Ethereum Funding Rates Resume Uptrend As ETH Prepares For Key Price Breakout

Several Ethereum key metrics are witnessing a positive sentiment following a renewed upward momentum in the digital asset’s price. Favorable macroeconomic and market conditions are believed to have bolstered the uptrend in ETH’s price and market dynamics, reflecting the potential for more price growth. Bullish Sentiment Building For Ethereum Amidst improving conditions, an encouraging trend […]

Related News

Bitcoin perpetual traders seem to be the only ones unmoved by the digital asset’s recent breakout. BTC which has had a tremendous rally during the first half of the week had been able to break out of the slump of the low $40,000s and moved on an upward trajectory above $47,500. However, perp traders have not reacted much to it given the state of the funding rates. Funding Rates Remain Flat The bitcoin perpetual traders are not reacting to the recent upside as expected. This is evidenced in the fact that the perp basis is still sitting at or even below neutral funding rates, marking the....

Ethereum funding rates had taken a beating after the Merge was completed. This event was the single most anticipated upgrade in the history of the network, and it had affected both price and funding rates in adverse ways. However, as the market begins to settle into the new normal of Ethereum being a proof of stake network, things are beginning to stabilize. One of those is funding rates returning to pre-Merge levels. Funding Rates Stabilizing The days leading up to the Ethereum Merge had been extremely volatile for the crypto market. Ethereum itself had borne the brunt of this, and even....

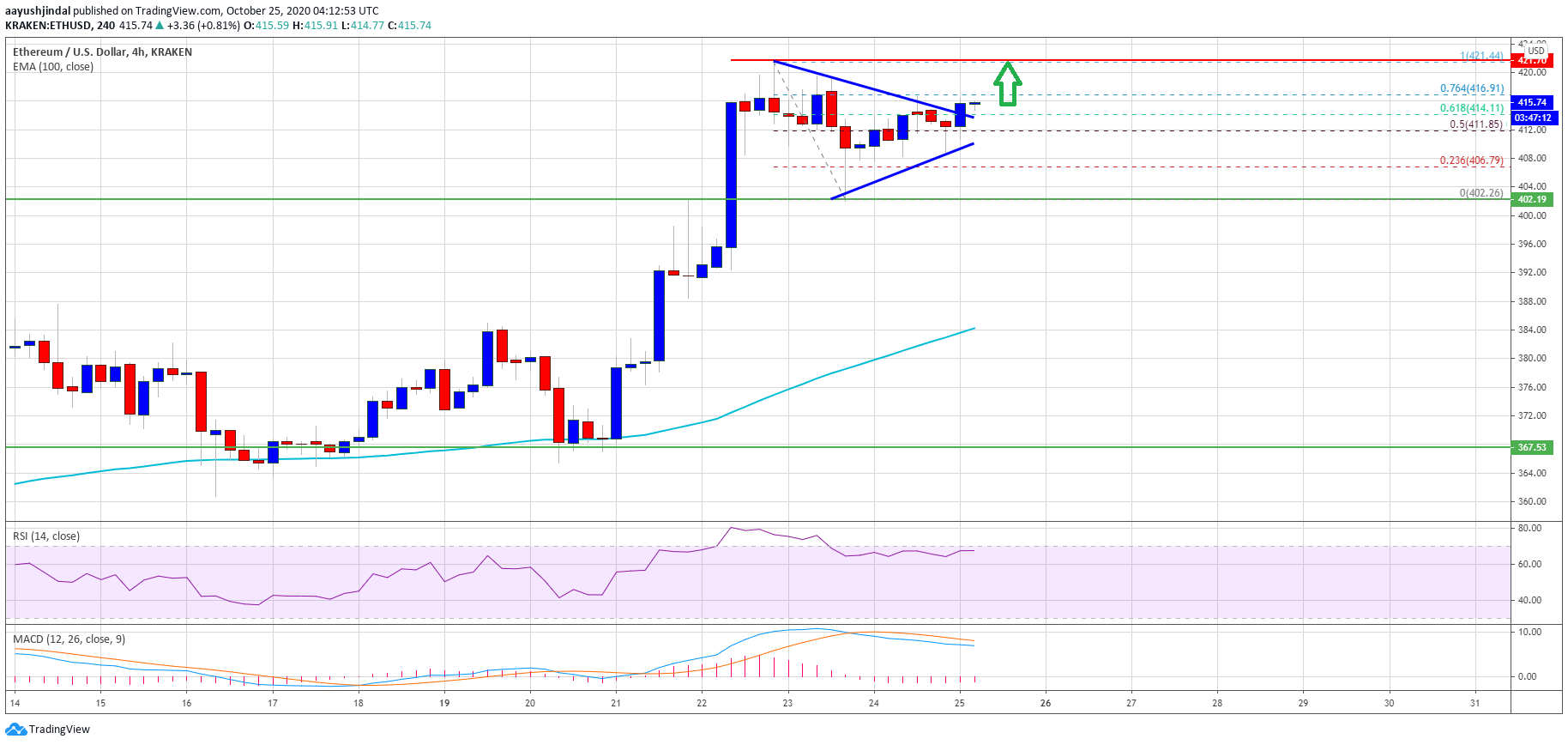

Ethereum traded to a new monthly high at $422 before correcting lower against the US Dollar. ETH price is trading well above the 100 SMA (H4) and it is likely to resume its upside above $422. ETH price is trading in a strong uptrend above the $400 support against the US Dollar. The price is […]

Ethereum (ETH) may be nearing the end of its price correction, as the second-largest cryptocurrency by market cap continues to trade slightly above $4,000, following a strong sell-off last week when it almost crashed to $3,400. Ethereum Price Correction May Be Over According to a CryptoQuant Quicktake post by contributor PelinayPA, Ethereum funding rates on Binance crypto exchange have remained positive, despite being in a narrow range. This shows that long positions on ETH still dominate the market. Related Reading: Bitcoin Market Feels “Too Efficient” As Arbitrage Opportunities Vanish –....

Ethereum recent performance in the futures market is generating optimism among traders and analysts, according to insights shared by CryptoQuant analyst ‘ShayanBTC.’ As the second-largest crypto by market capitalization, Ethereum has garnered notable attention following an uptick in funding rates—a measure used to gauge the demand balance between buyers and sellers in futures contracts. Related Reading: Ethereum Holds Key Support To Set A $6,000 Target – Analyst Rise In Funding Rates To Drive Breakout? Positive funding rates imply that there are more aggressive buyers, indicating bullish....