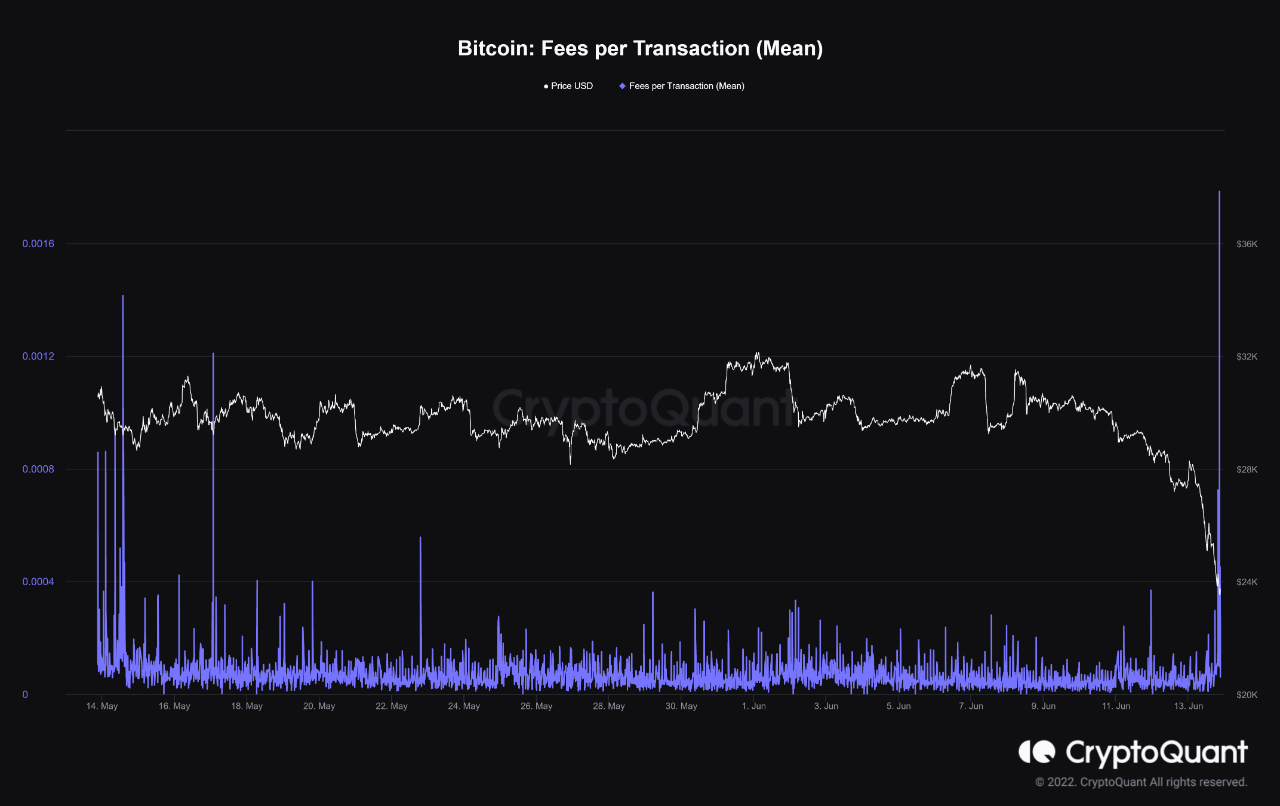

Bitcoin & Ethereum Fees Jump Up As Holders Rush To Sell

Data shows both Bitcoin and Ethereum have observed a spike in the transaction fees over the past couple of days as holders have rushed to sell amid the crash. Bitcoin & Ethereum Transaction Fees Shoot Up The “transaction fees” is an amount that users making transactions on the network have to pay in order to […]

Related News

26 days ago, Ethereum transitioned from a proof-of-work (PoW) network to a proof-of-stake (PoS) blockchain and after the change, the network’s fees remained low. This week, however, Ethereum’s gas fees have increased as data from October 10 shows the average fee tapped a high of $4.75 per transaction.

Ethereum’s Average Gas Fees Jump Over 80% in 3 Days

Ethereum’s gas fees have ticked upwards, jumping 84% higher from $2.58 per transaction on October 8, to $4.75 per transfer on October 10. Ethereum fees have not breached $4 since August 11, 2022, or....

On-chain data shows non-empty addresses on the Ethereum network have set a new record of 175.5 million, the highest among all digital assets. Ethereum Has Seen A New Record In Total Amount Of Holders According to data from on-chain analytics firm Santiment, the Total Amount of Holders has hit a new milestone for Ethereum recently. […]

Ethereum gas prices witnessed a major spike earlier. This was caused by the release of the “Stoner Cats” NFTs on the network. The release of the limited edition NFTs saw gas fees of the network-driven following the mad rush to acquires the pieces. Investors scrambled to mint the 10,000 NFTs released as part of the […]

While a number of digital currencies have seen price gains the two leading crypto assets, bitcoin and ethereum have seen transaction fees skyrocket. For instance, data shows that the median fee for a bitcoin transaction is $8.58, while the median fee is $9.35 when spending ether. Meanwhile, the average transaction fee for both networks has been much higher between $14 to over $20 per transfer. During the course of 2021, crypto assets have increased a great deal in value but alongside this, the fees to transact on these networks have risen as well. Bitcoin (BTC) and Ethereum (ETH) are the....

XRP is now moving into a new chapter marked by the arrival of Spot XRP ETFs, and Ripple CEO Brad Garlinghouse believes this is about to cause a rush toward the asset. Garlinghouse’s latest comment about an incoming rush to XRP arrives at a moment when the cryptocurrency has been struggling with bearish price action. […]