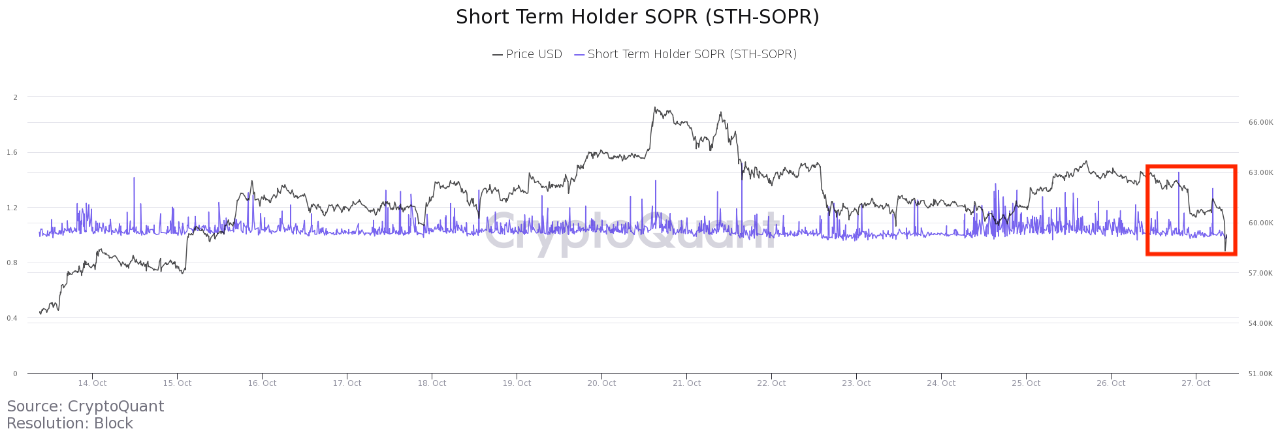

Bitcoin Crashes To $58k As Short-Term Holders Take Profits

Bitcoin has crashed to $58k, and on-chain data may suggest that profit-taking from short-term holders may be behind the event. On-Chain Data Shows Bitcoin Short-Term Holders Are Taking Profits As pointed out by an analyst in a CryptoQuant post, short-term holders seem to have started taking their profits. And the timing may suggest this to […]

Related News

On-chain data shows the Bitcoin short-term holders have been transferring large amounts to exchanges at a loss following BTC’s bearish action. Bitcoin Short-Term Holders Are Participating In Loss-Taking In a new post on X, CryptoQuant community analyst Maartunn has talked about the reaction to the recent Bitcoin price decline from the short-term holders (STHs). The […]

Total value locked across decentralized finance-enabled smart contracts has dipped 35% from its peak. The drop in the price of Ether (ETH) is failing to shake out the long-term holders, while the decentralized finance (DeFi) sector is also providing opportunities for investors. So suggests a new Glassnode report that noted many long-term Ether holders (>155 days) are sitting atop profits despite ETH/USD’s 55% decline from its peak level above $4,300. In comparison, the short-term Ether holders (“After almost hitting 46% of the market cap in unrealized gain, short-term holders are now....

On-chain data may suggest short-term Bitcoin holders could be behind the latest correction in the cryptocurrency’s price. Bitcoin Short-Term Holders Behind The Correction? As pointed out by a CryptoQuant post, on-chain data may hint that selling from short-term holders might be the drive behind the recent correction. The relevant indicator here is the Spent Output […]

On-chain data shows the Bitcoin short-term holder whales are sitting on their highest unrealized gain of the cycle after the latest rally. Bitcoin Short-Term Holder Whales Are Carrying $10.1 Billion In Profits As pointed out by CryptoQuant community analyst Maartunn in a new post on X, the Bitcoin short-term holder whales have seen their profits hit the highest point of the cycle. The short-term holders (STHs) broadly refer to the BTC investors who purchased the cryptocurrency within the past 155 days. These holders are considered to include the “weak hands” of the market, who....

On-chain data shows the Bitcoin short-term holder behavior has continued to display divergence from the price in recent weeks. Bitcoin Short-Term Holder SOPR Continues To Move Mostly Sideways As pointed out by an analyst in a CryptoQuant post, while the price has gone down recently, short-term holders have instead made more profits. The relevant indicator […]