What’s Behind LUNA’s Rally, Could Its Price Decouple From Bitcoin?

The price of LUNA moves on its own as the crypto market trends to the downside. Terra’s native cryptocurrency records a 6.4% profit in the last week, as BTC, ETH, and BNB, move sideways. Related Reading | Mars Protocol To Launch On Terra, But Why MARS Has Seen A Massive Dump At the time of writing, LUNA trades at $89.35 with a 4.8% loss in the last 24 hours. Despite recent losses, the cryptocurrency is quickly moving up the top 10 cryptos by market. Currently, it sits at the 7th position after pushing down Cardano (ADA), Solana (SOL), and Polkadot (DOT). A report from economist Murray....

Related News

As the crypto market sees some relief over the past week, the price of LUNA trends to the downside. The worst performer in the top 10 by market cap, the Terra native cryptocurrency appears at risk of further downside. Related Reading | What’s Behind LUNA’s Rally, Could Its Price Decouple From Bitcoin? At the time of writing, LUNA trades at $87 with a 17% loss and a 5% loss in the last week and 24-hours, respectively. Data from Material Indicators (MI) suggest thin support for LUNA’s price at its current levels. Around $83 there are around $700,000 in bids orders which could proved....

LUNA’s price still risks correcting, however, with a weakening RSI and decreasing trading volume. A technical setup that preceded an 80% price rally in the Terra (LUNA) market in August 2021 has appeared again.LUNA paints bullish MACD crossoverThe technical setup involves a so-called “signal line crossover” between LUNA’s weekly MACD line — equal to the difference between the token’s 12-week and 26-week moving averages (MA) — and the nine-week MA called the signal line, plotted above the zero line, as shown in the chart below.LUNA/USD weekly MACD illustration. Source: TradingViewTogether,....

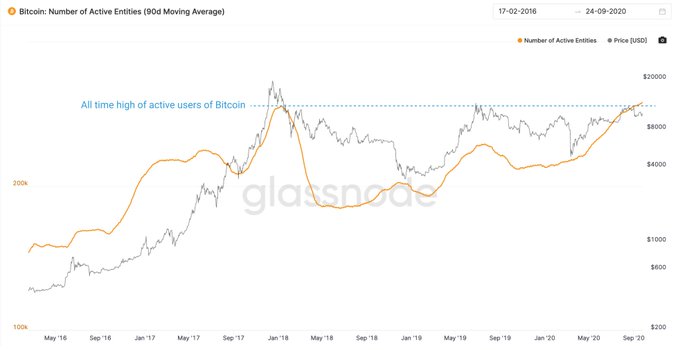

For the past few months, Bitcoin’s price action has largely been beholden to legacy markets like the S&P 500, the U.S. dollar index, and gold. The cryptocurrency has crashed and surge intandem with these markets, suggesting it is not uncorrelated as many once said. While this may be true in the short term, analysts think that the markets will decouple eventually. Bitcoin Is Primed to Decouple From the S&P 500, Top Analyst Says Willy Woo, […]

Chainalysis suggests ETH could decouple from other cryptocurrencies post Merge as its staking rewards could make it similar to bonds or commodities. Crypto analytics firm Chainalysis has suggested that the price of Ether (ETH) could decouple from other crypto assets post-Merge, with staking yields potentially driving strong institutional adoption.In a Sept. 7 report, Chainalysis explained that the upcoming Ethereum upgrade would introduce institutional investors to staking yields similar to certain instruments such as bonds and commodities, while also becoming much more eco-friendly.The....

Maybe one of the best-performing assets in 2021, LUNA has been trending against the market for the past 2 weeks. While Bitcoin, Ethereum, and other major cryptocurrencies remained rangebound, the native token for the Terra ecosystem re-entered uncharted territories. Related Reading | Terra Begins LUNA Burning, Why It Could Target $140 As of press time, LUNA trades at $87 coming in from a monthly low at $38 which represents almost a 40% increase over that period. As reported by NewsBTC, Terra deployed several improvements on its mainnet in the past months. These included Colombus-5,....