Trava Finance Is a Groundbreaking Protocol That Lets You Create Lending Pools...

Trava is the next generation of Lending Protocols, employing an innovative model of multiple lending pools created by users. This groundbreaking cross-chain lending development is something you have to check out if you ever wanted to create and manage your own lending pool, starting an online lending business and potentially earn big profits from it. The Trava smart contract is now live on both Binance Smart Chain and Fantom Network. A Decentralized Marketplace for Cross-Chain Lending Trava.Finance is the world’s first decentralised marketplace for cross-chain lending and....

Related News

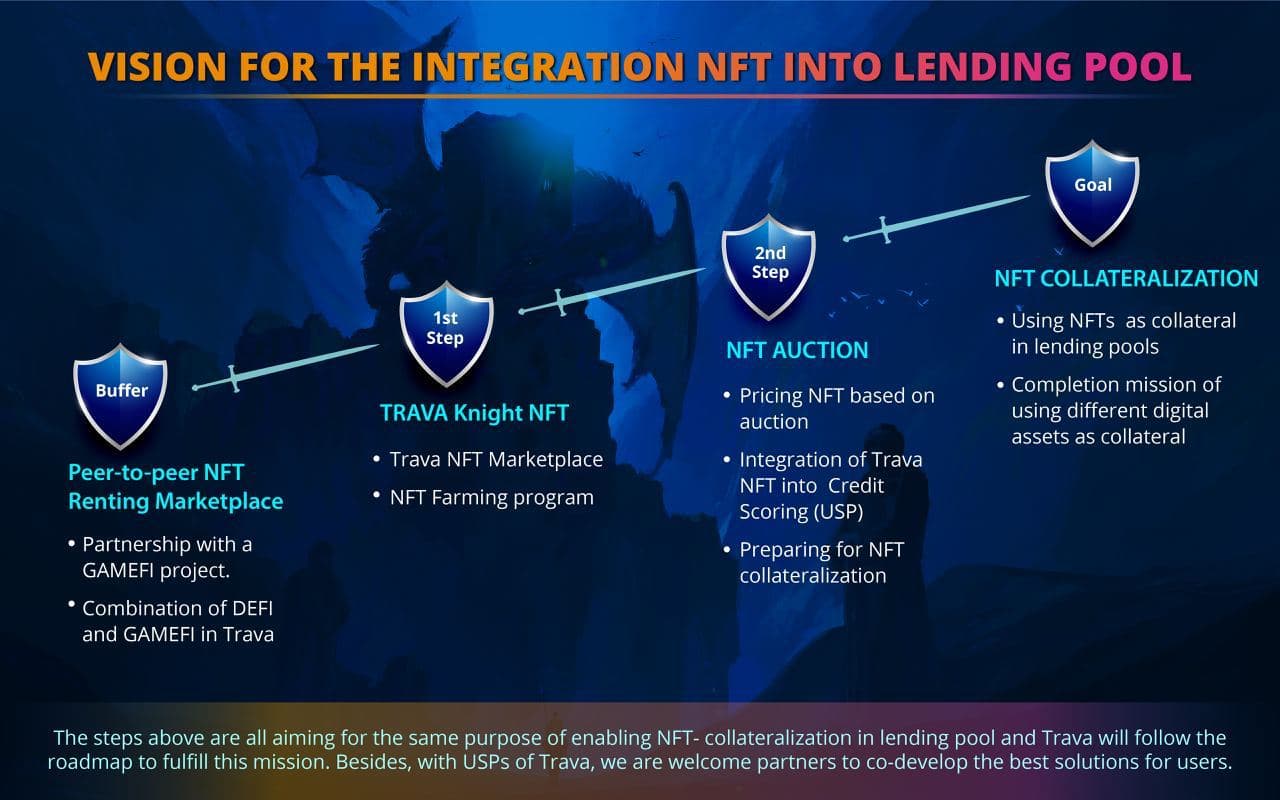

Something exciting & sensational is coming for NFT collectors and enthusiasts alike to look forward to. Trava.Finance is launching #KnightNFT for enabling NFT-collateralization. By opening the NFT marketplace for everyone and facilitating collateralization, we can see more activity in the future & benefits. This will enable Trava.Finance to progress towards achieving their goals and introducing more NFT utilities in their lending pool. Read on to find out more about the thrilling launch and what Trava.Finance is up to, in detail. Introducing Trava Knight NFT Trava.Finance is the....

EverLend.app is a secured lending protocol powered by Everscale. The platform was successfully launched on the 18th of March, 2022 together with its own utility token. The platform facilitates DeFi lending by hosting funding pools with interest rates based on Everscale’s asset supply and demand algorithm.

EverLend.app is a protocol where users can play the role of provider, borrower, or both, and interact with each other within the protocol to earn or pay flexible interest rates. At its core, it is a secured lending platform that charges interest on the use of....

Blockchain records show the hackers got away with more than $2,051,159 in DAI before moving the funds to a different address. Hackers were reportedly able to exploit savings pools at Gibraltar-based decentralized finance protocol Akropolis, getting away with more than $2 million in stablecoins. The firm stated on Twitter on April 12 that it had identified a hack “executed across a body of smart contracts in the savings pools.” Akropolis said the areas targeted by the hackers had already been audited twice, and only included “Curve Y and Curve sUSD savings pools.”Ethereum blockchain records....

Lending is the second-most-popular segment of decentralized finance today. The industry represents over $45 billion in total value locked yet still suffers from significant inefficiencies. Hashstack finance and the testnet version of Open Protocol offer a much-needed breath of relief on that front. DeFi Lending Is Popular No one will deny that decentralized lending and […]

The financial services company is only considering non-volatile assets as collateral in its DeFi lending solution that's under development. In a presentation made during the Singapore Fintech Festival, Annerie Vreugdenhil, chief innovation officer of ING, announced the firm is working on a trial of its decentralized finance, or DeFi, peer-to-peer lending protocol with the Netherlands Authority for the Financial Markets. Vreugdenhil said the following in regards to the development, as reported by Ledger Insights:We are looking into peer-to-peer lending in a DeFi kind of setup. But then not....