Short The State: How Bitcoin Enables Jurisdictional Arbitrage

Bitcoin lets anyone live and thrive wherever they want, ending government monopoly on our jurisdictions.This is an opinion editorial by Katie The Russian, CEO of Plan B Passport and co-host of the “The Bittersweet Podcast.”Because you are born into a nonconsensual monopoly brought upon you by the government, you have no real options — no real choices to pick the services that you want to receive from the State, the taxes you are willing to pay for it or the regulatory environment under which you decide to operate. Unless, you decide to enter the game of jurisdictional arbitrage and limit....

Related News

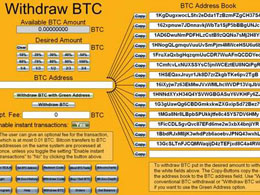

Bitcoin price is in a slow controlled descent with frequent spikes to the upside developing. Market orders are streaming through the exchanges like a ticker tape and buy limit orders fill the orderbooks down to $290. We look at arbitrage trading in the Bitcoin exchanges and consider options for trend in the coming days. Bitcoin Price Arbitrage. Bitcoin Price Analysis. Summary. Comments. Bitcoin Price Arbitrage. Many thanks to all the readers, supporters and cynics alike, who had responded to Sunday's article about manipulation in the exchanges. It's only by kicking the hornet's nest that....

Arbitrage serves an important function in the Bitcoin economy. Thanks to the individuals and automated bots that actively look for price differences between the various Bitcoin exchanges and buy from one and sell to another if the price disparity ever becomes high enough for the transaction to be worth it, people who are buying or selling BTC for their own use can rest assured that they are paying roughly the same price no matter which exchange they go to. Arbitrage also promotes competition among exchanges; if the only people trading on exchanges were those who were actually seeking to....

Crypto exchange Valr has announced it has closed its crypto arbitrage service to new customers in order to comply with the requirements of its banking partner. This announcement makes Valr the latest South African crypto exchange platform to close its arbitrage business. Ovex was one of the first exchanges to announce its exit from the market.

Banking Partner Requirements Push Exchange out of Arbitrage Market

The South African cryptocurrency exchange, Valr, will be exiting the crypto arbitrage market on February 28 in order to comply with its banking partner’s....

Over the past few years, New York state has proven to take aggressive stances to financial technology. The state of New York has a somewhat unusual reputation when it comes to financial regulation. The state’s regulator is not too keen on the OCC’s bank charter pan for fintech firms. Overseeing the financial technology sector is a coveted price, and a national bank charter may not be the best idea. It is unusual to see NY state go after the OCC this way, although it remains unclear how things will play out. Not too long ago, the OCC proposed their plans for a national bank charter in the....

A new working paper from Canada's central bank has found little evidence that arbitrage opportunities in cryptocurrency markets exist. The paper, Competition in the Cryptocurrency Market, analyses 10 months of publicly available data from exchanges like BTC-e and Cryptsy, from May 2013 to February 2014. Examining how 'network effects' (the phenomenon of new users augmenting the value of a technology) affect competition in the cryptocurrency economy, the paper looks at competition between both cryptocurrencies and cryptocurrency exchanges. The authors write: "For exchanges, we find little....