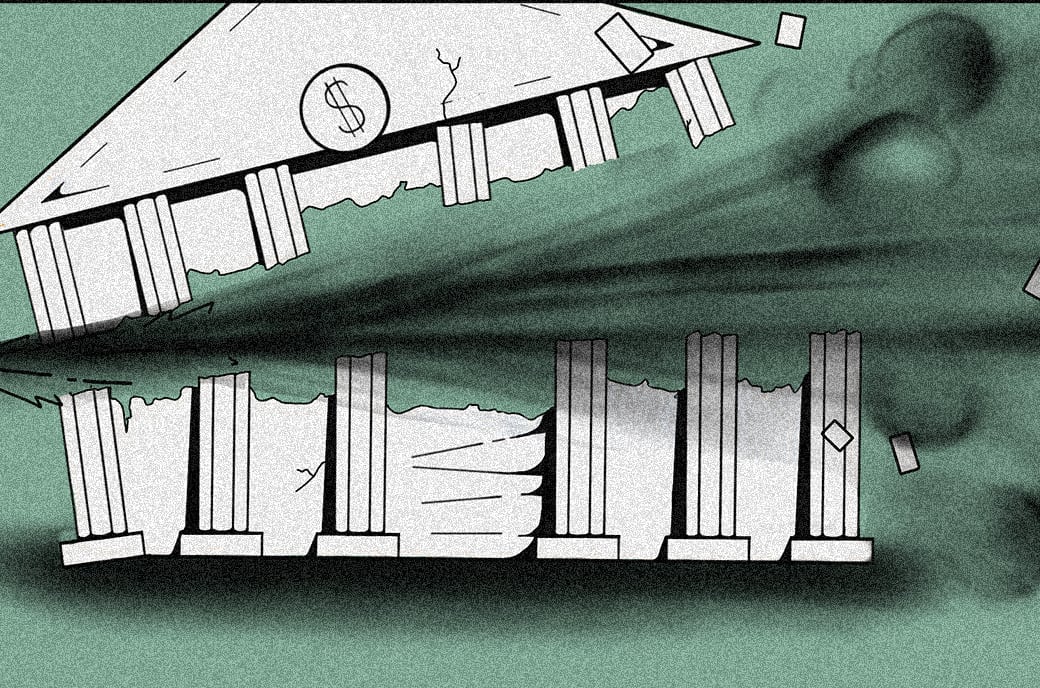

Are Central Banks Losing Control Of The Economy?

The Federal Reserve has an upcoming FOMC meeting in May, in which many people expect them to raise interest rates for the second time this year.Watch This Episode On YouTubeListen To The Episode Here:AppleSpotifyGoogleLibsynRumbleOvercastIn this episode of the “Fed Watch” podcast, I give a big update on central bank related news from around the world. It’s been several weeks since we’ve done a down and dirty update on material from the monetary world, so there is a lot to cover. Listen to the episode for my complete coverage. Below, I summarize Federal Reserve related headlines and their....

Related News

UK-based banking giant HSBC sees blockchain technology to benefit state-installed central banks, institutions that are tasked and responsible for a country's economic growth and wellbeing. In a document obtained by Business Insider, HSBC sees the potential of blockchain technology to transcend private and investment banks and influence or even enhance central banks' policies. The publication reports that HSBC sees central banks' current method of helping the economy through interest rates has a few drawbacks. Notably, there's no guarantee of the money pumped into the real economy as the....

Central banks are paying very close attention to stablecoins, seeking to control them — and decentralization may be the solution. Over the last couple of years, we have seen a lot of interest from central banks and governments in the stablecoin market. The reason behind it lies in the development of central bank digital currencies, or CBDCs.The idea of issuing a digital alternative to cash is a great motivator for central banks. It allows them to gain more control over the transition and processing of cashless transactions, which are currently overseen indirectly through private payment....

The world’s central banks are asking governments for help in stimulating the global economy, something at which they have failed. At the three-day annual Jackson Hole Economic Symposium in Wyoming, heads of the US Federal Reserve, the Bank of Japan, and the European Central Bank all met to discuss ways of meeting the current economic challenges. The consensus is that they need help. Without additional government intervention, they said, central banks would be unable to rescue the global economy through monetary policy alone. According to Jose Rodriguez, VP of payments for the Mexican....

Central banks have been responding to the rise of Bitcoin with the introduction of central bank digital currencies, or CBDCs. Thus far, movement on this front has been somewhat slow. Save for China, most central banks are still in the ideation phase, or are looking more into how a CBDC would affect their economy and […]

Bitcoin was designed to be a decentralised peer-to-peer payment protocol and one that would fall outside the control of both governments and banks. This, however, has not prevented central banks from voicing their opinion on the digital currency and its potential regulation. Although bitcoin regulation continues to be a contentious subject, some central banks have said it is necessary. Others have assessed the potential costs of regulation and realised that this would not outweigh the benefits. Additionally, institutions have explored both the risks and benefits associated with the use of....