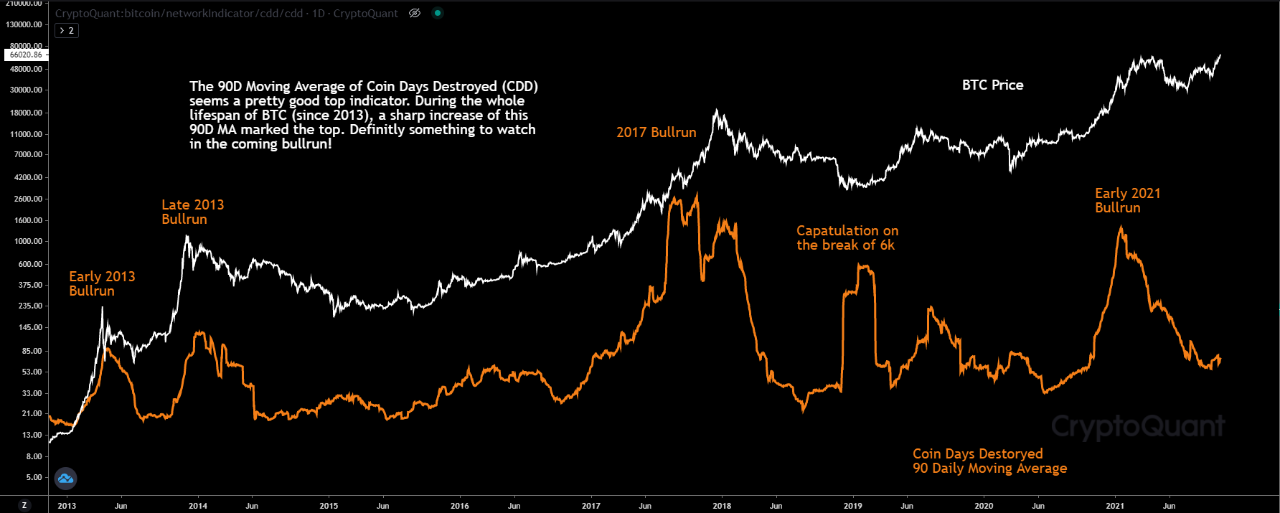

Can “Coin Days Destroyed” Indicator Predict Bitcoin Tops?

Historical data of the “coin days destroyed” indicator versus the Bitcoin price may suggest the metric can help predict tops. The Bitcoin Coin Days Destroyed (CDD) Indicator As explained by an analyst in a CryptoQuant post, the coin days destroyed metric might be a reliable indicator for BTC tops. A “coin day” is defined as […]

Related News

Quant explains how there may be a correlation between the Gemini Bitcoin netflow and BTC price tops, based on pattern of the last few years. Can Gemini Netflow Predict Bitcoin’s Price Tops? As posted by an analyst on CryptoQuant, the historical chart for the Gemini netflow (30-day MA) vs the price reveals there could be a correlation between the indicator and BTC tops. The Bitcoin netflow here refers to the net number of coins exiting or entering the crypto exchange Gemini. The indicator’s value is simply calculated by taking the difference between the inflows and the outflows.....

A quant breaks down how the Bitcoin NUPL indicator may be able to predict the beginning of a new bull run based on past pattern. How The Bitcoin NUPL Metric May Predict The Start Of Bull Run As explained by an analyst in a CryptoQuant post, the various phases of the NUPL indicator may shed some light relating to the bull run status for BTC. The net unrealized profit and loss (or NUPL in short) is a metric that’s defined as the difference between the market cap and the realized cap, divided by the market cap. NUPL = (Market Cap – Realized Cap) ÷ Market Cap In simpler terms, what....

Elliott Waves are a popular yet controversial technical analysis indicator. This post will explore the relevance of Elliott Waves for bitcoin trends. Elliott Waves are a technical analysis indicator to predict future price trends. The principles of Elliott Waves are founded on the belief that markets follow predictable sequences of optimism and pessimism. The sequence of a bull market follows the below pattern. A bear market follows an exact opposite sequence. To learn how to apply Elliott Waves,watch this tutorial by DanV, a very popular Trading View bitcoin chartist.

A quant has explained how the Bitcoin funding rate (72 hour) may be able to correctly signal tops and bottoms in the price of the crypto. Bitcoin Funding Rate May Be Able To Indicate Tops And Bottoms In The Market As explained by an analyst in a CryptoQuant post, the 72-hour version of the funding rate looks to have been effective at pointing out tops and bottoms in the BTC market. The “funding rate” is the periodic payment that Bitcoin futures traders (either long or short) have to make between each other. When the value of this metric is negative, it means shorts are paying a....

As we predicted a couple of days ago, the price of bitcoin continued to rise and reached $211 at the time of writing of this article. Our analysis for today continues on the same line of our analysis on the 16th of January, which used Fibonacci fan resistance lines to predict resistance and support lines. By studying the Bitfinex 1 hour chart from tradingview.com (look at the below chart), we can see that the price started rising sharply about 10 hours ago and recorded a high of over $221, before declining to around $206. The fall from $221 to $206 can be viewed as a 50% correction of the....