Bitcoin STH SOPR Metric Nears Upper Threshold — Are Short-Term Holders About ...

Following the slight pullback in Bitcoin’s price from the $115,000 level, several on-chain metrics are beginning to flash warning signals, and a possible shift in the current market trend. One of these crucial metrics is the Bitcoin Short-Term Holders SOPR. Rising Bitcoin STH SOPR Signals Warning Amid fluctuating market action, Bitcoin Short-Term Holders’ Spent Output […]

Related News

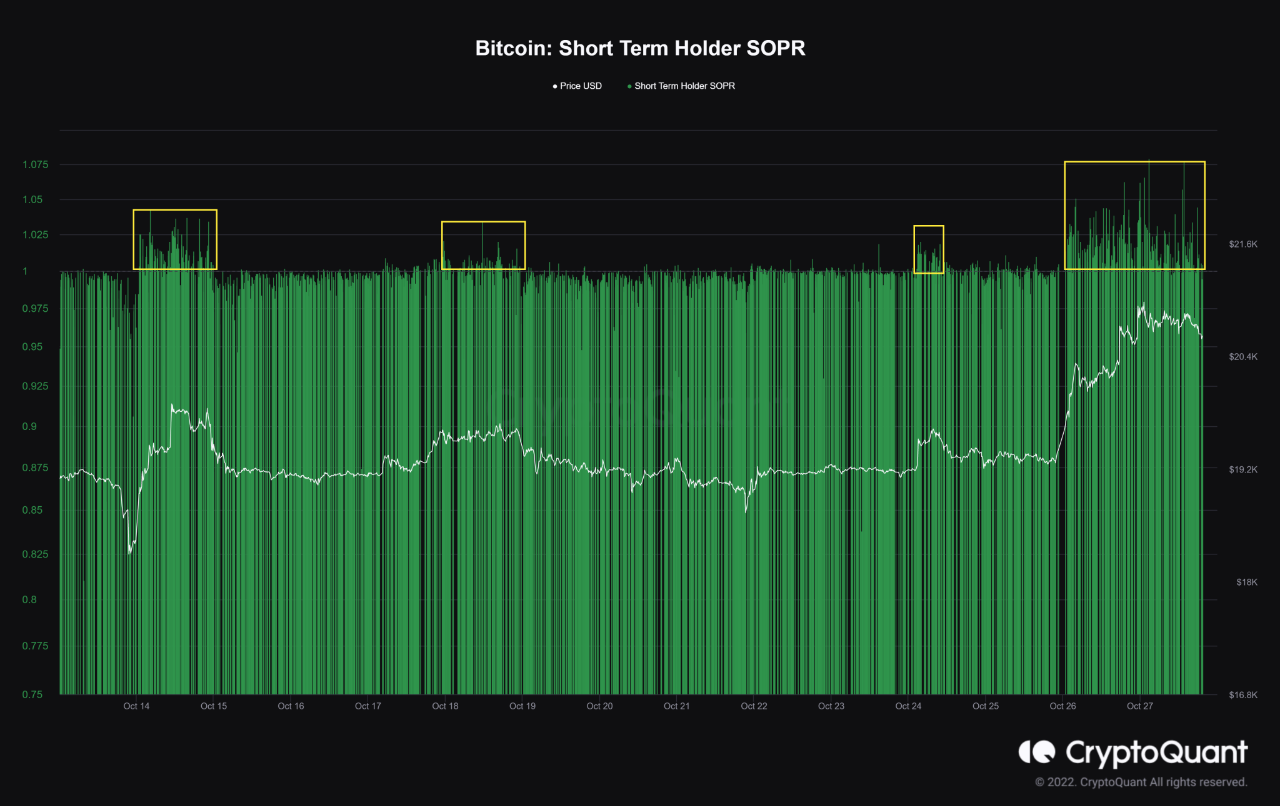

After surging to as high as $20.9k, Bitcoin has today observed a slight decline back into the low $20k levels as a result of profit taking from short-term holders. Bitcoin Short-Term Holder SOPR Has Been Elevated Over The Past Two Days As pointed out by an analyst in a CryptoQuant post, the short-term holders seem to be using the latest price rise for profit taking. The relevant indicator here is the “Spent Output Profit Ratio” (SOPR), which tells us whether the average investor is selling Bitcoin at a profit or at a loss right now. When the value of this metric is greater than....

Bitcoin on-chain data shows current trend with the short-term holder SOPR looks similar to that in June. This may mean that a bear period similar to then has started. Bitcoin Short-Term Holders Continue To Realize Losses As pointed out by an analyst in a CryptoQuant post, Bitcoin short-term holders have continued to realize profits recently, as suggested by the SOPR. This trend may be similar to the one seen in June. The “Spent Output Profit Ratio,” or SOPR in short, is an indicator that measures the profit ratio of the overall market by looking at the price each coin was sold....

On-chain data shows Bitcoin short-term holders are increasingly selling at a loss following the latest crash in the crypto’s price. Bitcoin Short-Term Holder SOPR Dips Further Below One As pointed out by an analyst in a CryptoQuant post, on-chain data shows that the STH SOPR has decreased to July levels, suggesting that short-term holders are increasingly realizing their losses. The Spent Output Profit Ratio, or “SOPR” in short, is a Bitcoin indicator that tells us whether investors are selling at a loss or a profit during a given period. The metric’s value is....

On-chain data shows the Bitcoin short-term holder SOPR is approaching the “breakeven” value, a point that has acted as resistance for the crypto’s price in the past. Bitcoin Short-Term Holder SOPR Surges Up And Approaches A Value Of “1” As pointed out by an analyst in a CryptoQuant post, the selling pressure from the short-term holders may see an increase if their SOPR keeps rising up. The “Spent Output Profit Ratio” (or SOPR in short) is an indicator that tells us whether the Bitcoin market as a whole is currently selling at a profit or at a loss.....

The price of Bitcoin has continued to maintain an impressive recovery trajectory following an earlier dip in the week, which saw the asset trade below the $50,000 price mark. The crypto market leader was greatly affected by a widespread decline in the global financial markets, losing over 16% of its market value, due to fears of a potential recession in the US, among other factors. However, as Bitcoin now hovers around $60,000, market experts and analysts have continued to roll out several conditions needed for the premier cryptocurrency to sustain this current positive performance.....