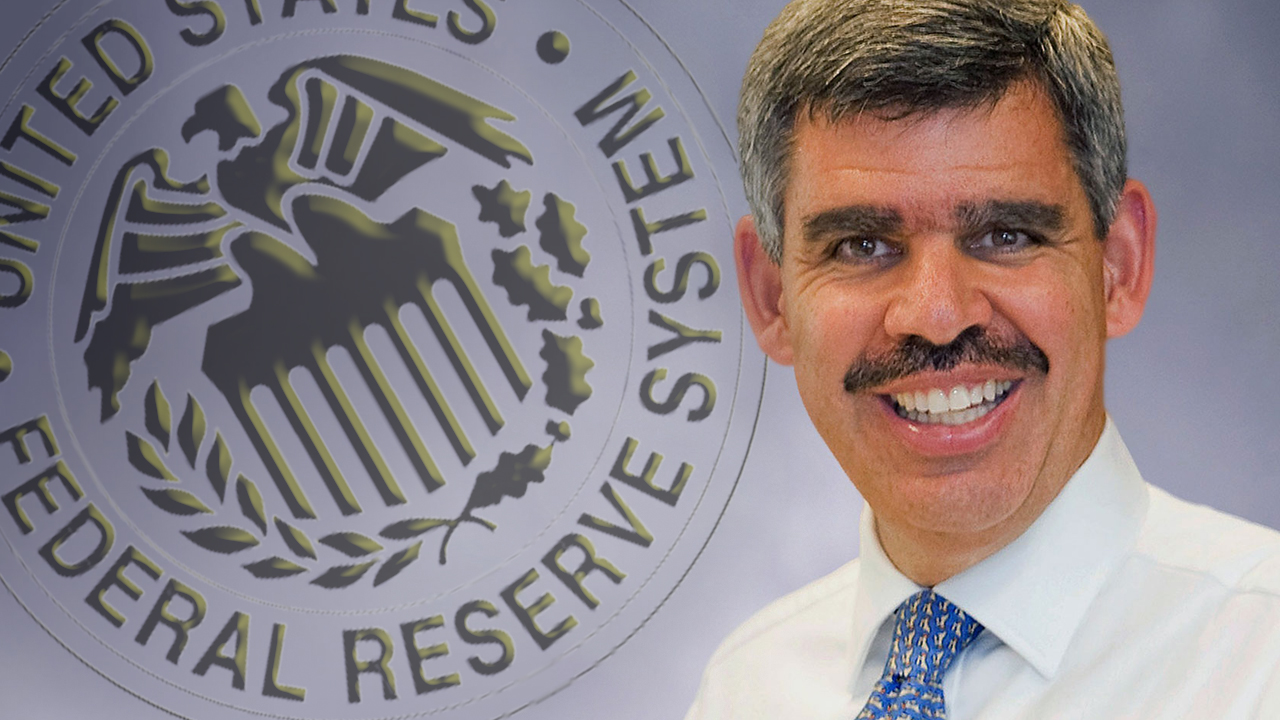

Economist Predicts the Fed’s Response to Inflation Will Push Crypto Higher

Allianz Chief Economic Advisor Mohamed El-Erian says that the Federal Reserve’s response to inflation will cause the prices of cryptocurrencies, like bitcoin, to “go higher.” He noted: “That’s what you get when you’ve waited too long to recognize what inflation is and to take action.” Predictions by Allianz’s Chief Economist Economist Mohamed El-Erian discussed the U.S. economy, the markets, and the Federal Reserve’s response to inflation in an interview with CNBC Monday. El-Erian is the president of....

Related News

Americans are still very concerned about inflation as the latest Survey of Consumer Expectations (SCE) report from August indicates that U.S. consumers expect inflation to be 5.2% a year from now. The SCE response data hasn’t been this high since 2013, and it’s increased since the month prior, when U.S. residents expected 4.9% at the time. Month After Month, Consumer Inflation Expectations Continue to Climb Higher The cost of services and goods in the United States has risen a great deal and Americans have been worried about rising inflation. Citizens have good reason to....

On Monday, December 13, following Friday’s U.S. consumer price index report published by the Bureau of Labor Statistics, Americans are discussing the Federal Reserve. Thousands of tweets concerning the Federal Reserve topic have been trending on Twitter, as inflation has gripped the U.S. economy. Furthermore, Mohamed El-Erian, the chief economic advisor for the German multinational financial services company Allianz says the term “transitory” was the “worst inflation call in the history,” according to a recent interview.

Allianz Chief Economic....

The U.S. Federal Reserve is expected to raise the federal funds rate during its next meeting on Wednesday and JPMorgan economist Michael Feroli believes that rising inflation will push the Fed to increase the rate by 75 basis points (bps). Last week, CME Group data indicated the market priced in a 95% chance that the U.S. will see a 50 bps rate hike this month. Although, while some expect a hawkish Fed, some believe the U.S. central bank may act dovishly if markets get worse.

Global Markets Shudder With Focus Directed at the Fed’s Next Rate Hike — JPMorgan Economist....

Bitcoin starts yet another 2022 week in the red with a 2% loss in 24 hours and a 13.5% loss in 7 days. The benchmark crypto has been on a downtrend since the end of 2021 and could potentially dip further due to macroeconomic factors. Related Reading | TA: Bitcoin Key Indicators Suggest A Strengthening Case For More Downsides At least, the above seems to correspond with the general sentiment in the market. The U.S. Federal Reserve is turning more hawkish due to a rise in inflation metrics, hitting new highs for the first time in 40 years. Thus, turning potential price expectations for....

As political leaders in crisis-hit Lebanon bicker over positions in the yet-to-be-formed government, the country’s runaway inflation rate surged to 211% in May 2022, new data has shown. Economist Steve Hanke insists that a currency board is a solution to Lebanon’s currency woes. Black Market in Fuel Driving Inflation The inflation rate in crisis-torn Lebanon surged to 211% in May, making it the 23rd consecutive time the consumer price index (CPI) has surged, a report has said. The revelation of the latest inflation figure comes as the country’s politicians reportedly....