur in the third quarter of 2021. The company said the timing could depend on the SEC completing its review process and....

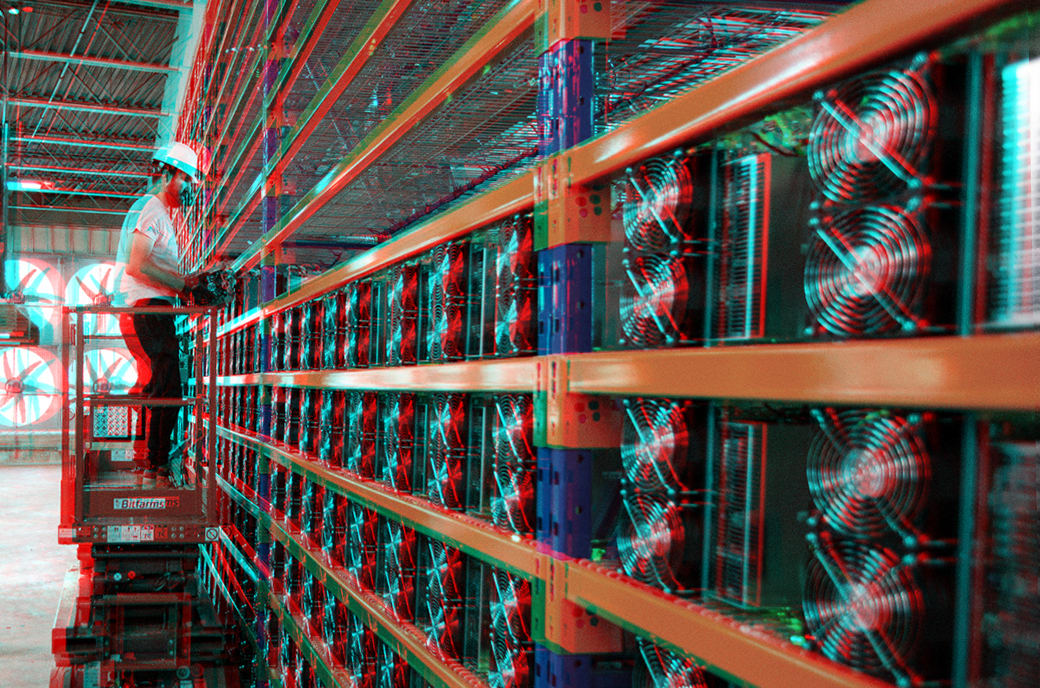

The bitcoin mining firm Argo Blockchain filed a registration statement with the U.S. Securities and Exchange Commission (SEC) for a proposed public offering due November 30, 2026, with an interest rate of 8.75% Senior Notes. The UK-based firm plans to raise a total of $57.5 million through the Notes sales to the public, offering them in increments of $25. They intend to use the funds for the construction of Argo’s Texas crypto mining facility, which aims to power 90% of operations through renewable sources and is estimated to cost around $2 billion. Our mining strategy is to....

Bitcoin mining company Argo Blockchain is the latest to seek a public listing in the U.S. markets, a sign of the market's increasing maturity.