Australia's crypto ecosystem 2020: The spark for a DeFi explosion

The Australian crypto ecosystem has flourished despite the pandemic, with a booming DeFi sector, a five year blockchain roadmap and the embrace of the technology by banks and the finance sector. For a country of 25 million people, Australia punches well above its weight both economically and in the world of blockchain. Australians have long been enthusiastic adopters of new technology, from cell phones to smart homes, and it’s little surprise they’ve embraced crypto too.Chainalysis ranked Australia 20th out of 154 countries surveyed this year for its 2020 Global Crypto Adoption index,....

Related News

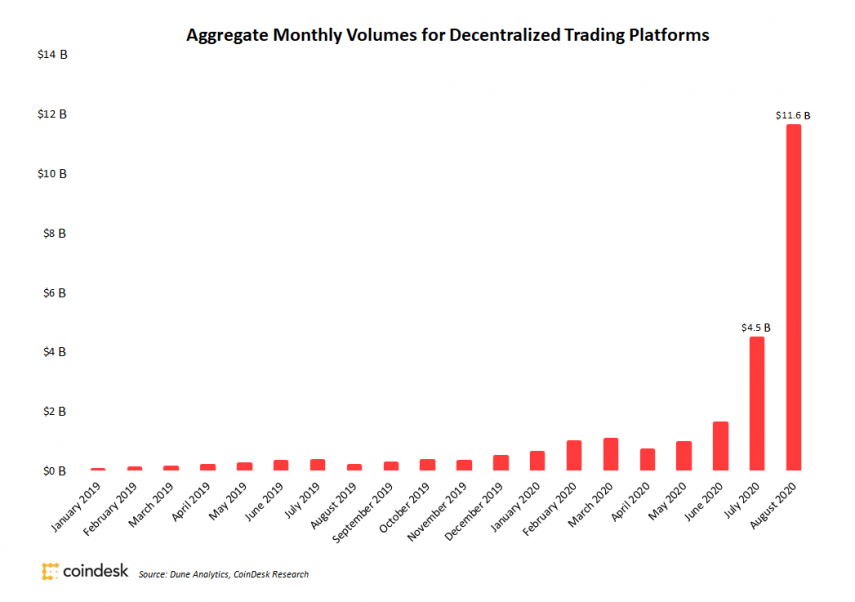

The first quarter of 2020 saw $5.1 billion added in volume to decentralized exchanges, 500% increase from the first 6 months in 2019. Data obtained from coindex This is made possible due to the recent rave that DeFi projects have caught on, the DeFi spark ignited the increased use of DEX platforms and platforms such […]

If 2020 was the year that DeFi found its feet, then 2021 is shaping up to be the year that DeFi is spreading its wings across the blockchain ecosystem and finding its place beyond the boundaries of Ethereum. It was somewhat inevitable, given that Ethereum’s eye-wateringly high gas fees continue to price many smaller investors […]

With the DeFi ecosystem experiencing continued growth, a notable amount of XRP is being seen across the sector. After a period of reduced demand, more of the token has been moved into several areas of the ecosystem, such as decentralized applications (dApps) and on-chain finance products. More XRP Moves Into DeFi Ecosystem XRP is becoming […]

Australia’s overall crypto perception improved in 2020 but adoption among women is still lacking. A recently published survey by the cryptocurrency exchange platform Independent Reserve shows nearly 20% of young adults in Australia own virtual currencies in 2020.According to the 2020 edition of the Independent Reserve Cryptocurrency Index (IRCI), Australia’s general crypto sentiment improved significantly compared to 2019. Indeed, figures from the IRCI survey put the 2020 crypto index at 47, a gain of over 10% from its previous value of 42, published in the 2019 reportThe survey, which....

The DeFi space has grown exponentially during the past couple years. In 2019, the entire decentralized finance ecosystem had been valued at less than $500 million. In February 2020, the DeFi market reached the $1 billion mark. Currently, the DeFi sector has reached nearly $100 billion according to available data. Even though there was a […]