Data Shows Bitcoin Top Buyers Already Capitulated, New Bull Rally Here?

On-chain data suggests Bitcoin buyers who entered at the top may have already capitulated. Last time such a trend happened was back in July 2021, following which a new bull rally occurred. Lackluster Bitcoin Sell-Off Recently May Suggest Top Buyers Have Already Capitulated As per the latest weekly report from Glassnode, there hasn’t been any significant loss realization recently despite world-changing events taking place this week. The relevant on-chain indicator here is the “net realized profit/loss,” which tells us whether the overall Bitcoin market is realizing profits....

Related News

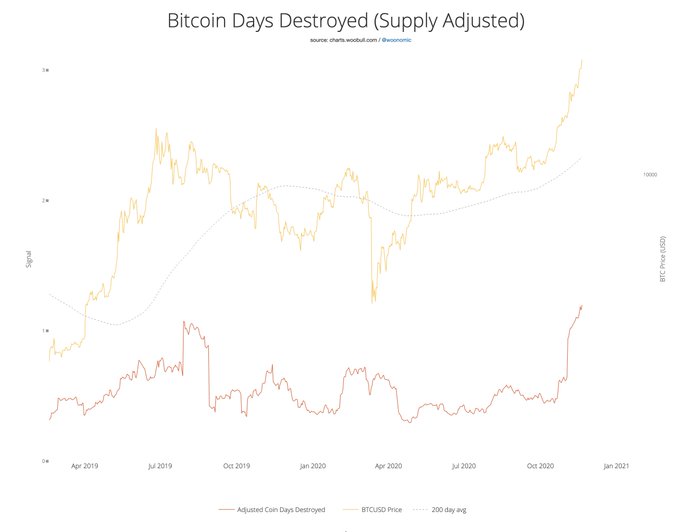

Bitcoin has undergone a strong rally over the past month as buyers rush in after the early 2020 crash. The price of the leading cryptocurrency currently trades for $18,600, which is almost the highest the cryptocurrency has traded since the 2017 bull market peak. While there appear to be many that believe the coin will move higher, data shows the coin is being sold to some extent. Bitcoin Is Being Sold Into This Rally, On-Chain […]

Last week, Dogecoin exploded with an 800% intraday move. On-chain data looking closely at daily active addresses, however, suggests that the pump and dump was almost entirely driven by Robinhood buyers. Here’s what this means for both sides of the coin. Dogecoin Reignites Retail Interest in Crypto After 800% Rally Dogecoin’s recent rally lived up […]

Altcoins could also see a strong buying interest and may run up vertically if Bitcoin rallies above $30,000. Bitcoin (BTC) rallied from an intraday low at $17,573.29 on Dec. 11 to an intraday high at $29,310.19 on Dec. 31, a 66.78% rally in a short span. This shows strong demand from traders at every higher level.Institutional crypto investment giant Grayscale bought 72,950 Bitcoin in December, which was 159.49% more than the 28,112 Bitcoin mined during that period, according to data from Coin98 Analytics. It is not only the institutions buying — a strong bull run also attracts speculators....

Those who bought BTC between six and 18 months ago are losing out big, says the research, but now there is even more reason to buy their supply. Bitcoin's (BTC) spot trading below $20,000 is seeing a new “capitulation” event encompassing an entire year’s worth of buyers, research reveals.In one of its Quicktake market updates on Sept. 29, on-chain analytics platform CryptoQuant flagged intense selling by a large number of recent hodlers.2021 bull market coins "have been sold aggressively"As BTC/USD lingers near levels barely seen since 2020, it is not just miners feeling the....

Bitcoin’s value against the U.S. dollar lost 7.3% during the last 24 hours after more than $600 million in value was removed from the $1.07 trillion crypto economy. Statistics show that a number of bitcoin miners capitulated over the last two weeks, selling 5,925 bitcoin worth millions, according to cryptoquant.com data.

More Than 6,100 Bitcoin Sold Since the First of the Month, Following a Brief Miner Capitulation Pause

Bitcoin’s U.S. dollar value slid from $23,593 per unit to $21,268 per coin at 8:30 a.m. (EST) on Friday morning. More than $600 million has been....