Microstrategy Outperforms Every Asset Class and Big Tech Stock Since Adopting...

Microstrategy (MSTR) has “outperformed every asset class and big tech stock” since the company adopted a bitcoin strategy and started accumulating the cryptocurrency in its corporate treasury, says CEO Michael Saylor. The pro-bitcoin executive will be stepping down as the CEO of Microstrategy and take the role of the company’s executive chairman to focus on bitcoin. Microstrategy’s Performance Since Adopting Bitcoin Strategy The Nasdaq-listed software company Microstrategy Inc. (Nasdaq: MSTR) released its Q2 financial results Tuesday. CEO Michael....

Related News

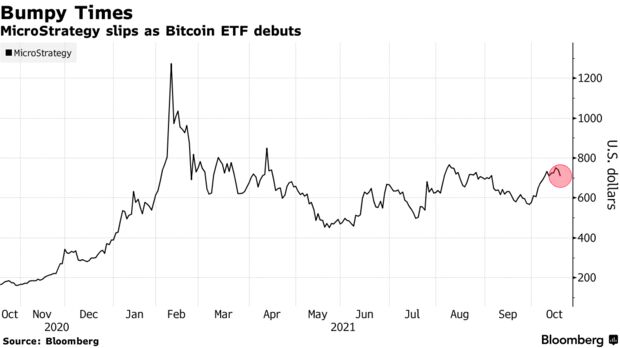

Following the launch of the first ever Bitcoin exchange-traded fund (ETF), Microstrategy’s stock took a hit. This may show that investors would prefer to get BTC exposure through the ETF rather than the tech company’s stock. Microstrategy’s Stock Drops 2% In Response To Bitcoin ETF Launch As reported by Bloomberg, the tech firm’s stock had […]

Michael Saylor’s MicroStrategy plans to raise $21B for additional Bitcoin ($BTC) purchases through the At The Market (ATM) Program. Specifically, MicroStrategy will sell $21B worth of 8% Series A perpetual strike preferred stock – shares that pay an 8% dividend, have a $0.001 par value, and are convertible into MicroStrategy’s Class A common stock without […]

MicroStrategy has officially announced its rebranding initiative, adopting the name Strategy. This transition marks a strategic evolution for the company, positioning it as the world’s first and largest Bitcoin Treasury Company while retaining its identity as a leading independent business intelligence firm and a Nasdaq 100 stock. MicroStrategy Rebrands As Strategy According to Microstrategy’s announcement, the […]

The CEO of Microstrategy says that bitcoin will emerge as a $100 trillion asset class and will grow 100X from where it is today. He said the cryptocurrency is winning against gold as a store of value and he is not worried about regulation. “I’m not at all troubled with the regulations that’s going on right now.” ‘Bitcoin Is Winning, Gold Is Losing’ as Store of Value Microstrategy CEO Michael Saylor talked about the future outlook for bitcoin in an interview with CNBC Friday. He discussed the institutional adoption of bitcoin, crypto regulation,....

Is Michael Saylor’s side of the story the reality of the situation? Or is he on a damage control tour? The ex-MicroStrategy CEO spent the whole day as a guest in what seems like every US financial show in existence, letting everyone know that this whole thing was his idea. Saylor picked his successor for […]