Bitcoin price 'macro top'? Not so fast — data shows the real FOMO isn't even ...

If this bull cycle is like 2017 or even 2019, then the majority of investor "FOMO" and associated price gains lie ahead. Bitcoin (BTC) bears thinking that $58,000 was this cycle's top will be sorely disappointed, fresh investment data from past bull markets shows.Compiled by on-chain analytics resource Whalemap, statistics covering BTC buys of between $5 million and $7 million conclude that even at recent all-time highs, Bitcoin was far from a "macro top.""No FOMO in sight" for BTCDuring the 2017 and shorter 2019 bull market, Bitcoin saw mass buy-ins of a similar size — $5-7 million. When....

Related News

Smaller Bitcoin entities are rapidly adding to their BTC stash, but this has preceded price tops in times gone by. Bitcoin (BTC) is seeing what looks like panic buying by retail investors, fresh data shows — but all might not be as it seems.In a tweet on April 4, William Clemente, lead insights analyst at Blockware, revealed a large spike in the BTC supply owned by smaller hodlers.2022 retail FOMO spike "an outlier"Typically referred to as “retail,” entities with 1 BTC or less are considered to be mainstream consumers rather than corporate or institutional investors.According to figures....

The Bitcoin correlation with the macro markets reached new highs in 2022. This saw the price of the digital asset, and the entire crypto market by extension, follow the movement of the stock and equities market very closely. There were forecasts that the cryptocurrency would begin to decouple from the macro market as time went on but data shows that the correlation still remains very high even now. Following The Macro Market One of the most prominent ways that the macro market and the bitcoin correlation have shone through has been during important events like the CPI data releases. The....

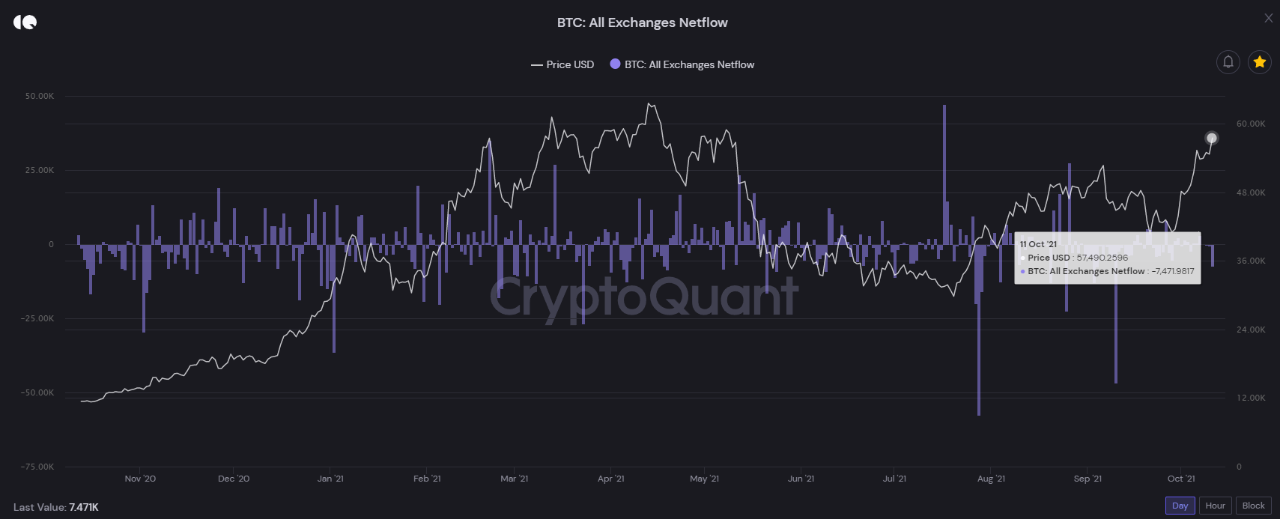

Bitcoin on-chain data suggests accumulation is going on as investors feel FOMO about the current rally above $57k. Bitcoin Accumulation Goes On As Investors Feel FOMO As explained by a CryptoQuant post, on-chain data is showing signs of accumulation as BTC netflows show negative spikes, and the stablecoins inflows indicate big moves. The Bitcoin netflow […]

Data shows the Bitcoin trading volume has dropped to its lowest level in 14 months, signaling that FOMO around the crypto may be no more. Bitcoin Trading Volume Sinks To Lows Not Seen Since December 2020 As per the latest weekly report from Arcane Research, the BTC trading volume has continued its decline this week, […]

The MVRV-Z Score is a tried and tested bottom indicator, but it is not back at base yet, one analyst warns. Bitcoin (BTC) needs to go lower before putting in a macro bottom, one of the market’s most accurate indicators shows.Data from sources including on-chain analytics firm Glassnode shows Bitcoin’s MVRV-Z Score is almost — but not quite — signaling a price reversal.MVRV-Z Score inches towards macro bottomAmid ongoing debate whether if, or when, BTC/USD will go beyond its current macro lows of $17,600, new figures suggest that the market easily has further to fall.As noted by Filbfilb,....