Bitcoin HODLer Selling Cooling Off As ETF Inflows Return: Glassnode

On-chain analytics firm Glassnode has revealed in a report that Bitcoin long-term holder have slowed down distribution after months of selling. Bitcoin Long-Term Holder Net Position Change Is Now Neutral In its latest weekly report, Glassnode has talked about how the behavior of the Bitcoin long-term holders has changed recently. The “long-term holders” (LTHs) refer to […]

Related News

On-chain analytics firm Glassnode has pointed out how Bitcoin spot ETF inflows are still not at the intensity seen during previous rallies this cycle. Bitcoin Spot ETF Inflows Are Currently Under 1,000 BTC Per Day In a new post on X, Glassnode has talked about the latest trend in the inflows of the spot exchange-traded […]

The total amount of capital inflows into bitcoin during the 30 days to Jan. 25 are as high as the entire bitcoin market capitalization in September 2017 and early 2019, according to new data from Glassnode. Glassnode co-founder and CTO Rafael Schultze-Kraft tweeted that cash inflows into bitcoin (BTC), as estimated by the realized cap, reached $70 billion during the calendar month in review, equalling the whole BTC market cap value for September four years ago and early 2019. In 2017, bitcoin prices rose sharply within a space of just three months, peaking at nearly $20,000 by December....

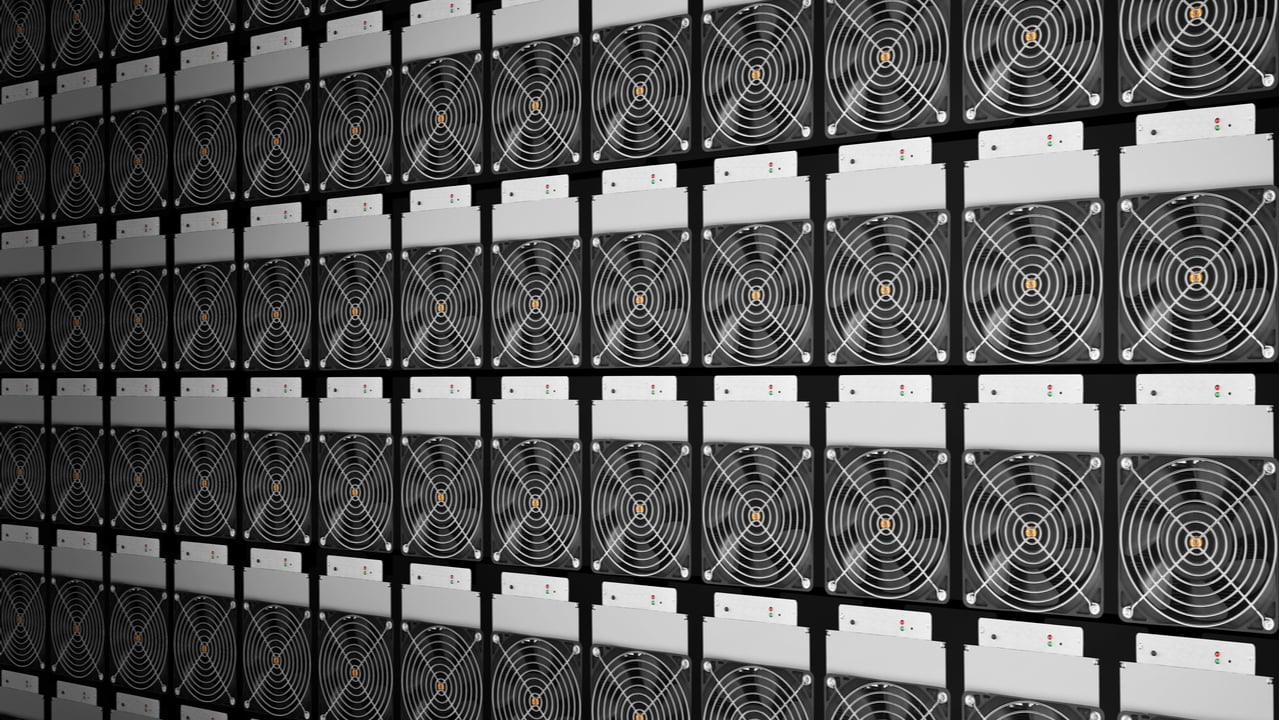

Bitcoin mining companies are now increasingly experimenting with immersion cooling, a form of cooling that allows them to get more hashpower out of existing miners. According to industry insiders, this cooling alternative will become mainstream in the future, as leading companies are already taking advantage and retrofitting these cooling devices to existing mining operations.

Immersion Cooling Getting Attention From Miners

Miners are experimenting with an alternative and lesser employed method for maintaining their equipment, called immersion cooling. This cooling process....

The Bitcoin market appears to be retracing the gains it has made since January as whales may be exiting and selling on centralized exchanges according to Glassnode. The number of Bitcoin whales is rapidly decreasing to levels not seen since earlier this year, possibly due to the three-month high of coin inflows to centralized exchanges (CEXs).Bitcoin (BTC) market tracker Glassnode has issued several bearish indicators for the largest cryptocurrency by market cap, including data suggesting a market exit for whales holding at least 1,000 coins, and exchange inflows of more than 1.7 million....

Bitcoin price has rallied above the $64,000 mark. Glassnode, a market intelligence platform, has analyzed this notable increase, which attributes the current price movement to a significant easing of sell-side pressure, particularly from the German government. Exhaustion of Sell-Side Pressure According to the on-chain data provided by Glassnode, the recent uptick in Bitcoin’s price is largely due to what they describe as the “complete exhaustion” of sell-side forces, particularly those stemming from the recent governmental actions. Over the past weeks, the German....