3 Reasons Why Bitcoin Stands Firm Against Tech Stock Sell-Off

A sell-off in the technology stocks this week didn't spill itself onto the Bitcoin market.

Related News

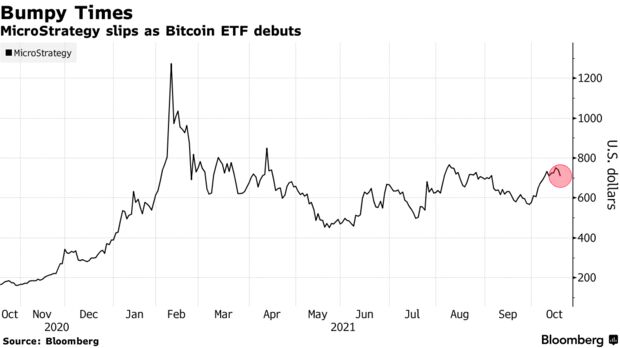

Following the launch of the first ever Bitcoin exchange-traded fund (ETF), Microstrategy’s stock took a hit. This may show that investors would prefer to get BTC exposure through the ETF rather than the tech company’s stock. Microstrategy’s Stock Drops 2% In Response To Bitcoin ETF Launch As reported by Bloomberg, the tech firm’s stock had […]

According to a recent interview, trial lawyer Kyle Roche from the legal firm Roche Freedman LLP has started a tech startup called Ryval that aims to be “the stock market of litigation financing.” The firm plans to launch during the first quarter and allow people to leverage tokens in order to wager on civil lawsuits.

Ryval’s Initial Litigation Offering Concept

The trial lawyer Kyle Roche was recently interviewed by the Vice author Maxwell Strachan as Roche’s new tech startup Ryval was showcased for its litigation tokenization concept. Ryval co-founder....

Ripple's partnership with MoneyGram may not be as warm as it once was, but it's paying off. Ripple Labs has sold a huge chunk of its 2019 investment in MoneyGram. Per a Friday night filing with the Securities and Exchange Commission on Friday night, from Nov. 27 through Dec. 4, Ripple Labs managed to sell 2,264,113 shares of MoneyGram (MGI). The tech firm netted a total of $15,303,792.60 from the sales.MoneyGram's stock value has soared in recent months, from $2.94 on Oct. 1 to $8.53 on Nov. 23. In no small part thanks to news of Ripple's sell-off, MGI has slipped back down to $6.54 as of....

After skyrocketing above $370 following the Reddit-driven short squeeze, GameStop shares are now trading at around $160. GameStop Corporation, an American gaming and consumer electronics retailer, has announced its plans to sell up to 3.5 million GME shares following the stock’s massive and controversial rally.The firm announced Monday that it has filed a prospectus supplement with the United States Securities and Exchange Commission, under which it may offer and sell up to 3.5 million shares of GME stock via an at-the-market, or ATM, equity offering program. GameStop said that its total....

"There are many reasons why the price of Bitcoin can rise or fall, but S2F is not one of them”, contends report author. A report authored by the research team of ByteTree purports to debunk one of the most popular Bitcoin (BTC) valuation models — Stock-to-Flow. The model provides a very optimistic forecast for Bitcoin, claiming that a year from now we should see price levels above $100,000.Source: Glassnode.BytTree’s co-founder and chief investment officer, Charlie Morris, dedicates the entire fourth chapter of the report to “debunking” it. The stock-to-flow models have been applied for....