Fresh Bitcoin Long Positions Open Up On Exchanges As Funding Rates Turn Positive

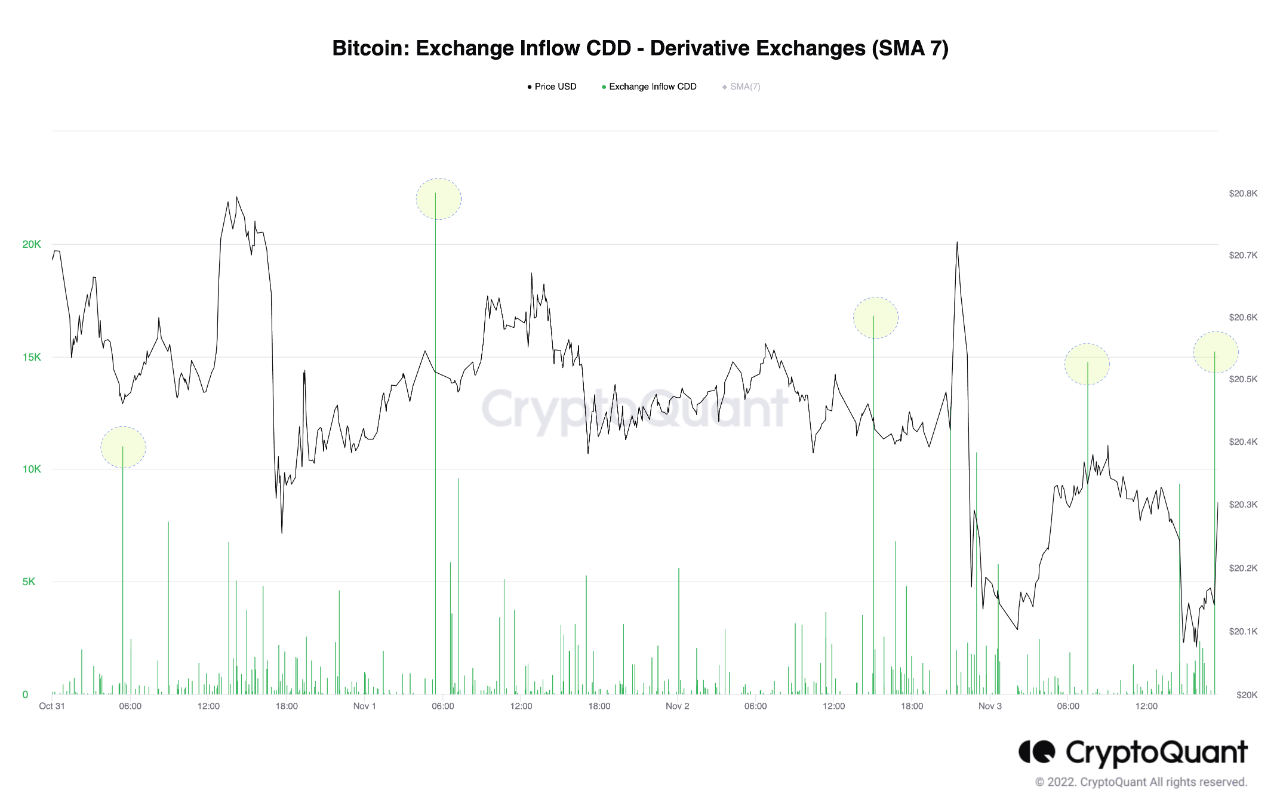

On-chain data shows Bitcoin funding rates have turned positive, suggesting there have been some fresh long openings on derivative exchanges. Bitcoin Funding Rate Turns Green After Derivative Exchange Inflows Spike Up As pointed out by an analyst in a CryptoQuant post, the new long positions can drive the price up in the short term. There are mainly two Bitcoin indicators of relevance here, the derivative exchange inflow CDD, and the funding rates. First, the “derivative exchange inflow CDD” is a metric that tells us whether old BTC supply is moving into derivative exchange....

Related News

Data shows funding rates for Bitcoin have turned positive, a signal that might indicate market sentiment is bullish among traders. Bitcoin Funding Rates Turn Positive, While Derivative And Spot Reserves Move Down As pointed out by a CryptoQuant post, the funding rates seem to be slightly positive for the BTC market right now. The Bitcoin funding rates are the payment that traders need to pay so that they can keep an open position. This additional, periodic fee is based on the difference between the perpetual contract market and the spot price. These funding rates are used for perpetual....

Data shows following the crash, Bitcoin funding rates flipped to negative for the first time since September as market sentiment resets. Bitcoin Funding Rates Turn Negative For The First Time Since Late September As per the latest weekly report from Glassnode, market sentiment reset after the latest crash in BTC’s price as funding rates turned negative. The “perpetual funding rate” is an indicator that measures the periodic fee that Bitcoin futures traders have to pay each other to keep their positions. This metric helps us know about which direction leveraged positions....

Data shows the Bitcoin funding rates on exchanges have turned negative, a sign that the shorts have now become the dominant force in the market. Bitcoin Funding Rates Have Turned Negative After Market Crash As pointed out by an analyst in a CryptoQuant Quicktake post, the Bitcoin funding rates have seen a sharp decline recently. The “funding rate” refers to a metric that keeps track of the periodic fee that derivatives contract holders are currently exchanging with each other. When the value of this indicator is positive, it means the long investors are paying a premium to the....

On-chain data shows the Bitcoin open interest is sharply rising, a sign that a long squeeze may be brewing in the crypto futures market. Bitcoin Open Interest Has Observed Rise Recently, While Funding Rates Remain Positive As pointed out by an analyst in a CryptoQuant post, the futures market may be heading towards a long squeeze in the near future. The “open interest” is an indicator that measures the total amount of Bitcoin futures positions currently open on derivatives exchanges. It includes both long and short positions. An increasing value of the metric suggests users are....

On-chain data shows the Bitcoin funding rates have now hit a 6-month high, something that could lead to a long squeeze in the market. Bitcoin Funding Rates Currently Have A Highly Positive Value As pointed out by an analyst in a CryptoQuant post, BTC funding rates have surged up to the highest for the last six months. The “funding rate” is an indicator that measures the periodic fee that traders in the Bitcoin futures market have to pay each other. When the value of this metric is greater than zero, it means long traders are paying shorts to hold onto their positions right now.....